g

g

The House just passed my bill – The GENIUS Act!

This historic legislation will bring our payment system into the 21st century. It will ensure the dominance of the U.S. dollar. It will increase demand for U.S. Treasuries.

I look forward to @POTUS signing GENIUS into law – the first step in making America the crypto capital of the world.

The House just passed my bill – The GENIUS Act!

This historic legislation will bring our payment system into the 21st century. It will ensure the dominance of the U.S. dollar. It will increase demand for U.S. Treasuries.

I look forward to @POTUS signing GENIUS into law – the first step in making America the crypto capital of the world.

Bring America’s payment system into the 21st century

Bring America’s payment system into the 21st century

Cement U.S. dollar dominance

Cement U.S. dollar dominance

Increase demand for U.S. treasuries

Increase demand for U.S. treasuries

r

r

It’s #CryptoWeek in the House.

With votes on the GENIUS Act, CLARITY Act, and the Anti-CBDC Surveillance State Act, we have a historic opportunity to cement America’s leadership in digital assets.

All 3 bills protect our freedoms, provide regulatory clarity, and promote innovation. (1/3)

It’s #CryptoWeek in the House.

With votes on the GENIUS Act, CLARITY Act, and the Anti-CBDC Surveillance State Act, we have a historic opportunity to cement America’s leadership in digital assets.

All 3 bills protect our freedoms, provide regulatory clarity, and promote innovation. (1/3)

The House votes on my GENIUS Act this week.

With this bill, we are one step closer to becoming the global leader in crypto.

Let’s get this to @POTUS’s desk ASAP.

The House votes on my GENIUS Act this week.

With this bill, we are one step closer to becoming the global leader in crypto.

Let’s get this to @POTUS’s desk ASAP.

the worldwide leader in stablecoins

Let’s get it done!z

the worldwide leader in stablecoins

Let’s get it done!z

Requiring all stablecoins to be backed 1-to-1

Requiring all stablecoins to be backed 1-to-1

Giving consumers strong rights in bankruptcy

Giving consumers strong rights in bankruptcy

Establishing strict marketing standards

Establishing strict marketing standards

My historic legislation establishes the first ever regulatory framework for stablecoins to modernize America’s payment system and affirm the dominance of the US dollar. See the many statements of support from industry stakeholders @BankingGOP.

My historic legislation establishes the first ever regulatory framework for stablecoins to modernize America’s payment system and affirm the dominance of the US dollar. See the many statements of support from industry stakeholders @BankingGOP.

NEW: Senator @RubenGallego and nine other senators just issued a joint statement regarding the updated text of the GENIUS Act that was released last week, saying they cannot support the bill in its current form. The group notes several concerns, including insufficient provisions on anti-money laundering, national security, and financial system safety.

Notably, four Dems on the list supported the bill in its original form during the @BankingGOP markup in March: Gallego, Warner, Kim and Blunt Rochester. Democrat Angela Alsobrooks, a co-sponsor of the bill, did not sign the letter.

“This is all about the political dynamics of President Trump,” one Republican Senate aide tells me.

The letter comes following major media scrutiny of Trump’s various crypto ventures, including a New York Times story that stated Trump's family members could profit heavily from $2 billion worth of @worldlibertyfi USD1 stablecoins being used for an investment by a foreign fund.

It also comes just two days after @LeaderJohnThune initiated a process that would expedite a full floor vote on the GENIUS Act.

NEW: Senator @RubenGallego and nine other senators just issued a joint statement regarding the updated text of the GENIUS Act that was released last week, saying they cannot support the bill in its current form. The group notes several concerns, including insufficient provisions on anti-money laundering, national security, and financial system safety.

Notably, four Dems on the list supported the bill in its original form during the @BankingGOP markup in March: Gallego, Warner, Kim and Blunt Rochester. Democrat Angela Alsobrooks, a co-sponsor of the bill, did not sign the letter.

“This is all about the political dynamics of President Trump,” one Republican Senate aide tells me.

The letter comes following major media scrutiny of Trump’s various crypto ventures, including a New York Times story that stated Trump's family members could profit heavily from $2 billion worth of @worldlibertyfi USD1 stablecoins being used for an investment by a foreign fund.

It also comes just two days after @LeaderJohnThune initiated a process that would expedite a full floor vote on the GENIUS Act.

@SenThomTillis @SenatorHagerty @SenMcCormickPA @BernieMoreno @SenRubenGallego @SenTinaSmith @MarkWarner @ChrisVanHollenB

@SenThomTillis @SenatorHagerty @SenMcCormickPA @BernieMoreno @SenRubenGallego @SenTinaSmith @MarkWarner @ChrisVanHollenB

K

K

NEW per my @FoxBusiness colleague @EdwardLawrence: The #crypto executive order has officially been signed.

Here are the details:

NEW per my @FoxBusiness colleague @EdwardLawrence: The #crypto executive order has officially been signed.

Here are the details:

The Executive Order establishes the Presidential Working Group on Digital Asset Markets to strengthen U.S. leadership in digital finance.

The Executive Order establishes the Presidential Working Group on Digital Asset Markets to strengthen U.S. leadership in digital finance.

The Working Group will be tasked with developing a Federal regulatory framework governing digital assets, including stablecoins, and evaluating the creation of a strategic national digital assets stockpile.

The Working Group will be tasked with developing a Federal regulatory framework governing digital assets, including stablecoins, and evaluating the creation of a strategic national digital assets stockpile.

The Working Group will be chaired by the White House AI & Crypto Czar @DavidSacks and include the Secretary of the Treasury, the Chairman of the Securities and Exchange Commission, and the heads of other relevant departments and agencies.

The Working Group will be chaired by the White House AI & Crypto Czar @DavidSacks and include the Secretary of the Treasury, the Chairman of the Securities and Exchange Commission, and the heads of other relevant departments and agencies.

The White House AI & Crypto Czar will engage leading experts in digital assets and digital markets to ensure that the actions of the Working Group are informed by expertise beyond the Federal Government.

The White House AI & Crypto Czar will engage leading experts in digital assets and digital markets to ensure that the actions of the Working Group are informed by expertise beyond the Federal Government.

The Executive Order directs departments and agencies with identifying and making recommendations to the Working Group on any regulations and other agency actions affecting the digital assets sector that should be rescinded or modified.

The Executive Order directs departments and agencies with identifying and making recommendations to the Working Group on any regulations and other agency actions affecting the digital assets sector that should be rescinded or modified.

The Executive Order prohibits agencies from undertaking any action to establish, issue, or promote central bank digital currencies (CBDCs).

The Executive Order prohibits agencies from undertaking any action to establish, issue, or promote central bank digital currencies (CBDCs).

The Executive Order revokes the previous Administration’s Digital Assets Executive Order and the Treasury Department’s Framework for International Engagement on Digital Assets which suppressed innovation and undermined U.S. economic liberty and global leadership in digital finance.

The Executive Order revokes the previous Administration’s Digital Assets Executive Order and the Treasury Department’s Framework for International Engagement on Digital Assets which suppressed innovation and undermined U.S. economic liberty and global leadership in digital finance.

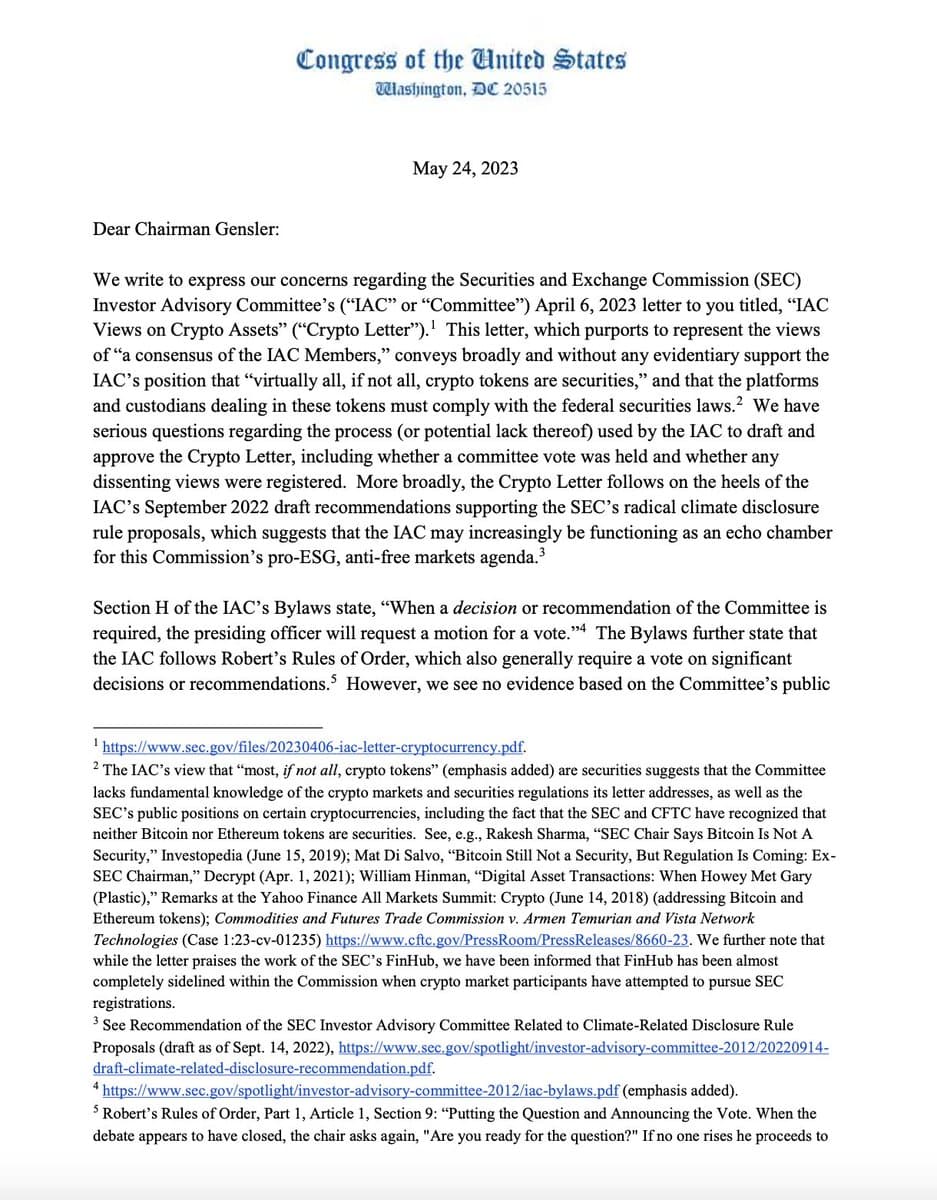

SCOOP: 18 U.S. states have filed to sue the @SECGov and its commissioners, accusing them of unconstitutional overreach and unfair persecution of the #crypto industry under the leadership of agency chief @GaryGensler.

The lawsuit, signed by 18 Republican Attorneys General, details how the agency has committed “gross government overreach” with its regulation by enforcement crusade against the $3 trillion industry, resulting in an infringement upon states’ rights to regulate their economies.

Story developing and full write-up coming soon.

SCOOP: 18 U.S. states have filed to sue the @SECGov and its commissioners, accusing them of unconstitutional overreach and unfair persecution of the #crypto industry under the leadership of agency chief @GaryGensler.

The lawsuit, signed by 18 Republican Attorneys General, details how the agency has committed “gross government overreach” with its regulation by enforcement crusade against the $3 trillion industry, resulting in an infringement upon states’ rights to regulate their economies.

Story developing and full write-up coming soon.

(1/6)

(1/6)

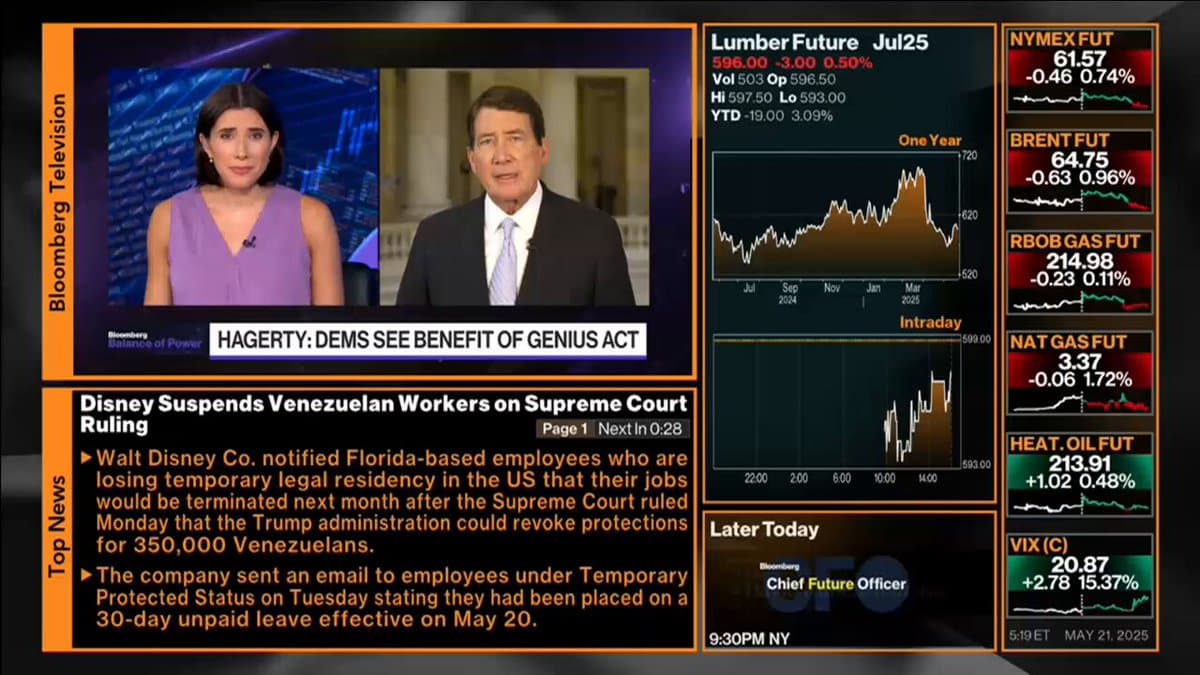

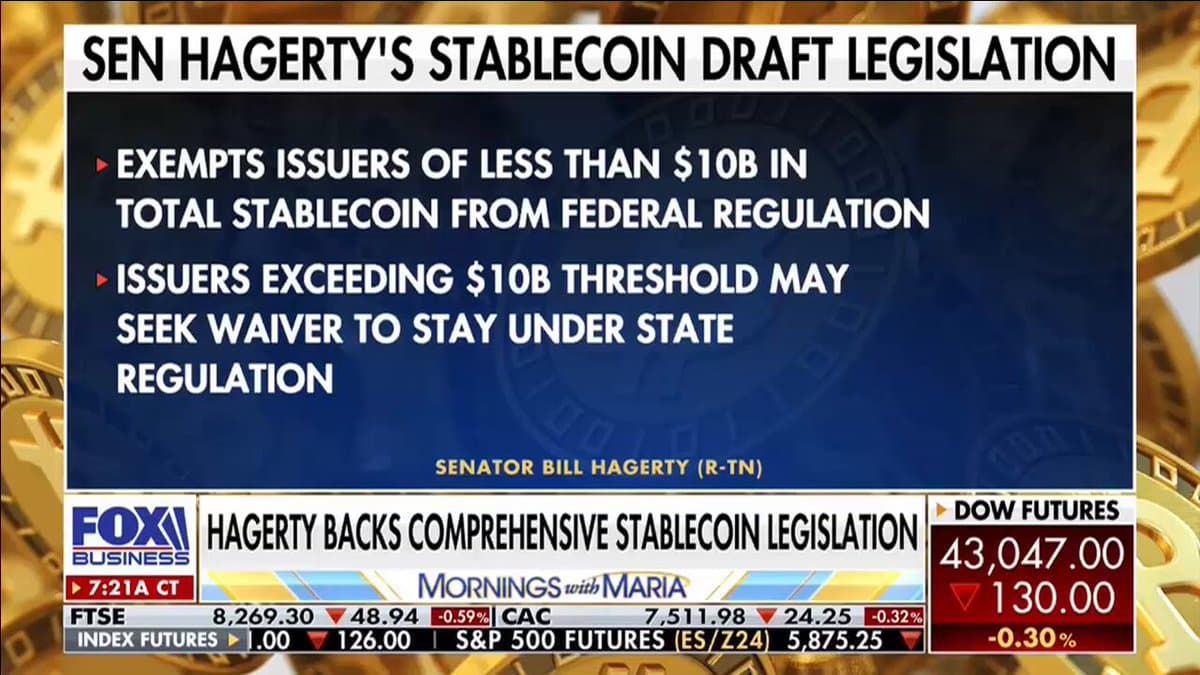

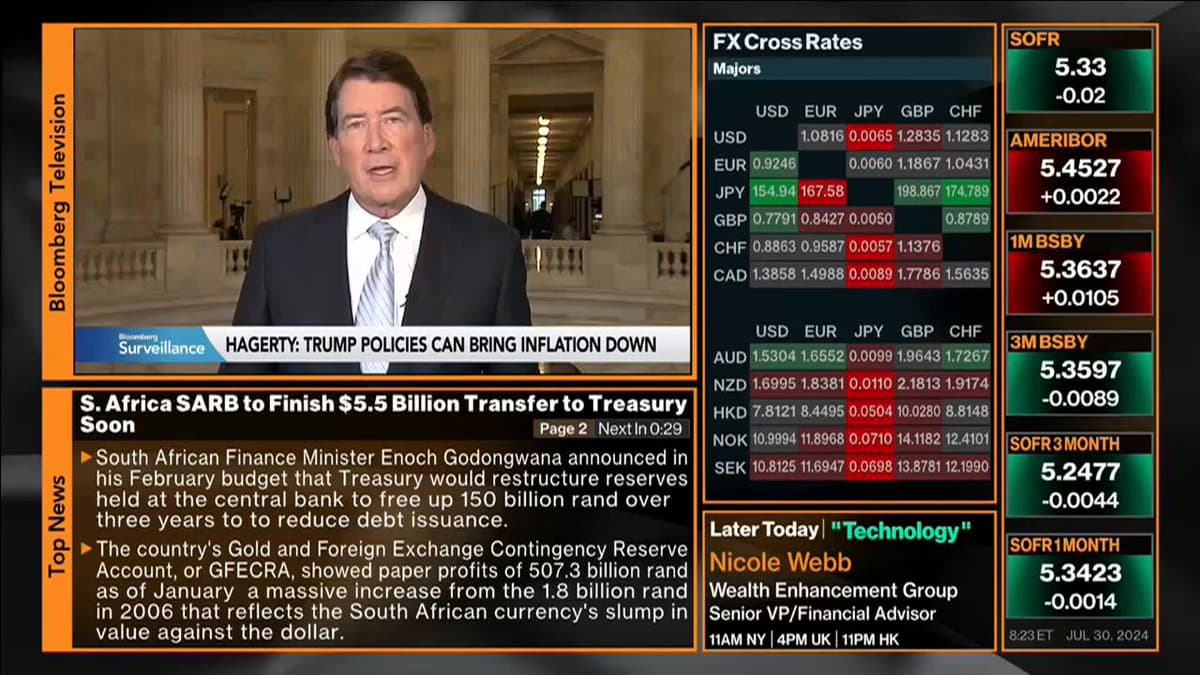

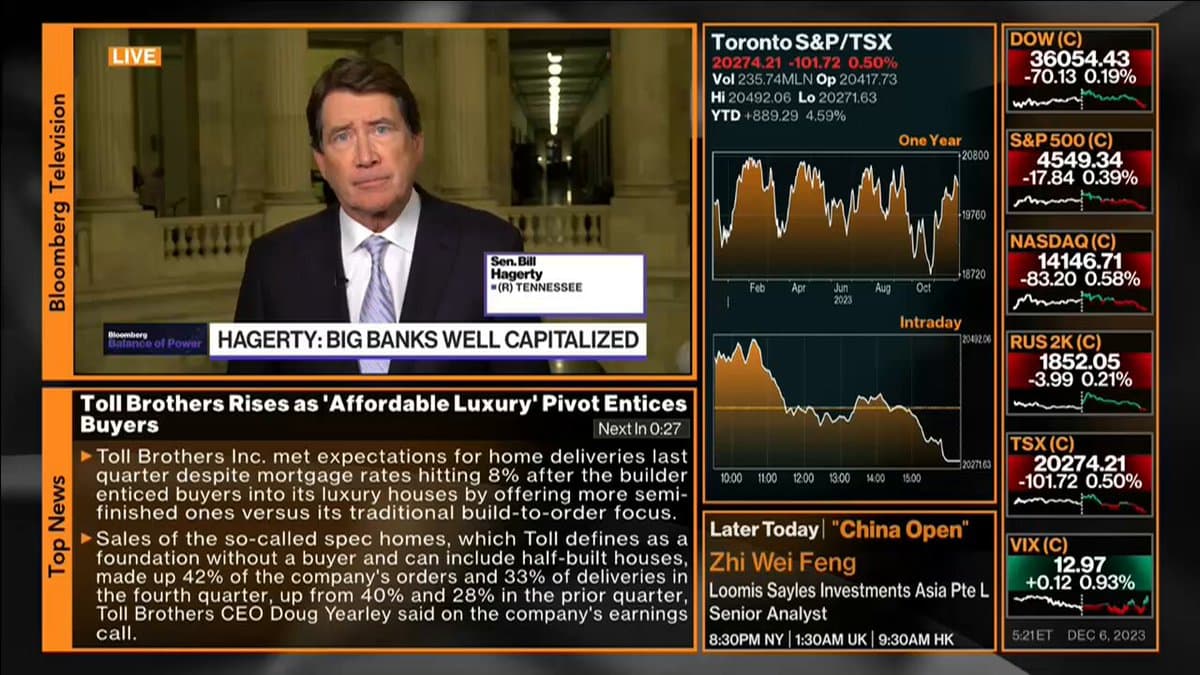

US Senator Bill Hagerty explains why he loves #Bitcoin at the Bitcoin 2024 Conference in Nashville

US Senator Bill Hagerty explains why he loves #Bitcoin at the Bitcoin 2024 Conference in Nashville  “I love liberty and freedom, I don’t care for centralization.”

“I love liberty and freedom, I don’t care for centralization.”  d

d

US Senator Bill Hagerty explains why he loves #Bitcoin at the Bitcoin 2024 Conference in Nashville

US Senator Bill Hagerty explains why he loves #Bitcoin at the Bitcoin 2024 Conference in Nashville  “I love liberty and freedom, I don’t care for centralization.”

“I love liberty and freedom, I don’t care for centralization.”  d

d

US Senator Bill Hagerty says he's fighting to pass pro-#Bitcoin legislation that promotes freedom and opportunity.

7

US Senator Bill Hagerty says he's fighting to pass pro-#Bitcoin legislation that promotes freedom and opportunity.

7

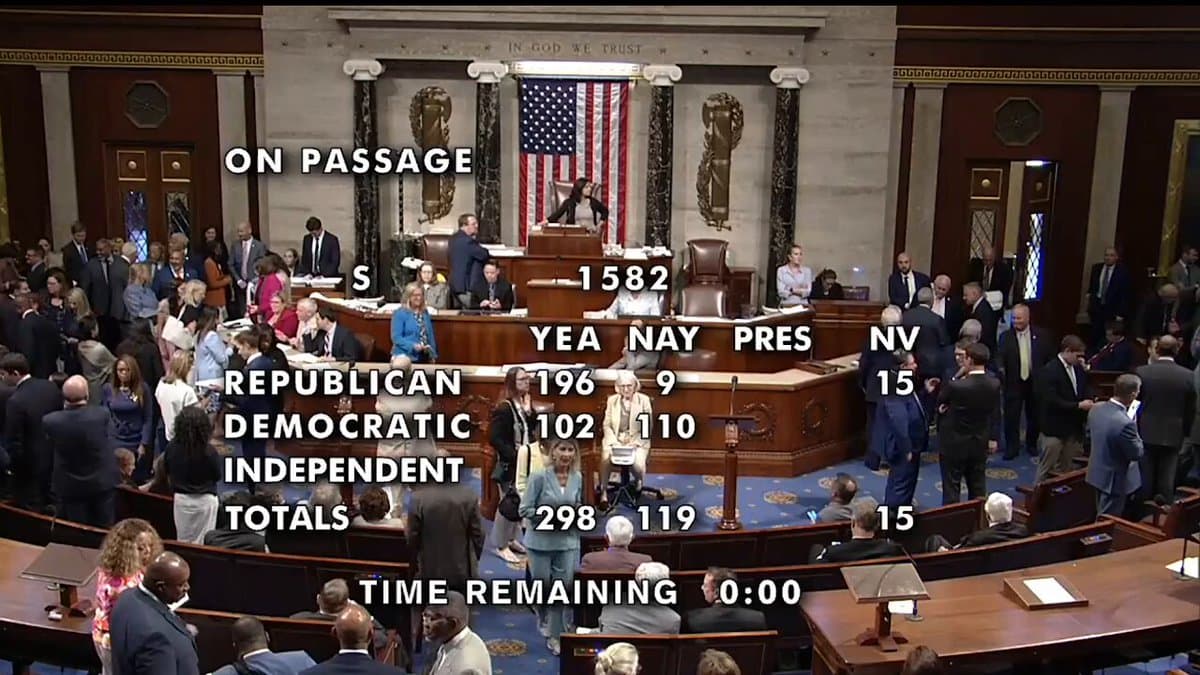

US House fails to overturn President Biden's veto on bill that would allow highly regulated financial firms to custody #Bitcoin and crypto.

They needed to 2/3's of the votes to overturn the veto.

US House fails to overturn President Biden's veto on bill that would allow highly regulated financial firms to custody #Bitcoin and crypto.

They needed to 2/3's of the votes to overturn the veto.

THE FUTURE OF CRYPTO IN THE U.S. - LIVE X SPACE TODAY @ 6PM ET

Join us on X Spaces TODAY at PM ET as we discuss the future of crypto policy in the U.S. with Senator @BillHagertyTN and Senate Candidates @CaptainSamBrown and @DaveMcCormickPA.

Co-Host: Mayor @JessAnderson2

Set your reminder:i

THE FUTURE OF CRYPTO IN THE U.S. - LIVE X SPACE TODAY @ 6PM ET

Join us on X Spaces TODAY at PM ET as we discuss the future of crypto policy in the U.S. with Senator @BillHagertyTN and Senate Candidates @CaptainSamBrown and @DaveMcCormickPA.

Co-Host: Mayor @JessAnderson2

Set your reminder:i

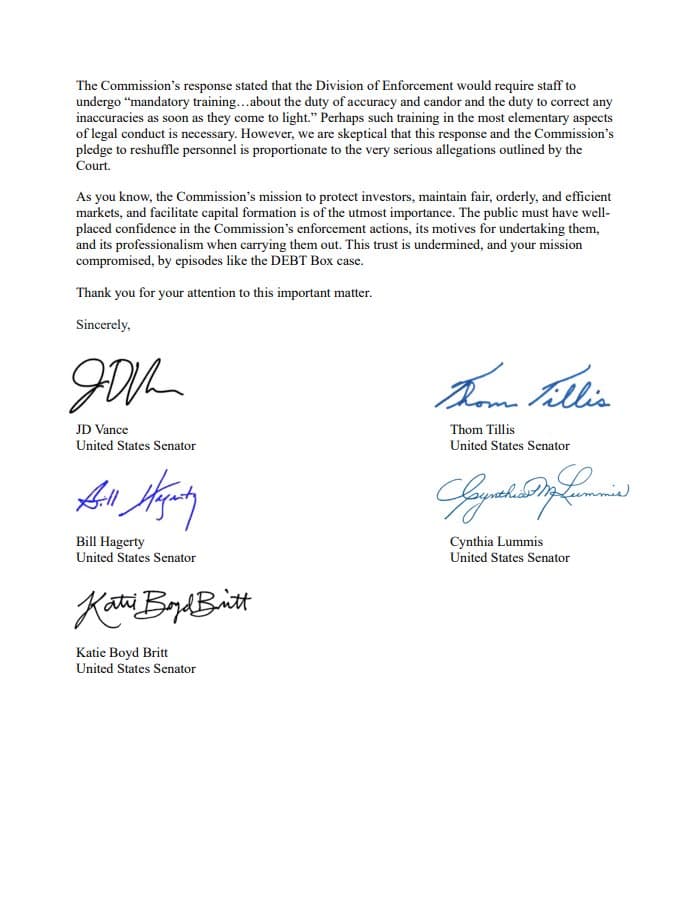

NEW: A Utah judge has found the @SECGov engaged in bad faith conduct against #crypto firm @TheDebtBox.

The judge has placed sanctions on the SEC for “abuse of judicial process,” ordered them to pay the legal fees of Debt Box and denied its motion to dismiss the charges without prejudice, meaning it will not be able to refile the same charges at a later date.

Full decision here:

storage.courtlistener.com/recap/gov.usco…

NEW: A Utah judge has found the @SECGov engaged in bad faith conduct against #crypto firm @TheDebtBox.

The judge has placed sanctions on the SEC for “abuse of judicial process,” ordered them to pay the legal fees of Debt Box and denied its motion to dismiss the charges without prejudice, meaning it will not be able to refile the same charges at a later date.

Full decision here:

storage.courtlistener.com/recap/gov.usco…

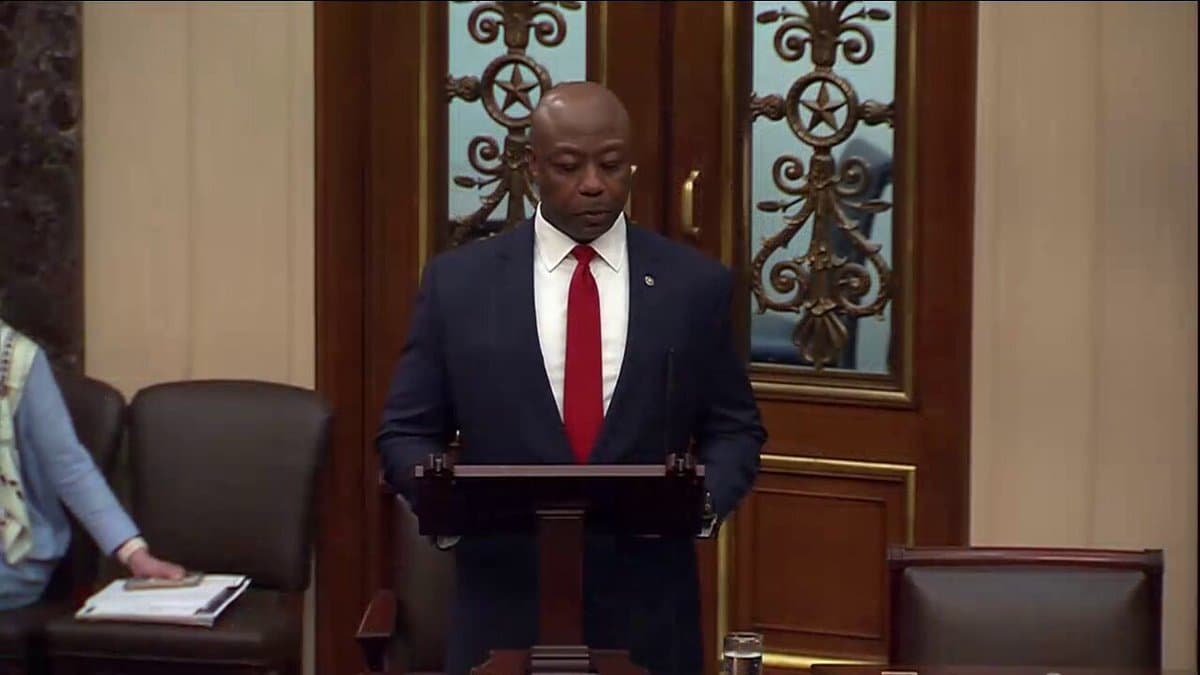

WATCH: Hagerty Calls out Dems for Using Crypto Industry to Distract from Biden Admin's Lax Sanctions Enforcement Funding Iran-Back Hamas

WATCH: Hagerty Calls out Dems for Using Crypto Industry to Distract from Biden Admin's Lax Sanctions Enforcement Funding Iran-Back Hamas

hhagerty.senate.gov/press-releases…https://t.co/BEpRwf7nTd

hhagerty.senate.gov/press-releases…https://t.co/BEpRwf7nTd

https://t.co/4wZCitBUmZ

https://t.co/4wZCitBUmZ

hfdic.gov/news/press-rel…

hfdic.gov/news/press-rel…