Great news!

After years of litigation, millions of your taxpayer dollars spent, and irreparable harm done to the country, we reached an agreement with SEC staff to dismiss their litigation against Coinbase. Once approved by the Commission (which we're told to expect next week) tm paid and zero changes to our business.

This is hugely vindicating, especially because many people questioned my decision to engage in litigation with the SEC on this matter in 2023. People told me the courts would give a lot of leeway to the government. They said public market investors wouldn't like it. They said it would take years and cost us tens of millions of dollars in legal fees (which it did). They said the agency would use mafia tactics like trying to pressure other companies not to work with us while the lawsuit was underway (which they did).

But I knew a few truths that helped make it an easy decision to fight them in court:

1. The SEC was wrong on the law.

They were exceeding the authority given to them by congress by asking us to delist a number of assets that were not securities. We had taken a conservative approach to ensure we weren't listing any securities, and the SEC itself had allowed us to go public in 2021 after reviewing our listing standards in depth. We tried to “come in and register” but it turned out it was a fake offer, as every crypto company discovered. Regulators are supposed to enforce the law, but they can't make up new laws on the spot if they don't like the current ones, or weaponize a lack of clarity in the law.

2. Caving to their demands could have killed the crypto industry in America.

The SEC made it clear to us that the only way to avoid litigation was to delist the many assets they falsely claimed were securities. It was a bullying tactic, pure and simple, driven by Gensler's own political agenda. And if we had caved, it would have dramatically limited the scope of which crypto assets were allowed in the US, and pushed the industry further offshore, into the shadows. Never forget how close a few activists in government came to unlawfully killing an entire industry in America! It could have easily gone the other way. Thank goodness the founding fathers created the judicial branch, as a check and balance on executive power.

3. It was the right thing to do for our customers and the industry.

At the end of the day, it didn't matter what our chance of success was. I had to stand up for our customers’ and our industry’s rights. I also knew it would serve as a deterrent for future bad actors around the world we may have to engage with, for them to know that we won't be bullied or pressured. We are comfortable engaging in litigation across multiple fronts, indefinitely, while continuing to build. This is business as usual. As Bain in The Dark Knight says, "you merely adopted the dark; I was born in it".

Growing up I had a naive view that regulators exist to hold companies accountable. What I realized in this ordeal is sometimes, companies must hold regulators accountable who are painting outside the bounds of the law, to preserve freedom. Accountability can actually happen both ways. At Coinbase, our mission is to increase economic freedom, and I initially thought we could achieve this solely through our crypto products. But I'm increasingly realizing that we can move the needle on economic freedom in the courts and through our policy efforts as well, when we see bad actors in government around the world. We plan to do more of this.

I have to give credit here to the Trump administration, for winning the election, and for the departure of the activist head of the SEC, Gary Gensler, who orchestrated this unlawful action along with Elizabeth Warren, and a handful of their lackeys in congress. I feel confident we would have won this case in the courts either way, given our facts were so strong, but it certainly helped accelerate the process and drive accountability. I called out the sketchy behavior of the SEC back in 2021, and I believe this comment turned out to be prescient.

I want to give a shout out to all the other crypto companies who fought back with their own lawsuits (we certainly were not the only ones).

I want to give a shout out to all the crypto startups who couldn't afford the legal fees, and went bankrupt due to the administration's abusive tactics. Your company may have died, but crypto lives on. Don't stop building.

I want to give a shout out to both Democrat and Republican members of congress, who are working hard to ensure America leads on crypto. I know that Gary Gensler and Elizabeth Warren do not represent the entire Democratic party.

And I want to give a shout out to all the crypto holders in the US who elected pro-crypto candidates, on both sides of the aisle, to make sure your rights were preserved. It turns out the crypto voter is real, and showed up in the millions.

Finally, I expect we'll continue working productively with the SEC on any number of items over the years, just as we do with every agency around the world where we operate. I look forward to the SEC being reformed under Paul Atkins, Mark Uyeda, Hester Peirce, and DOGE, and new more sensible personnel coming into leadership roles. I commend the new leadership that is already in place for working to right this wrong - it's a great step in the right direction, and took courage. Now let's get some crypto legislation passed in the US to finally clarify the rules, and really kick off this next phase of building.

Vice President JD Vance says #Bitcoin and crypto is “a way of storing value in the modern digital age.”

America is embracing Bitcoin

Vice President JD Vance says #Bitcoin and crypto is “a way of storing value in the modern digital age.”

America is embracing Bitcoin  u

u

https://t.co/jwuUHYEjuj

https://t.co/jwuUHYEjuj

l

l

“We don’t wanna see this asset become owned only by governments and CERTAINLY don’t wanna see it controlled by governments because it’s great virtue is as freedom money.”

“We don’t wanna see this asset become owned only by governments and CERTAINLY don’t wanna see it controlled by governments because it’s great virtue is as freedom money.”

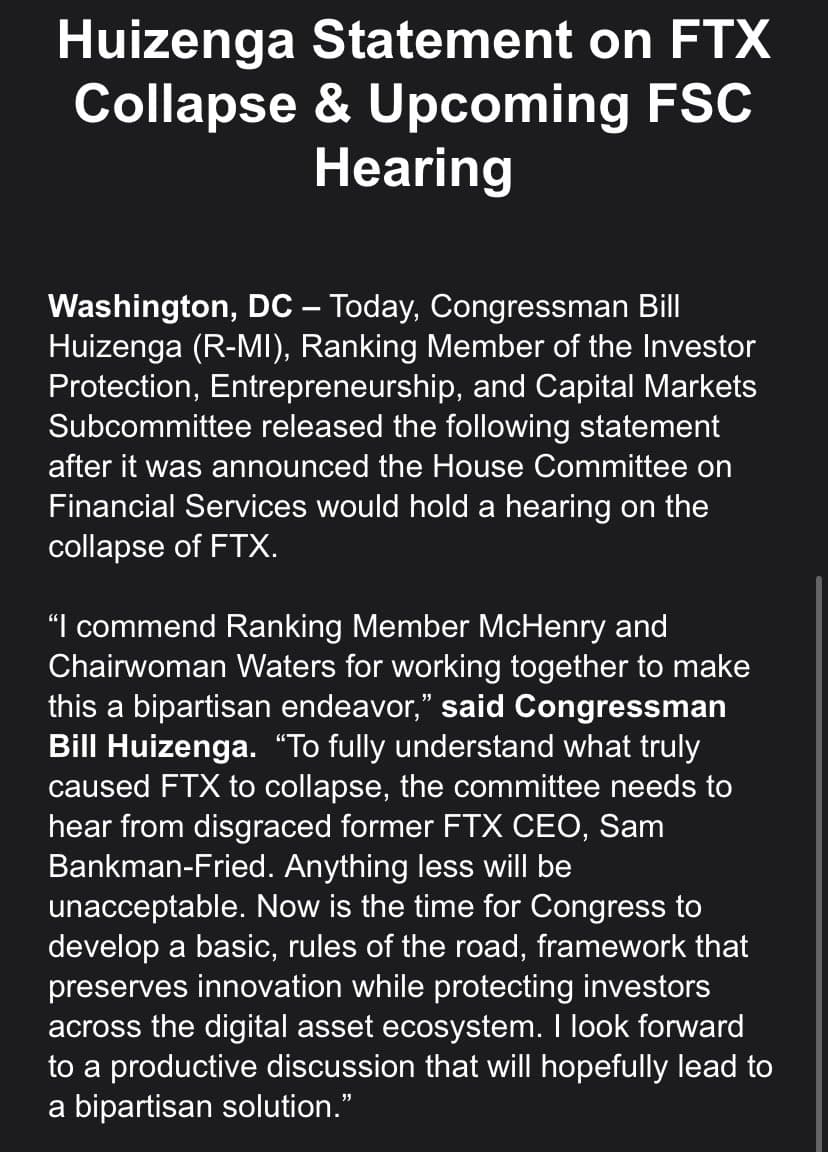

financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

Watch his opening remarks

Watch his opening remarks

Watch

Watch

hyoutu.be/gd6xfPjINVo

Topics:

- #Crypto in the US

- Keeping the #SEC & Gary Gensler Accountable

- Bill Hinman #Ethereum Investigation

- Meeting SBF & #FTX Collapse

- #CBDCs & the #DigitalDollar https://t.co/smEbVWO7Ix

hyoutu.be/gd6xfPjINVo

Topics:

- #Crypto in the US

- Keeping the #SEC & Gary Gensler Accountable

- Bill Hinman #Ethereum Investigation

- Meeting SBF & #FTX Collapse

- #CBDCs & the #DigitalDollar https://t.co/smEbVWO7Ix

Crypto donations to Ukraine have totaled almost $100 million.

Crypto donations to Ukraine have totaled almost $100 million.

40% of the vendors supporting Ukraine have accepted crypto as payment.

40% of the vendors supporting Ukraine have accepted crypto as payment.

Banks in Ukraine are not operating. Crypto exchanges are operating 24/7.

Crypto is essential.

https://t.co/mXmwG7JPqf

Banks in Ukraine are not operating. Crypto exchanges are operating 24/7.

Crypto is essential.

https://t.co/mXmwG7JPqf

Watch

Watch