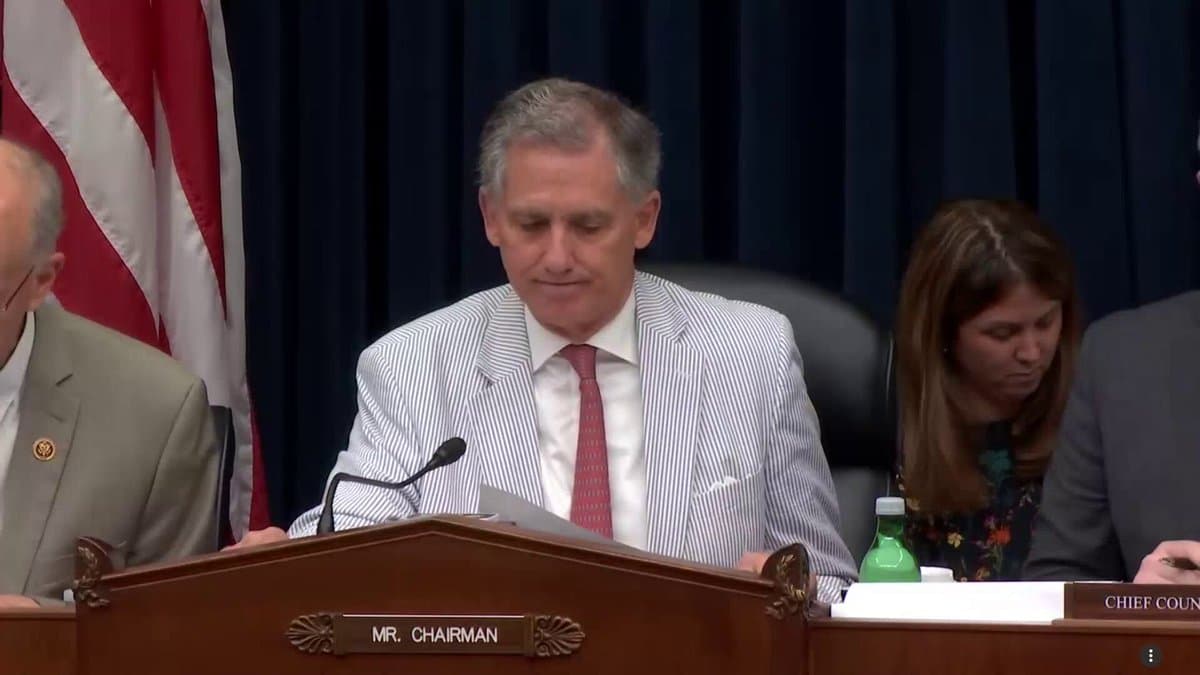

Congressman Dan Meuser

@RepMeuser

President Trump is right to take bold action to end political debanking—and I fully back his executive order. No American should be denied banking access because of their political views, religious beliefs, or lawful business activities.

We’ve seen this happen across the country: firearms manufacturers, energy producers, and crypto innovators dropped by their banks—targeted not for risk, but for politics.

As Chairman of the Oversight & Investigations Subcommittee, I’ve led the fight to expose and stop this abuse. President Trump’s action is a major step forward—and now Congress must finish the job.

That’s why I introduced the SAFE Guidance Act and support the FIRM Act to ensure no administration can weaponize the banking system again.

Access to financial services isn’t optional in a free market—it’s essential.

meuser.house.gov/media/press-re…

2025-08-07T20:24:50.000Z

Analysis on Stance

Add your own analysis on this stanceCongressman Dan Meuser once again demonstrates his strong pro-crypto stance by applauding President Trump's executive order aimed at ending political debanking. This action, which Meuser fully supports, is a significant win for the crypto industry, which has been a frequent target of debanking practices. Meuser's 100 stance score on this issue reflects his unwavering commitment to ensuring fair access to financial services for all lawful businesses, including those in the crypto space.

The Congressman's statement highlights a critical issue: the use of debanking as a political weapon. He correctly points out that businesses, including firearms manufacturers, energy producers, and crypto innovators, have been unfairly targeted and denied banking services based on political considerations rather than legitimate risk assessments. This practice not only stifles innovation and economic growth but also undermines the principles of a free market.

Meuser's leadership as Chairman of the Oversight & Investigations Subcommittee has been instrumental in exposing and combating this abuse of power. His introduction of the SAFE Guidance Act and his support for the FIRM Act further demonstrate his commitment to protecting businesses from politically motivated debanking. These legislative efforts aim to establish clear guidelines and safeguards to prevent future administrations from weaponizing the banking system against lawful industries.

By advocating for equal access to financial services, Meuser is championing a core principle of a free market economy. His consistent high stance scores and his active engagement in this issue solidify his position as a true advocate for the crypto industry and a defender of economic freedom.

https://t.co/npgXVRQIW5

https://t.co/npgXVRQIW5