https://t.co/4QLHOqEvOY

https://t.co/4QLHOqEvOY

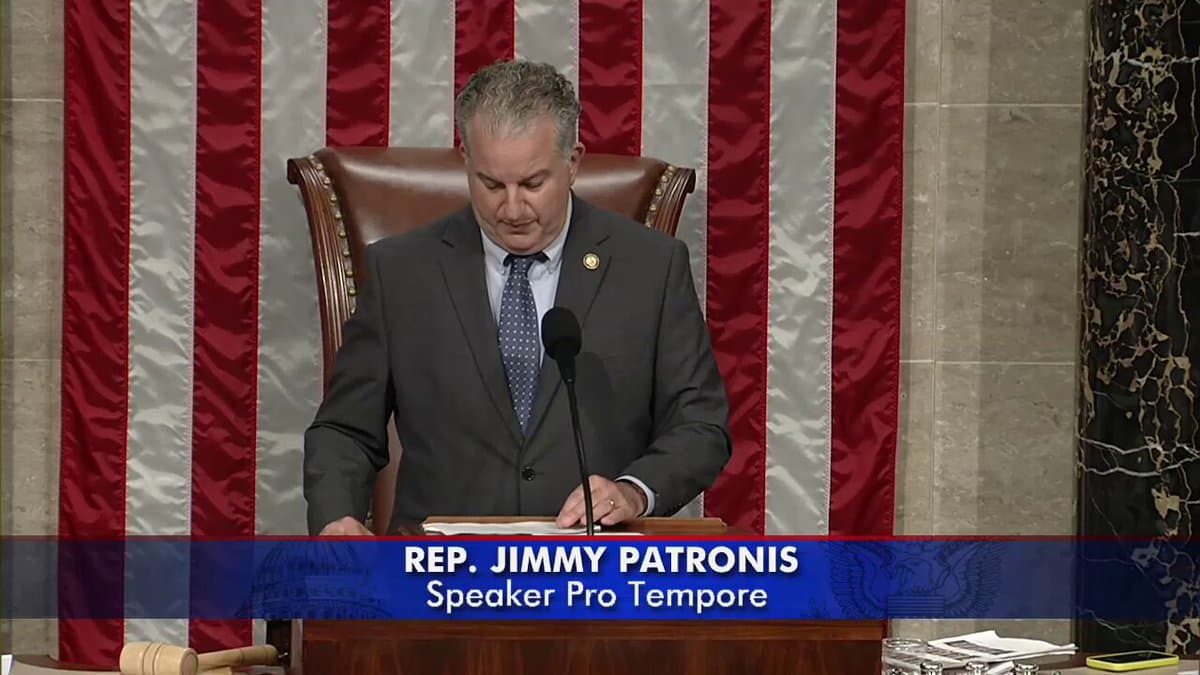

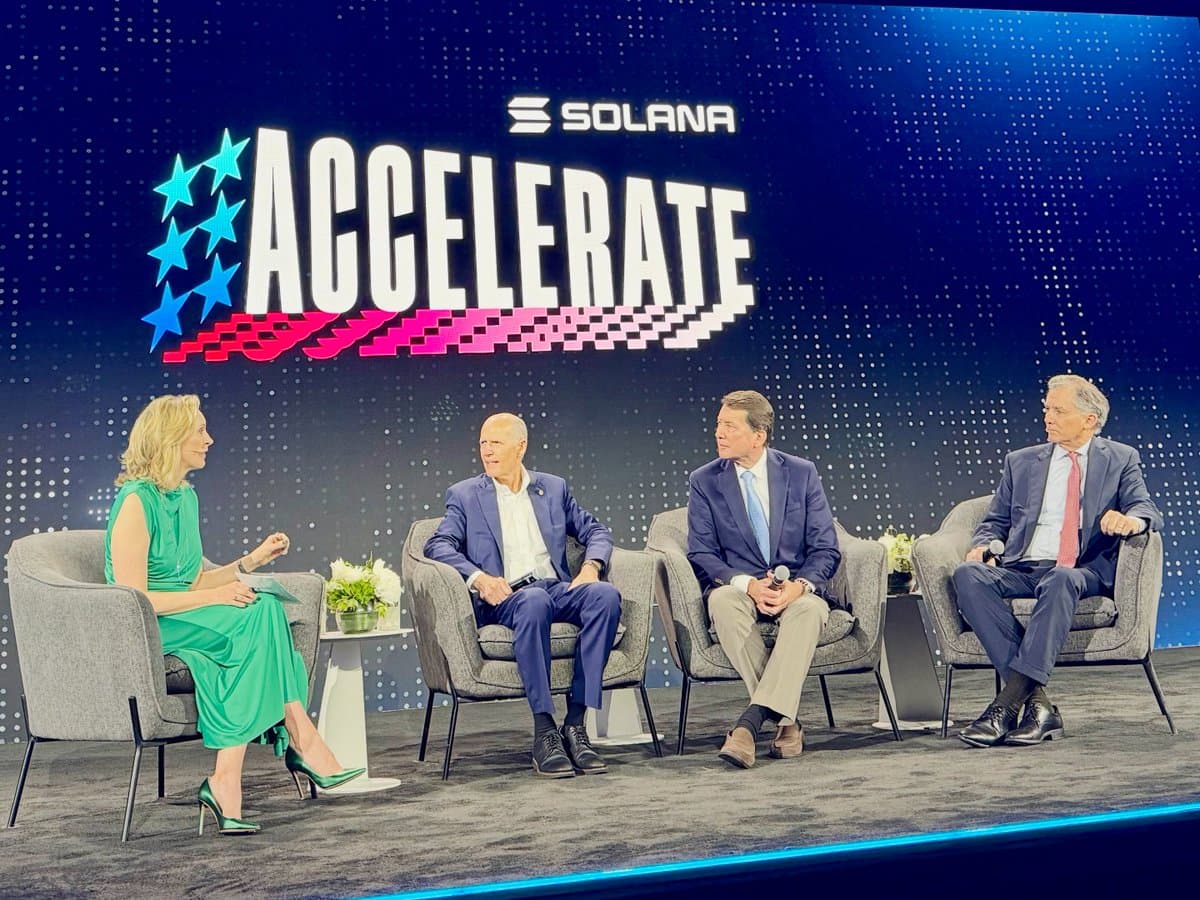

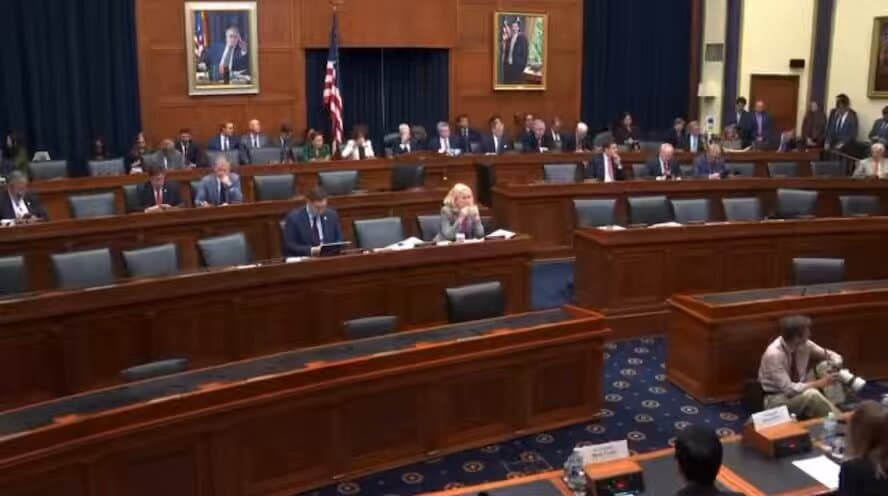

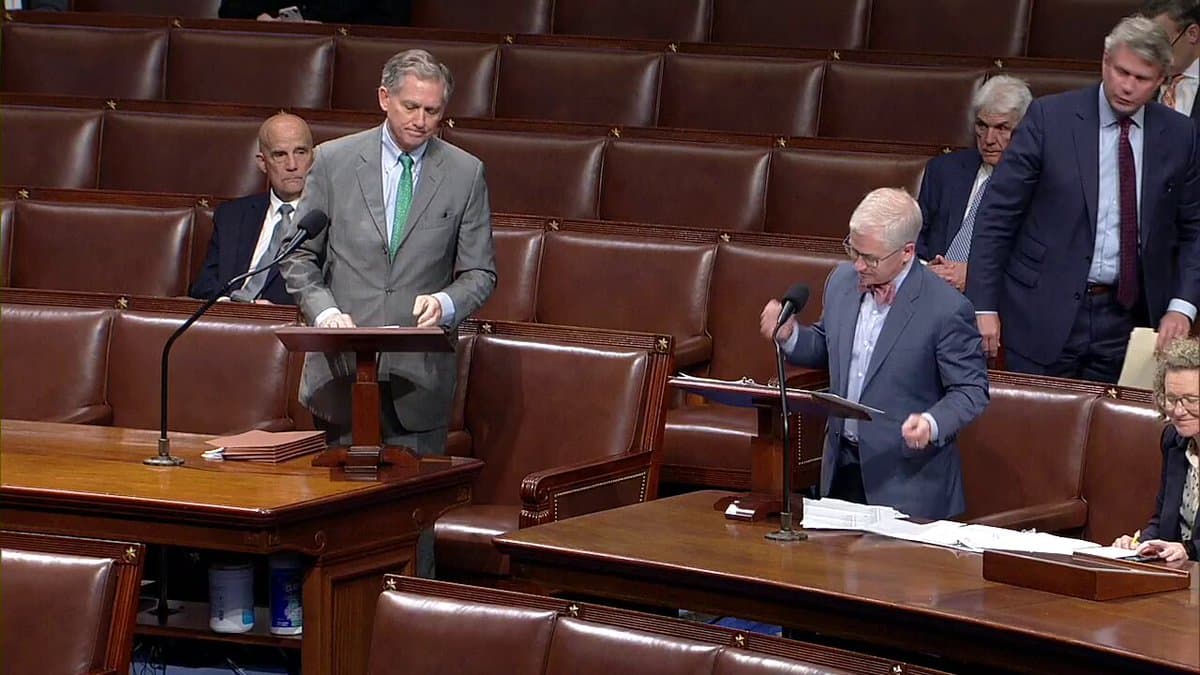

WATCH: Chairman @RepFrenchHill speaks at @RulesReps on the three bills as part of "Crypto Week:"

WATCH: Chairman @RepFrenchHill speaks at @RulesReps on the three bills as part of "Crypto Week:"

CLARITY Act

CLARITY Act

GENIUS Act

GENIUS Act

Anti-CBDC Surveillance State Act https://t.co/VoHiAoaUt1

Anti-CBDC Surveillance State Act https://t.co/VoHiAoaUt1

NEW: Chairman @RepFrenchHill and @HouseAgGOP Chairman @CongressmanGT drop new op-ed as "Crypto Week" gets underway.

Read the Chairmen's piece

NEW: Chairman @RepFrenchHill and @HouseAgGOP Chairman @CongressmanGT drop new op-ed as "Crypto Week" gets underway.

Read the Chairmen's piece

https://t.co/86iAFAqANQ

https://t.co/86iAFAqANQ

hyoutu.be/-Grq_b1wtAA

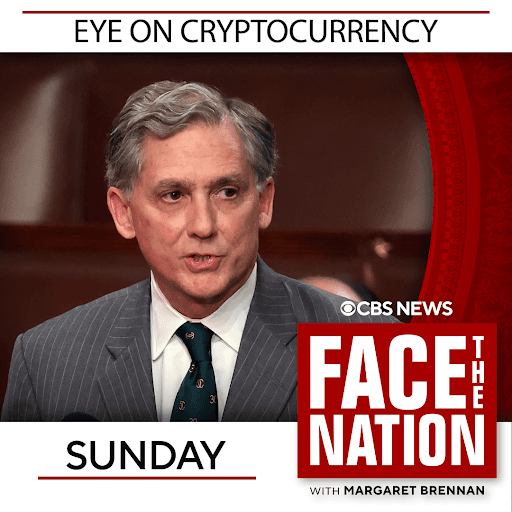

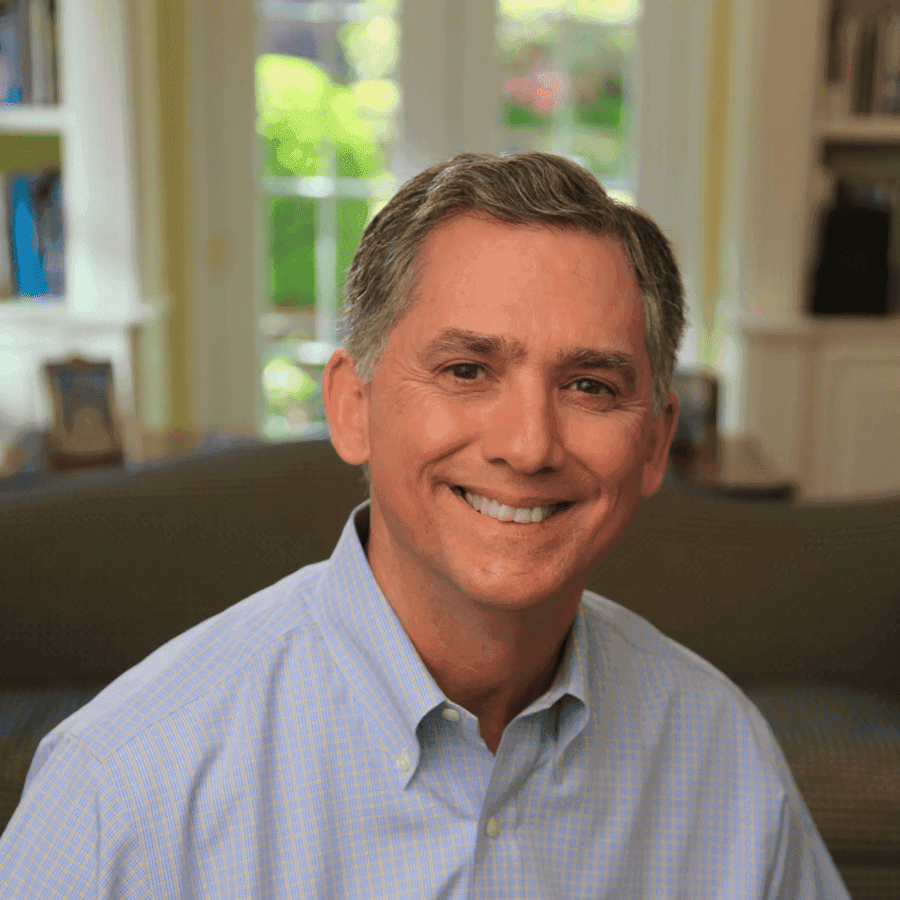

Congressman French Hill, Chairman of the House Financial Services Committee, joined me to discuss the upcoming Crypto Week, during which the House will vote on the Stablecoin and Crypto Market Structure bills, as well as the anti-CBDC legislation.

Topics:

- What is Crypto Week

- Genius Act Stablecoin Bill

- Clarity Act Market Structure Bill

- AntiCBDC Bill

- Implications of Stablecoin legislation passing

- Crypto tax policy

#interview #podcast #congress #crypto #stablecoins @RepFrenchHill @SenLummis @SenatorHagerty

hyoutu.be/-Grq_b1wtAA

Congressman French Hill, Chairman of the House Financial Services Committee, joined me to discuss the upcoming Crypto Week, during which the House will vote on the Stablecoin and Crypto Market Structure bills, as well as the anti-CBDC legislation.

Topics:

- What is Crypto Week

- Genius Act Stablecoin Bill

- Clarity Act Market Structure Bill

- AntiCBDC Bill

- Implications of Stablecoin legislation passing

- Crypto tax policy

#interview #podcast #congress #crypto #stablecoins @RepFrenchHill @SenLummis @SenatorHagerty

https://t.co/evfJUNiamg

https://t.co/evfJUNiamg

NEW: Chairman @RepFrenchHill, Chairman @CongressmanGT, and @GOPMajorityWhip chart course for America's digital asset leadership in their new @CoinDesk op-ed.

Read more

NEW: Chairman @RepFrenchHill, Chairman @CongressmanGT, and @GOPMajorityWhip chart course for America's digital asset leadership in their new @CoinDesk op-ed.

Read more

https://t.co/76kqVTl03u

https://t.co/76kqVTl03u

@MorningsMaria https://t.co/yMQ3u3khvR

@MorningsMaria https://t.co/yMQ3u3khvR

@FoxNews https://t.co/1U9LXgLYK6

@FoxNews https://t.co/1U9LXgLYK6

https://t.co/M1xN5KZP1e

https://t.co/M1xN5KZP1e

@SquawkCNBC https://t.co/eZqDXEygkV

@SquawkCNBC https://t.co/eZqDXEygkV

@LizClaman https://t.co/YwDc5S1LEk

@LizClaman https://t.co/YwDc5S1LEk

NEW: Stablecoin and Market Structure: One Big Bill or Two?

@FinancialCmte Chairman @RepFrenchHill addresses a key question from industry stakeholders in the latest episode of @CryptoAmerica_. Plus, catch up on the week’s biggest headlines.

NEW: Stablecoin and Market Structure: One Big Bill or Two?

@FinancialCmte Chairman @RepFrenchHill addresses a key question from industry stakeholders in the latest episode of @CryptoAmerica_. Plus, catch up on the week’s biggest headlines.  https://t.co/UtVx6fhtYd

https://t.co/UtVx6fhtYd

https://t.co/E27ZKGTgqe

https://t.co/E27ZKGTgqe

https://t.co/JebW2FbdGH

https://t.co/JebW2FbdGH

@MorningsMaria https://t.co/1woN9OmiCu

@MorningsMaria https://t.co/1woN9OmiCu

NEW: Chairman @RepFrenchHill statement on Executive Order establishing a Strategic Bitcoin Reserve and Digital Asset Stockpile

NEW: Chairman @RepFrenchHill statement on Executive Order establishing a Strategic Bitcoin Reserve and Digital Asset Stockpile https://t.co/WH50KFq5SD

https://t.co/WH50KFq5SD

Chairman @RepFrenchHill: “As more voices come to the table to discuss a robust legislative solution for stablecoins, I will continue to listen to ensure we get this right. Building on our prior work, we have a new opportunity with the Trump Admin and Republican control of the House and Senate to pass legislation that would establish a framework for a dollar-backed stablecoin in the US. @RepBryanSteil and I released our discussion draft based on conversations with our members, and we welcome feedback from our House and Senate colleagues, the Trump Admin, and industry leaders. The strong bipartisan support we saw for digital asset legislation in the last Congress demonstrates that digital assets are not a partisan issue, and I look forward to working together to pass meaningful legislation.”

Chairman @RepFrenchHill: “As more voices come to the table to discuss a robust legislative solution for stablecoins, I will continue to listen to ensure we get this right. Building on our prior work, we have a new opportunity with the Trump Admin and Republican control of the House and Senate to pass legislation that would establish a framework for a dollar-backed stablecoin in the US. @RepBryanSteil and I released our discussion draft based on conversations with our members, and we welcome feedback from our House and Senate colleagues, the Trump Admin, and industry leaders. The strong bipartisan support we saw for digital asset legislation in the last Congress demonstrates that digital assets are not a partisan issue, and I look forward to working together to pass meaningful legislation.”

NEW: Chairman @RepFrenchHill and @RepBryanSteil today released their discussion draft for #stablecoins.

Read more

NEW: Chairman @RepFrenchHill and @RepBryanSteil today released their discussion draft for #stablecoins.

Read more financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

Chairman @RepFrenchHill: "In the 119th Congress, we have a bicameral project for both a stablecoins bill and a regulatory framework that will bring clarity to digital assets in the United States."

Watch more

Chairman @RepFrenchHill: "In the 119th Congress, we have a bicameral project for both a stablecoins bill and a regulatory framework that will bring clarity to digital assets in the United States."

Watch more

financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

https://t.co/vy9RiCT7FB

https://t.co/vy9RiCT7FB

I

I

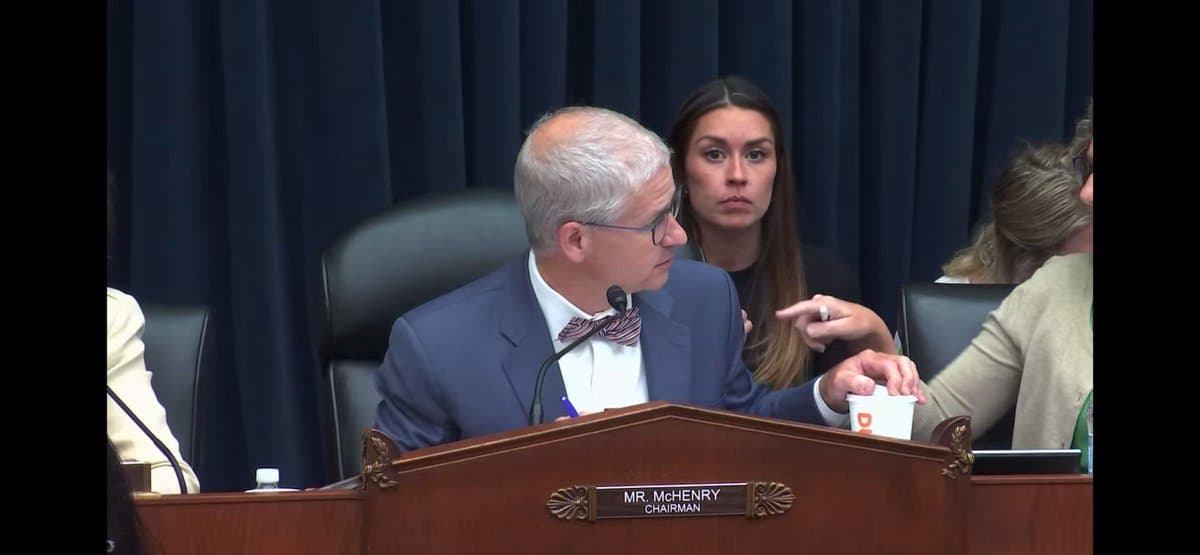

NEW: The CEO of @Anchorage @nathanmccauley just told @RepFrenchHill that in June 2023, the company’s bank told them explicitly they were dropping them as a client because they are “in the business of crypto.” Anchorage is itself a federally chartered and @USOCC-examined bank that got debanked for being involved in #crypto.

NEW: The CEO of @Anchorage @nathanmccauley just told @RepFrenchHill that in June 2023, the company’s bank told them explicitly they were dropping them as a client because they are “in the business of crypto.” Anchorage is itself a federally chartered and @USOCC-examined bank that got debanked for being involved in #crypto.

https://t.co/6BtXQveJhj

https://t.co/6BtXQveJhj

https://t.co/BOC8wfCVLA

https://t.co/BOC8wfCVLA

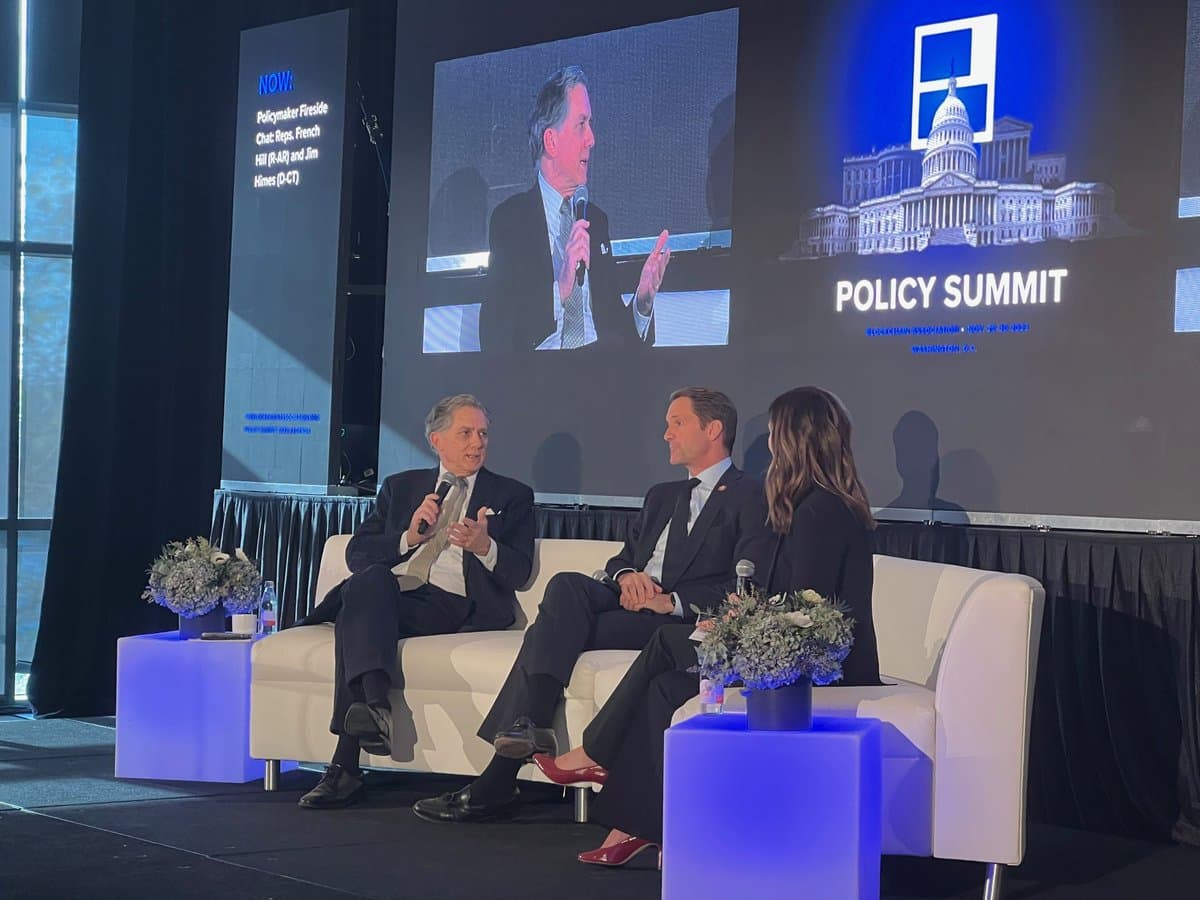

w/ Congressman @RepFrenchHill

What would pro-crypto America look like & what laws need to be passed to get there?

As the @FinancialCmte Vice-Chairman, Congressman Hill is at the center of these convos in D.C.

These are his answers

w/ Congressman @RepFrenchHill

What would pro-crypto America look like & what laws need to be passed to get there?

As the @FinancialCmte Vice-Chairman, Congressman Hill is at the center of these convos in D.C.

These are his answers

financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

Watch his remarks

Watch his remarks

@RepFrenchHill:

Congress must act to provide regulatory clarity to the digital asset ecosystem.

Without it, the SEC will continue to pursue a "regulation by enforcement" agenda that leaves markets and individuals worse off.

H.R. 4763 delivers a critical solution.

@RepFrenchHill:

Congress must act to provide regulatory clarity to the digital asset ecosystem.

Without it, the SEC will continue to pursue a "regulation by enforcement" agenda that leaves markets and individuals worse off.

H.R. 4763 delivers a critical solution.

To date, the U.S. digital asset ecosystem has been mired by uncertainty and regulation by enforcement.

Congress has the chance to provide the robust consumer protections and regulatory clarity needed to foster innovation here in America by advancing #FIT21.

To date, the U.S. digital asset ecosystem has been mired by uncertainty and regulation by enforcement.

Congress has the chance to provide the robust consumer protections and regulatory clarity needed to foster innovation here in America by advancing #FIT21.

The bipartisan Financial Innovation and Technology for the 21st Century (FIT21) Act

The bipartisan Financial Innovation and Technology for the 21st Century (FIT21) Act

@GOPMajorityWhip's CBDC Anti-Surveillance State Act

@GOPMajorityWhip's CBDC Anti-Surveillance State Act

https://t.co/WM8wPYRMZR

https://t.co/WM8wPYRMZR

BREAKING: House to consider the Financial Innovation and Technology for the 21st Century Act.

#FIT21 will deliver robust consumer protections and regulatory clarity for digital asset markets.

BREAKING: House to consider the Financial Innovation and Technology for the 21st Century Act.

#FIT21 will deliver robust consumer protections and regulatory clarity for digital asset markets.

Read more

Read more  financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

financialservices.house.gov/calendar/event…

financialservices.house.gov/calendar/event…

U.S. Congressman French Hill says "bad actors still prefer to use traditional finance rather than digital assets."

U.S. Congressman French Hill says "bad actors still prefer to use traditional finance rather than digital assets."

Read more

Read more  financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

@CFTCbehnam says many digital assets are commodities.

@CFTCbehnam says many digital assets are commodities.

@GaryGensler says almost all are securities.

#FIT21 provides much needed clarity with marching orders for both regulators & robust protections for consumers. https://t.co/eJjmsgJc6Y

@GaryGensler says almost all are securities.

#FIT21 provides much needed clarity with marching orders for both regulators & robust protections for consumers. https://t.co/eJjmsgJc6Y

financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

Watch his opening remarks

Watch his opening remarks

Read his full statement

Read his full statement  financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

https://t.co/kdiTuIABnf

https://t.co/kdiTuIABnf

| @MorningsMaria https://t.co/zQju62oFcf

| @MorningsMaria https://t.co/zQju62oFcf

#FIT21 @FinancialCmte https://t.co/dDYH3efJTX

#FIT21 @FinancialCmte https://t.co/dDYH3efJTX

hyoutu.be/Kae_FrxNpi8

Topics:

- How the US can get Crypto Right

- Crypto Bills that have been introduced

- Can #Congress pass Crypto #Regulations this year

- #BackRock & TradFi Entering the Crypto market

- SEC Gary Gensler & #Ripple #XRP Lawsuit Victory

- #DigitalDollar #CBDC

- #Blockchain Voting

- Updating the Accredited Investor Laws

#interview #bitcoin #web3 #tech #jobs

hyoutu.be/Kae_FrxNpi8

Topics:

- How the US can get Crypto Right

- Crypto Bills that have been introduced

- Can #Congress pass Crypto #Regulations this year

- #BackRock & TradFi Entering the Crypto market

- SEC Gary Gensler & #Ripple #XRP Lawsuit Victory

- #DigitalDollar #CBDC

- #Blockchain Voting

- Updating the Accredited Investor Laws

#interview #bitcoin #web3 #tech #jobs

financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

Watch his full remarks

Watch his full remarks

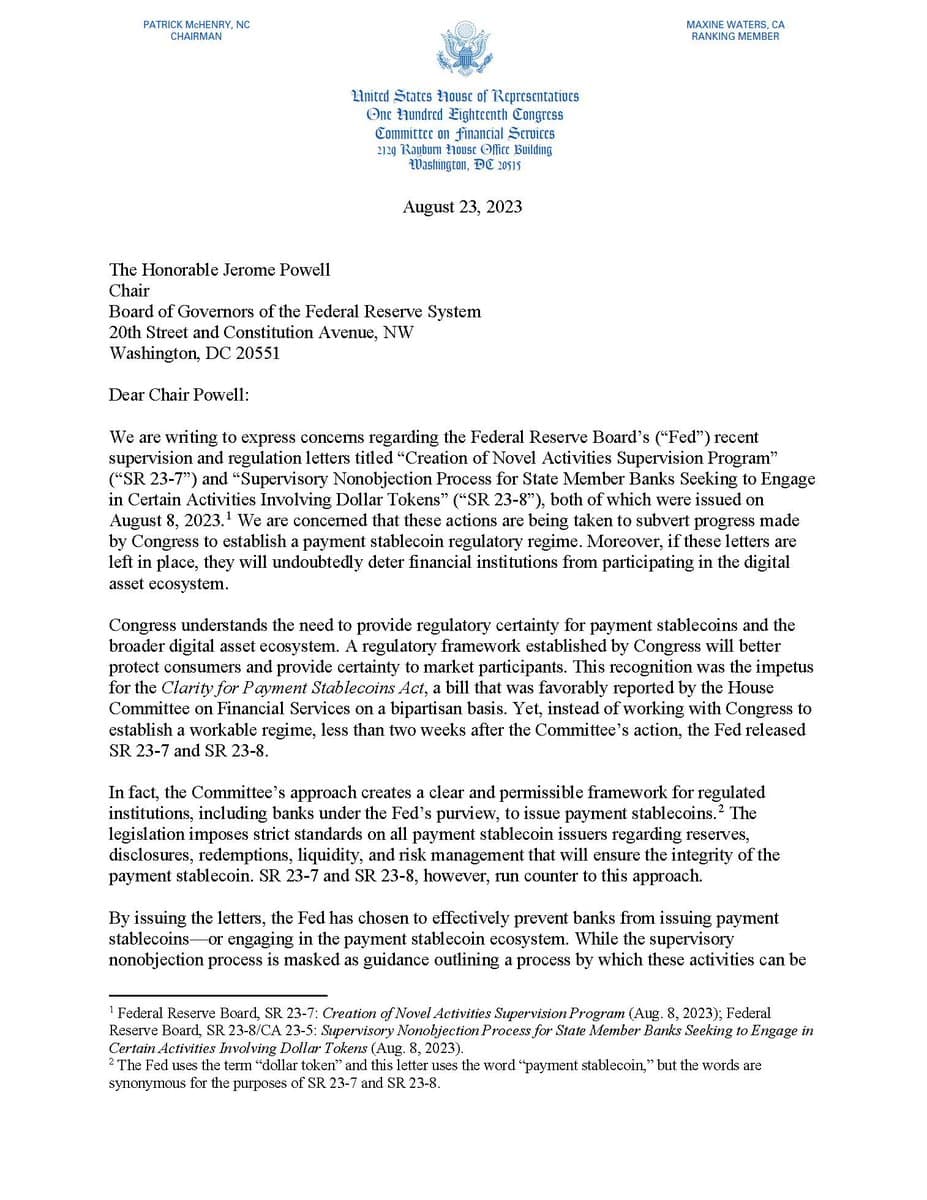

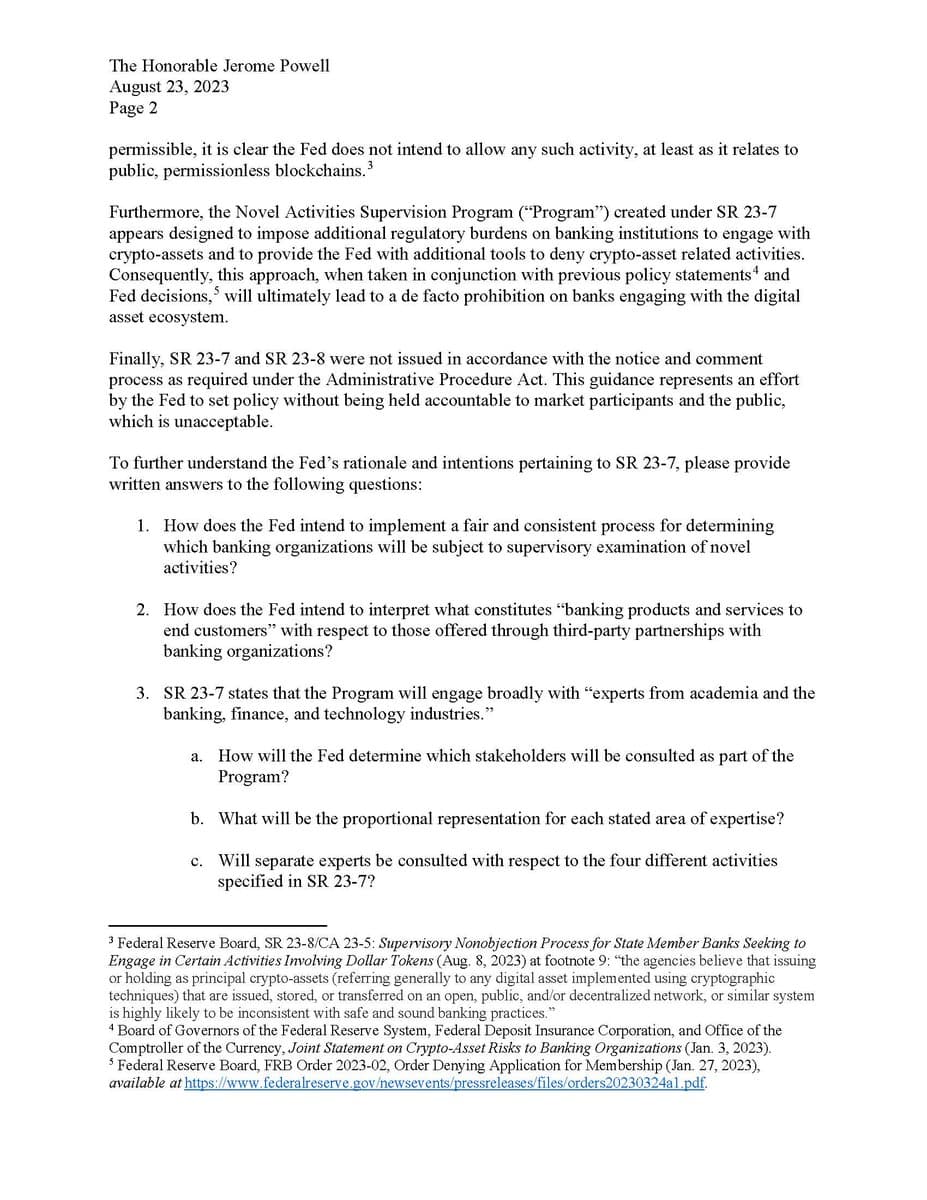

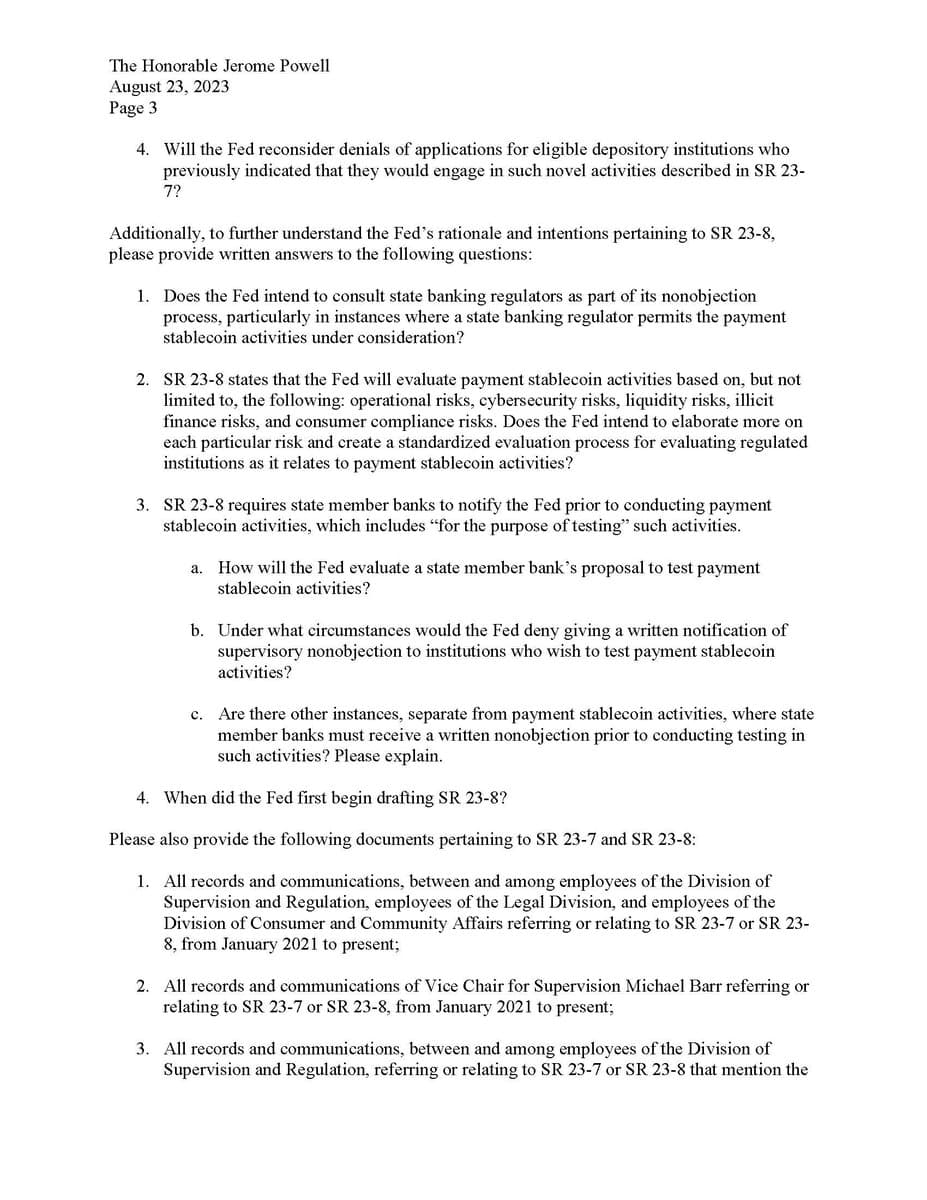

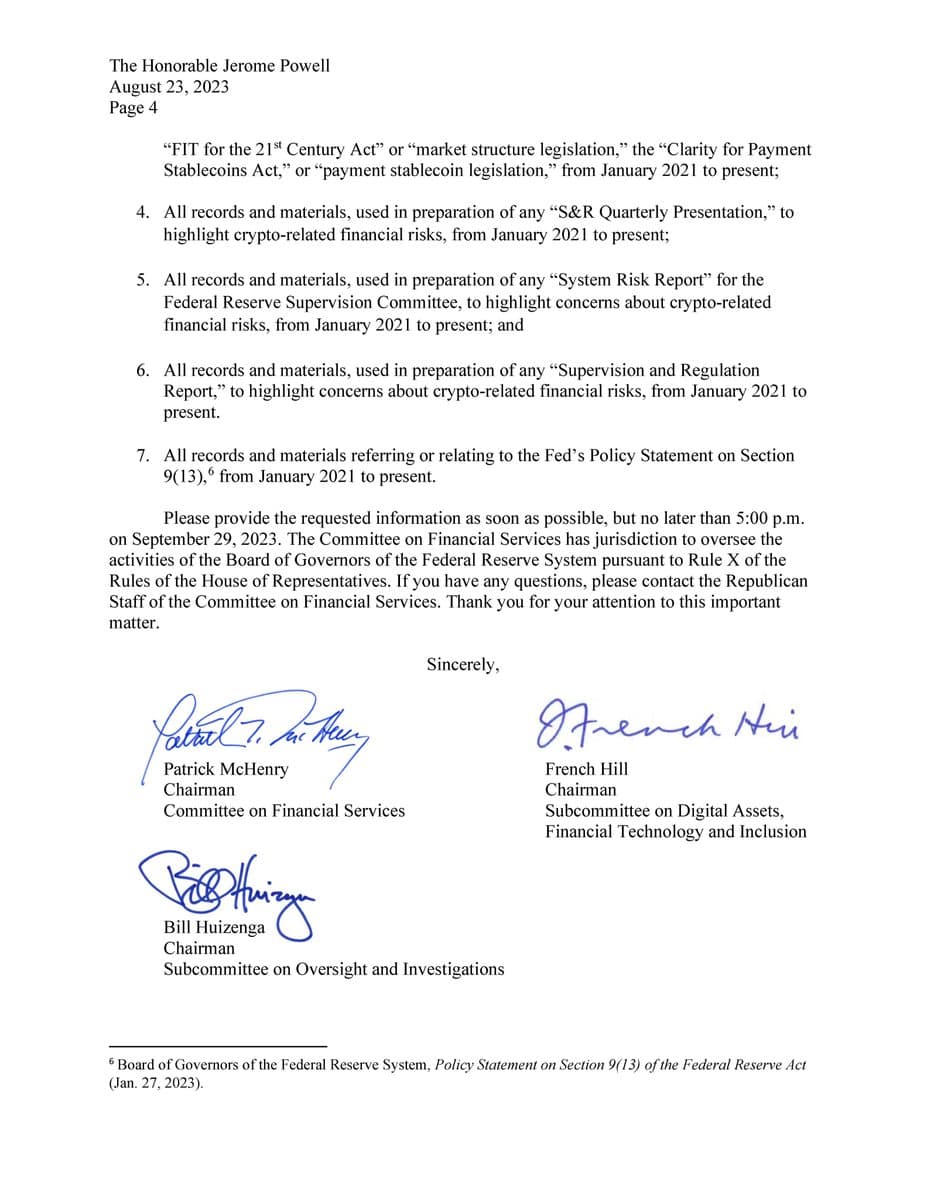

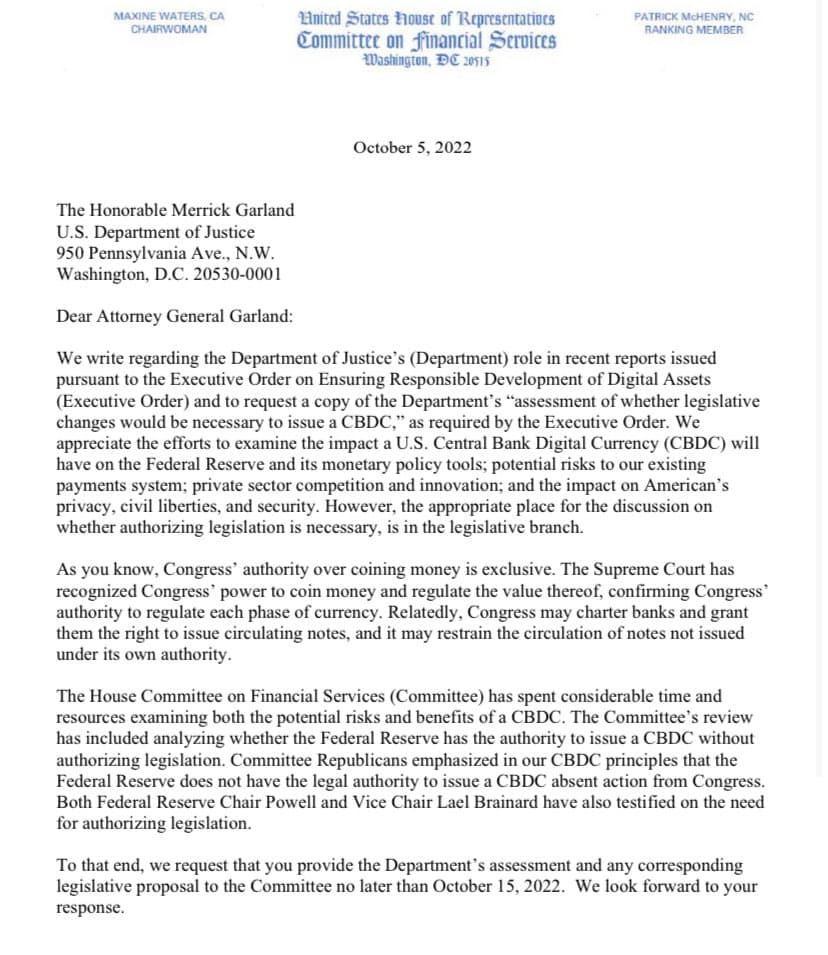

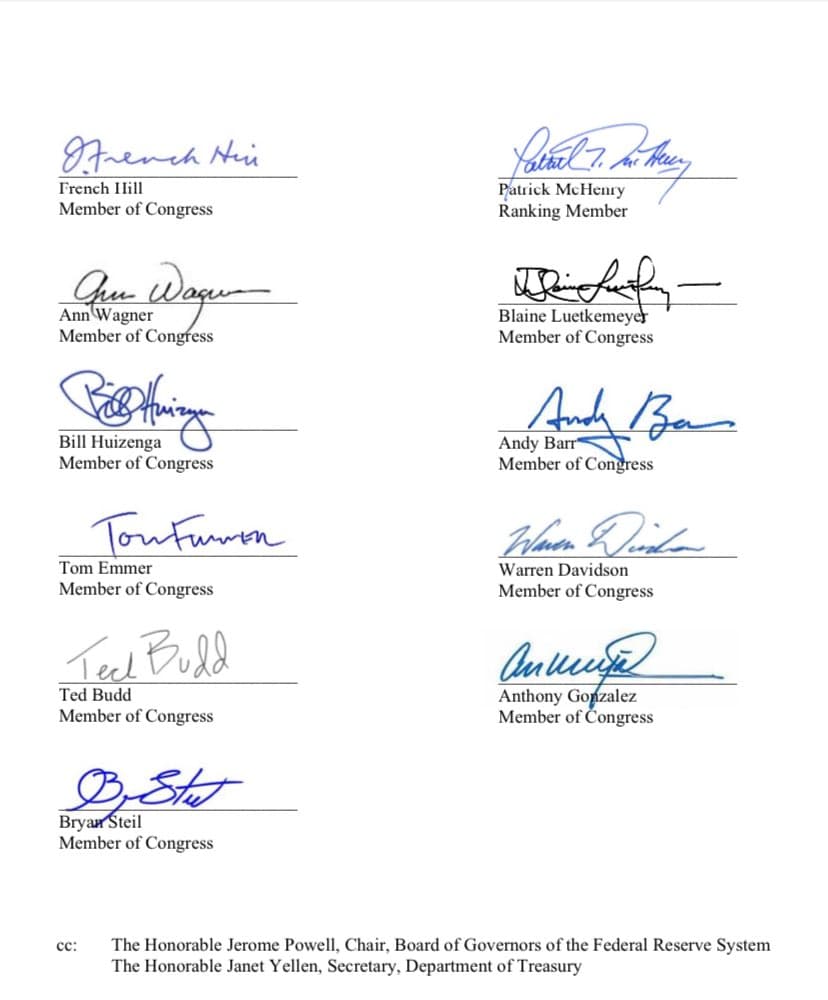

Read more on their letters

Read more on their letters  hfinancialservices.house.gov/news/documents…https://t.co/GInBcOCm90

hfinancialservices.house.gov/news/documents…https://t.co/GInBcOCm90

financialservices.house.gov/news/documents…

financialservices.house.gov/news/documents…

Watch his opening remarks

Watch his opening remarks

Read the letter

Read the letter  …publicans-financialservices.house.gov/news/documents…

…publicans-financialservices.house.gov/news/documents…

Read more

Read more  …publicans-financialservices.house.gov/news/documents…

…publicans-financialservices.house.gov/news/documents…