Does Roger Marshall Support Crypto?

Based on previous comments, Roger Marshall has indicated they are very pro-cryptocurrency. Below you can view the tweets, quotes, and other commentary Roger Marshall has made about Bitcoin, Ethereum, and cryptocurrency innovation.

U

U

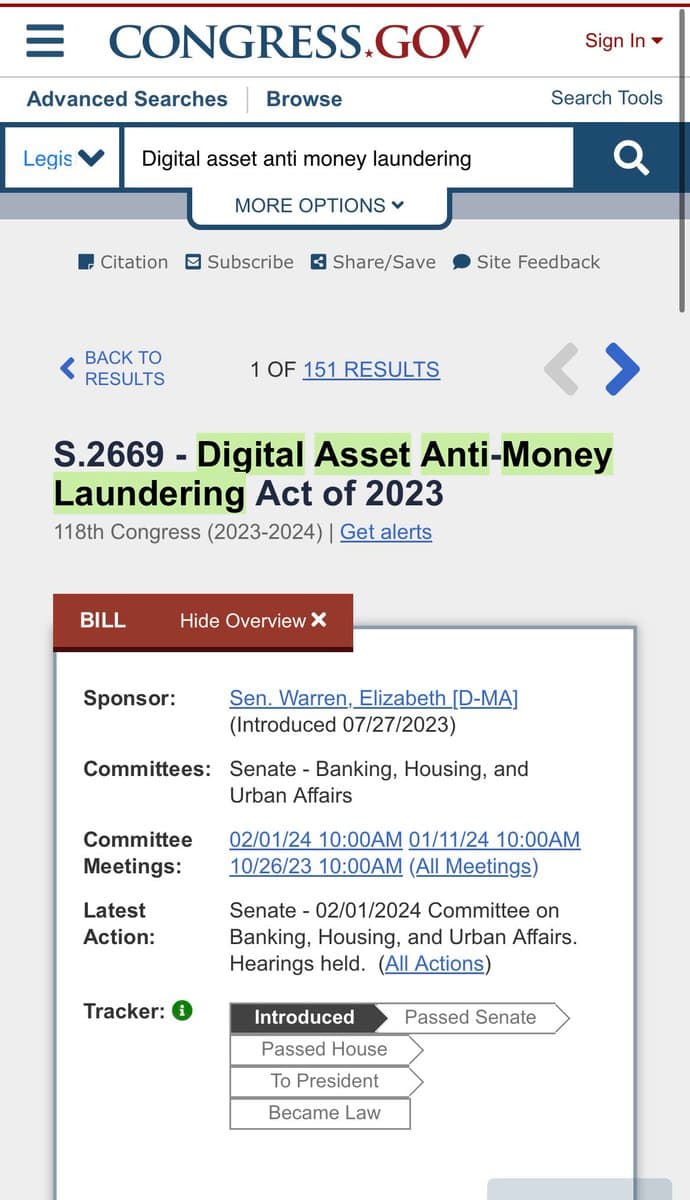

In a video, Senator Marshall admitted that he and Senator Warren approached the American Bankers Association (ABA), the largest lobbying organization for the U.S. banking industry, for assistance in crafting the Digital Asset Anti-Money Laundering Act. Senator Marshall also mentioned Warren’s meeting with JPMorgan CEO Jamie Dimon, who agreed that "crypto is only a tool for criminals." The footage was sourced from a parliamentary security intelligence forum earlier in December.

https://t.co/9lO902fdyn

https://t.co/9lO902fdyn

Analysis on Stance

Add your own analysis on this stance

Analysis on Stance

Add your own analysis on this stance

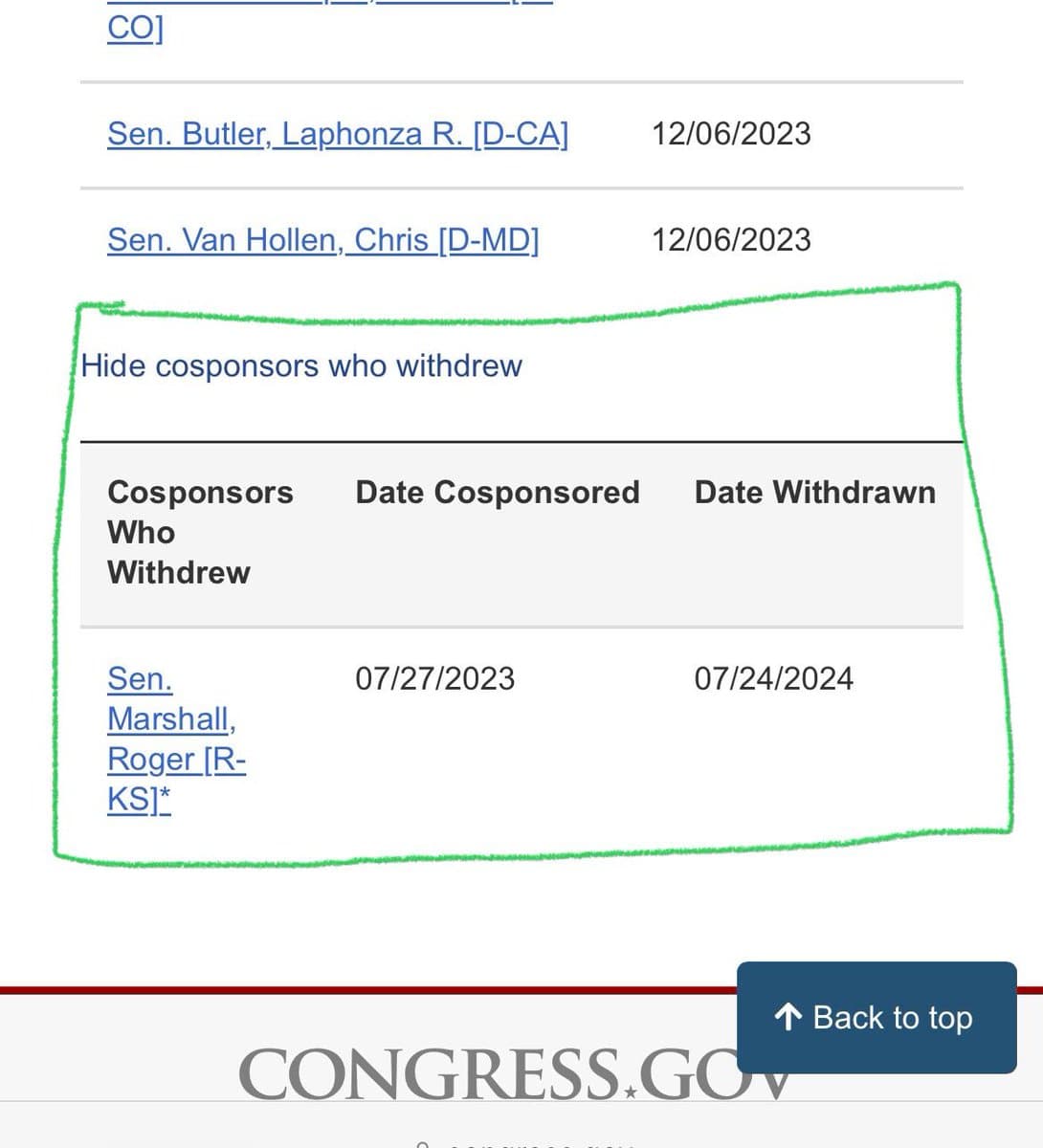

Senator Roger Marshall, along with Senator Elizabeth Warren and others, reintroduced the Digital Asset Anti-Money Laundering Act of 2023. The legislation would classify certain industry participants, including individual miners and validators, as financial institutions subject to the Bank Secrecy Act compliance regime. Treating these entities commensurate with the largest banks, hedge funds, and money transmitters would weigh them down with unnecessary compliance, stifle innovation, hinder industry growth, and force activity offshore to jurisdictions with less adequate security and oversight.