Is The Bill "S.J. Res 3" Crypto Friendly?

Description:

A joint resolution providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Internal Revenue Service relating to "Gross Proceeds Reporting by Brokers That Regularly Provide Services Effectuating Digital Asset Sales".

Date Introduced:

2025-01-21

Status:

Introduced and Sponsored

Stance on Crypto:

Very Pro-Crypto

Links:

Primary Analysis:

Primary Analysis:

This resolution expresses Congressional disapproval of a rule submitted by the Internal Revenue Service (IRS) relating to "Gross Proceeds Reporting by Brokers That Regularly Provide Services Effectuating Digital Asset Sales". The rule was published in the Federal Register on December 30, 2024.

This resolution is considered pro-crypto because it seeks to overturn a rule that would have imposed more stringent reporting requirements on digital asset brokers, and would specifically make it extremely challenging for DeFi protocols to comply. It is overly broad, would place an undue burden on crypto businesses, and would stifle innovation in the crypto industry.

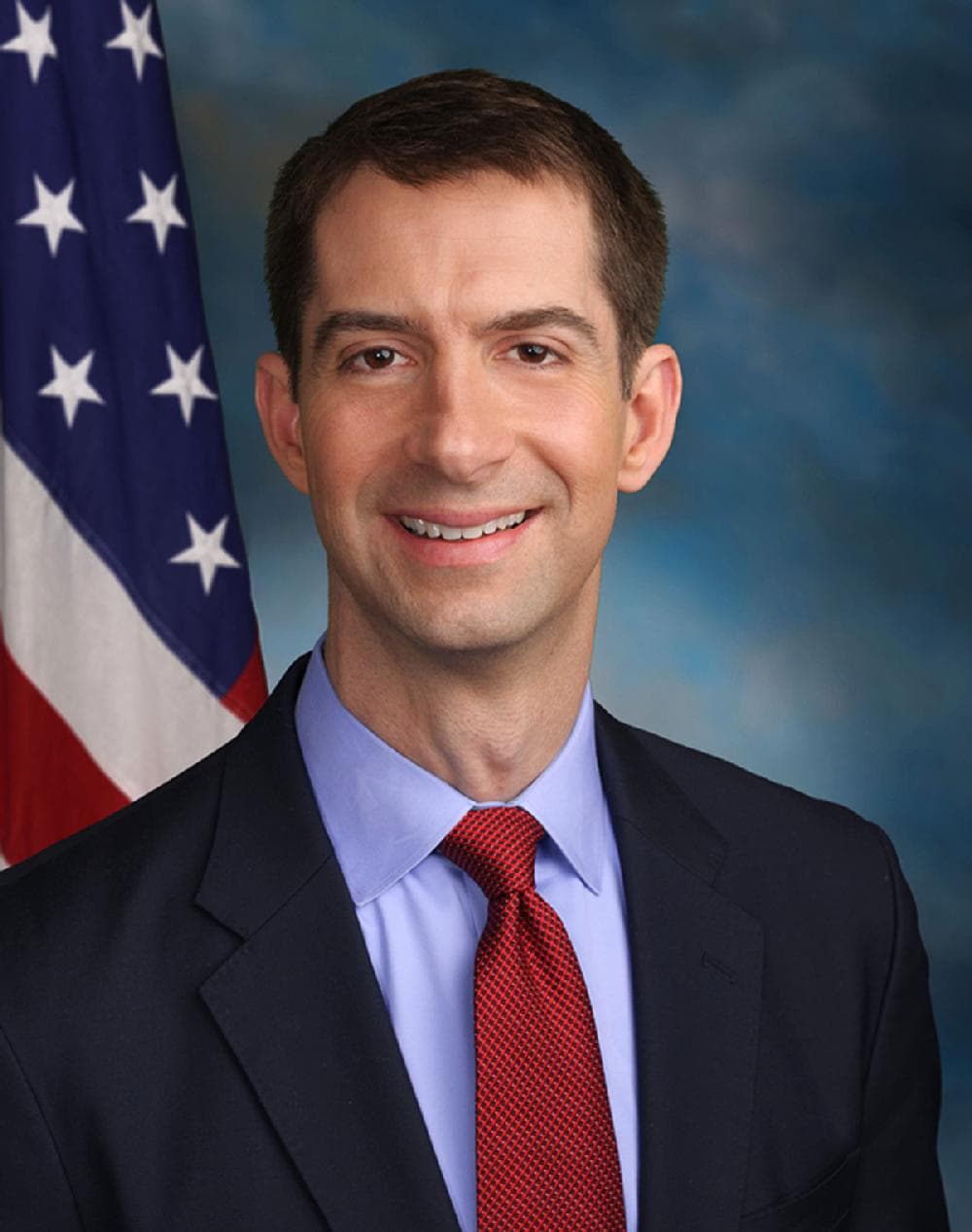

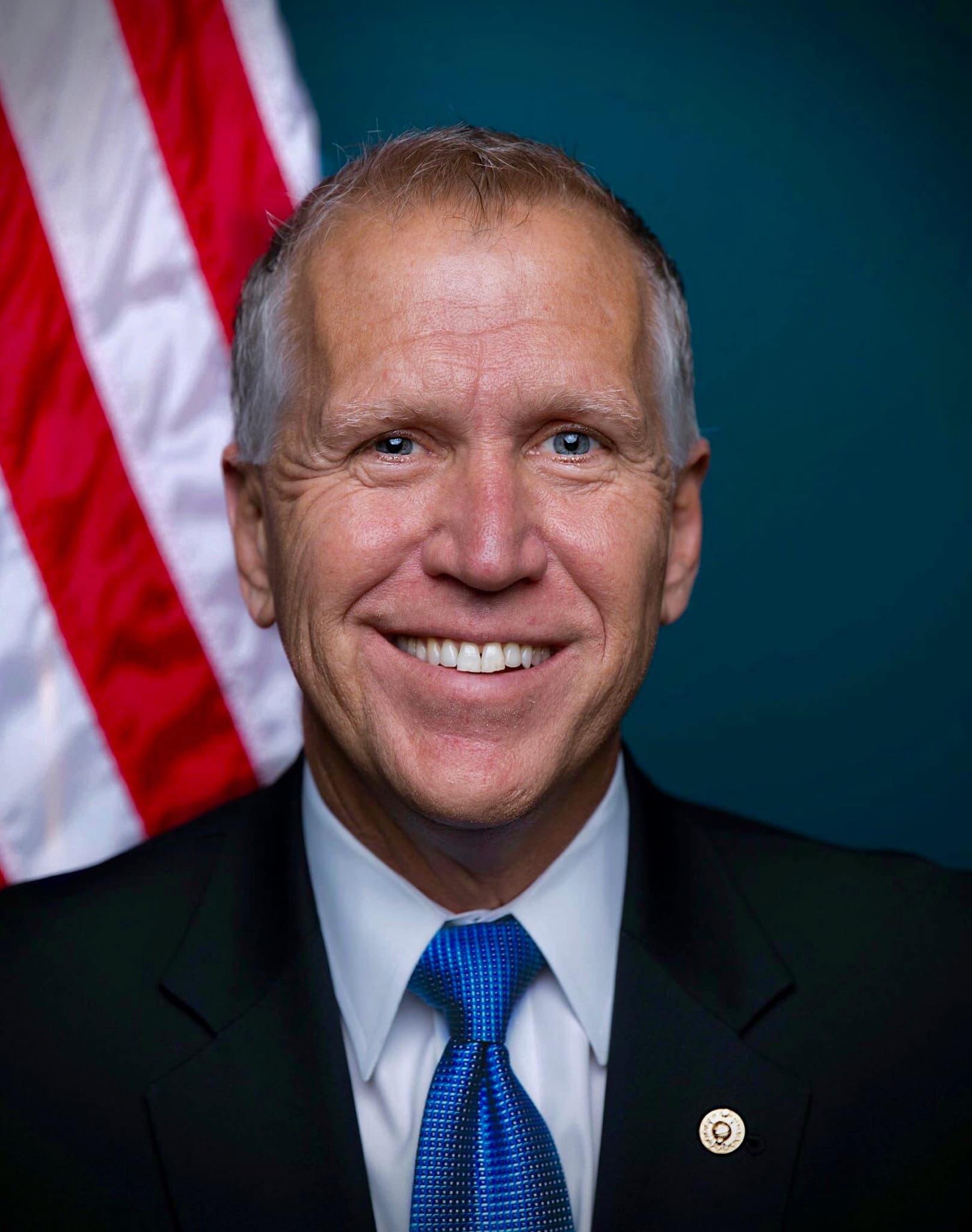

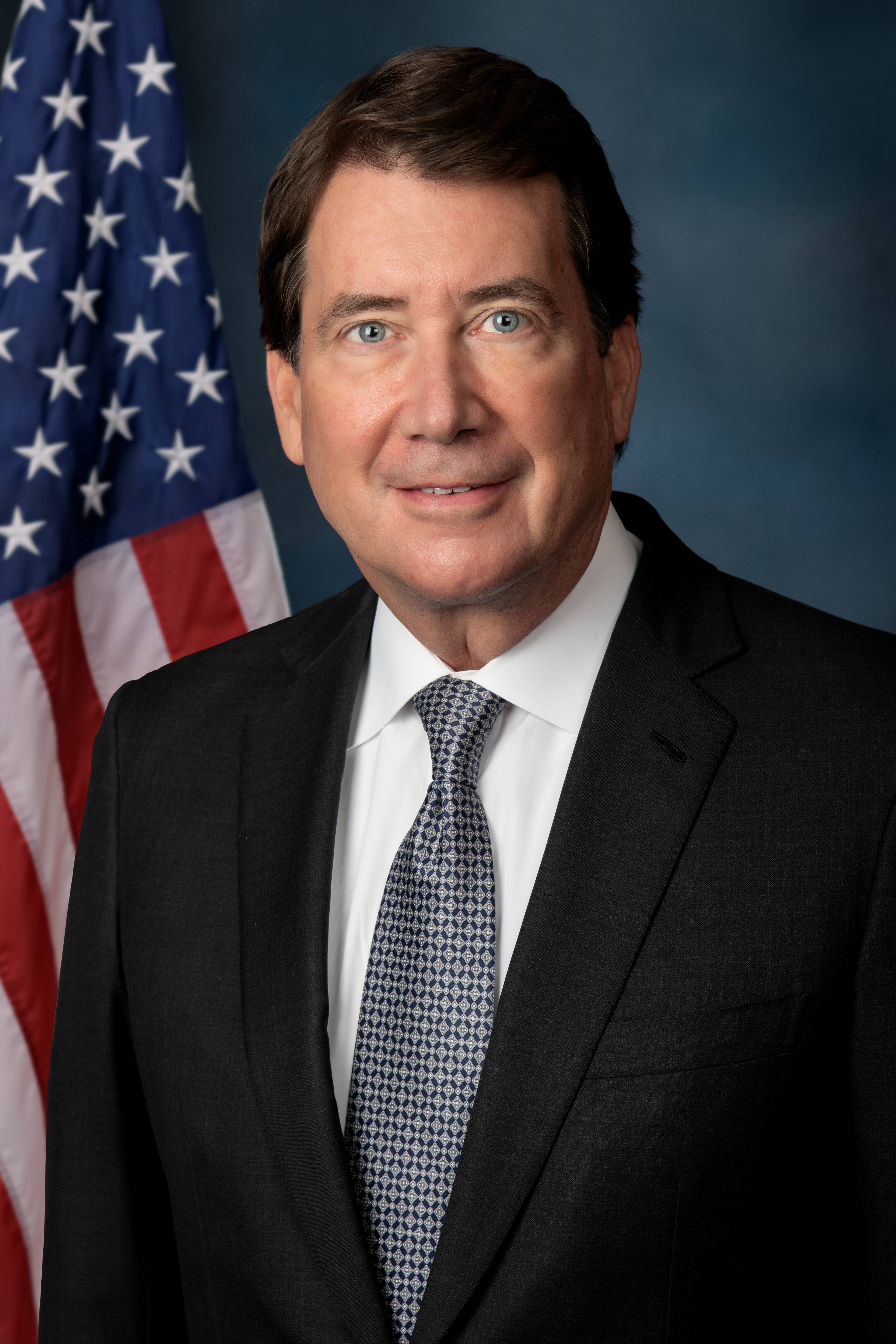

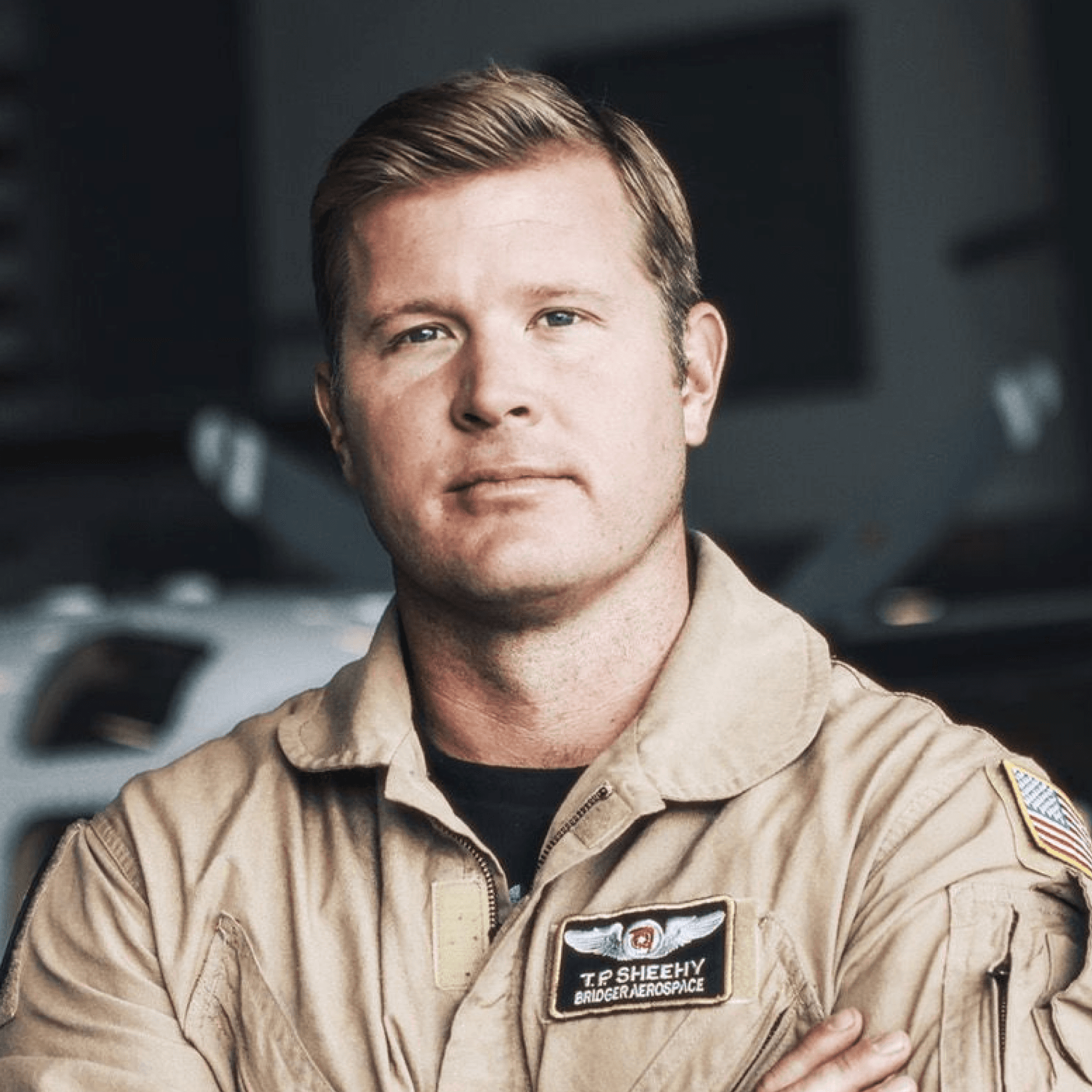

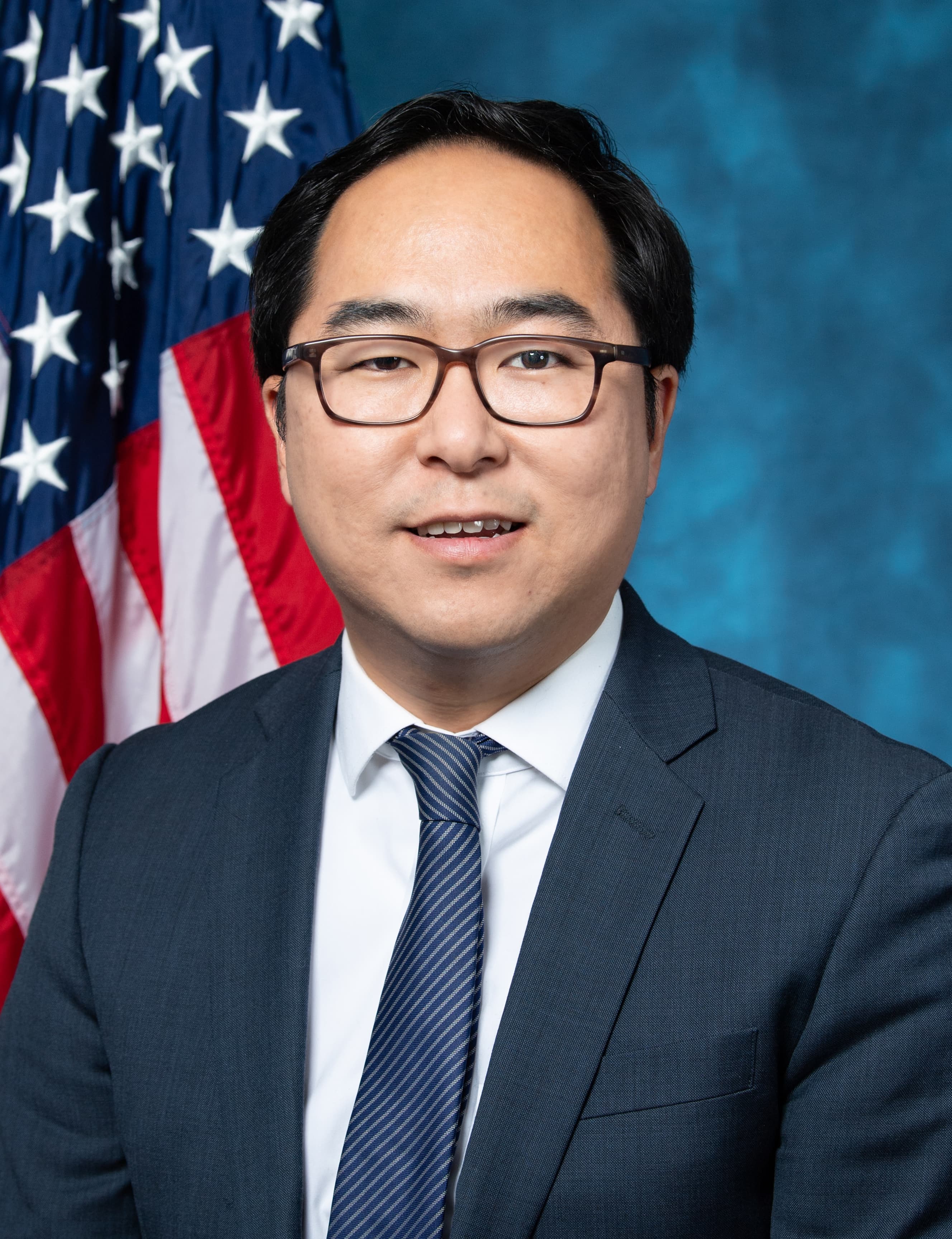

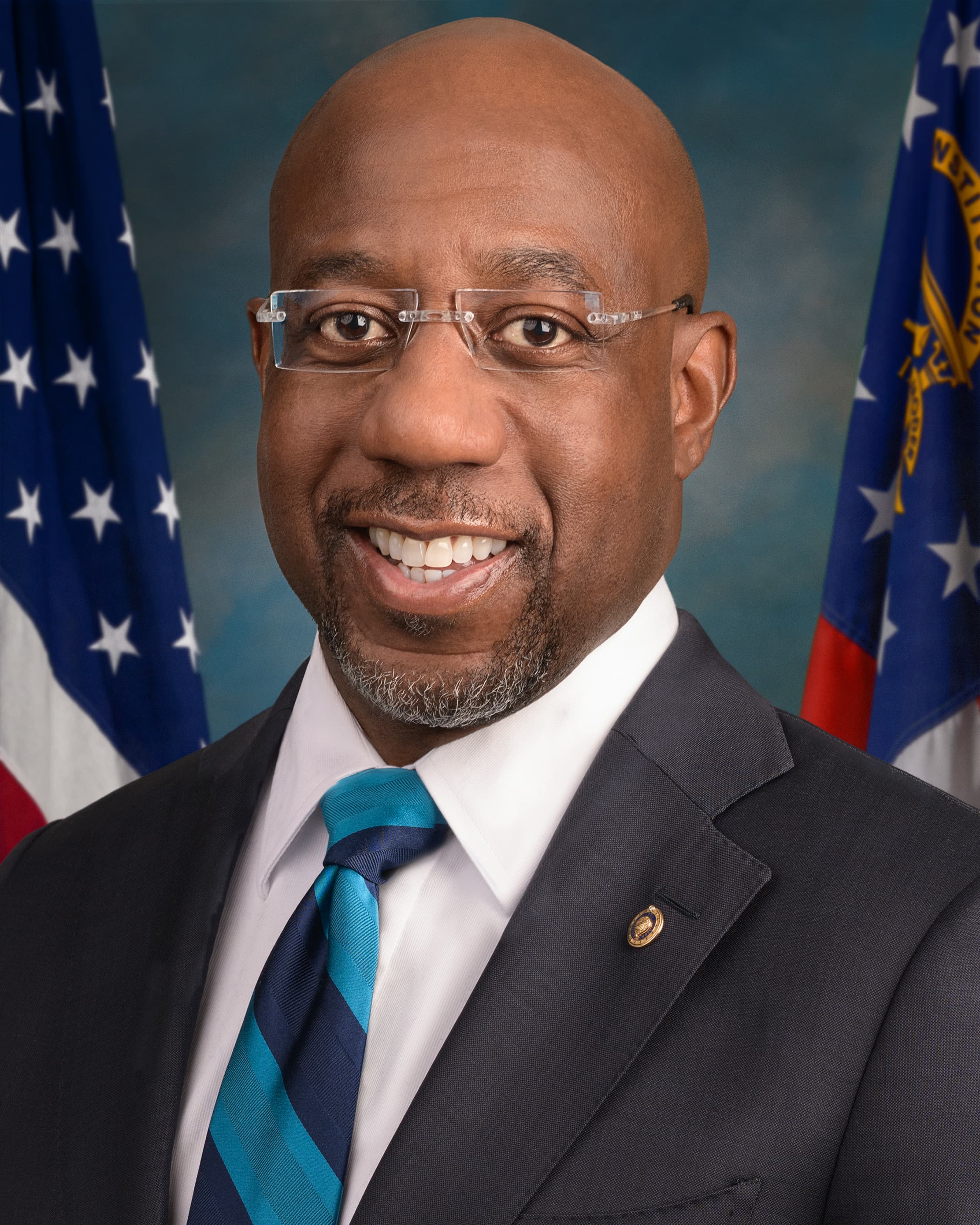

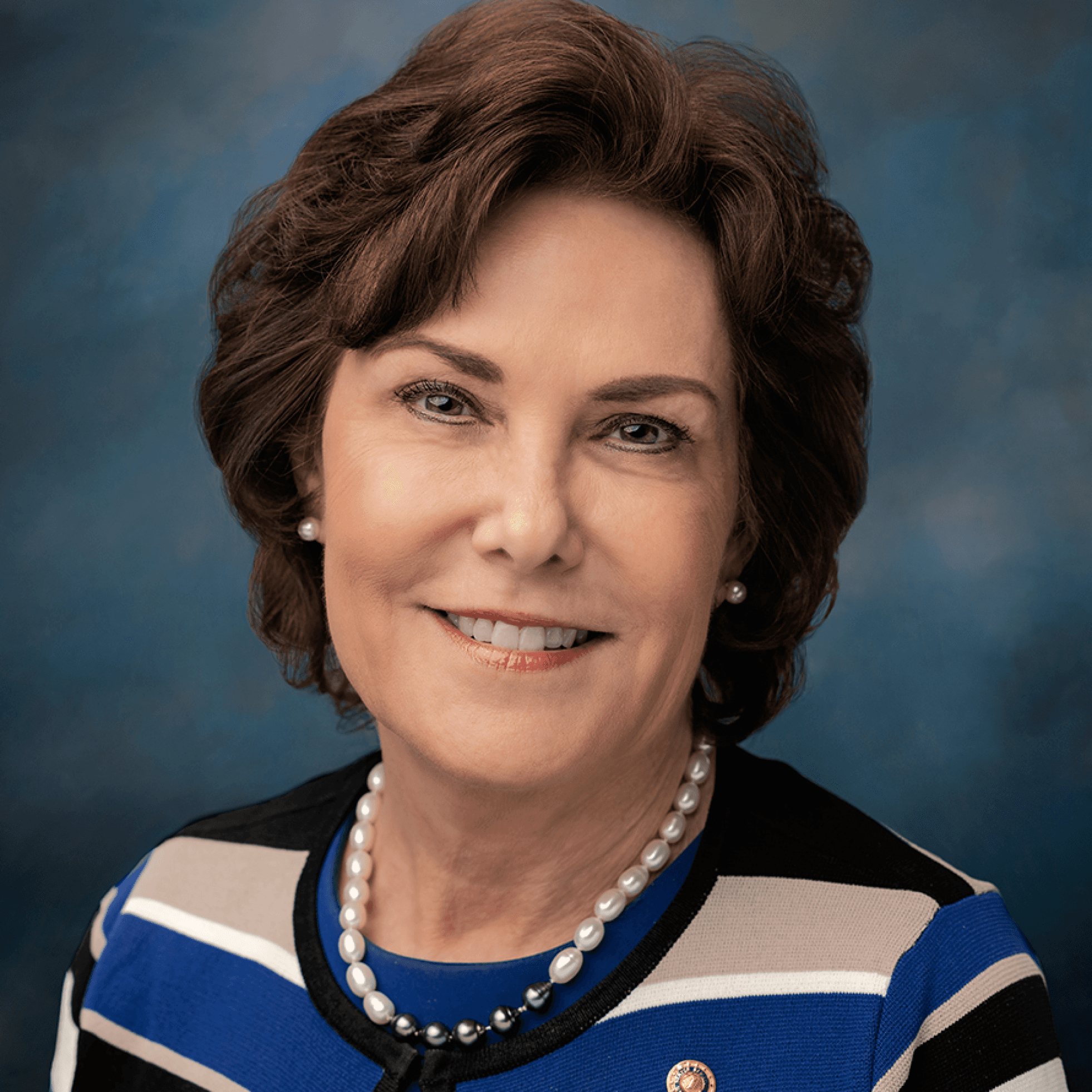

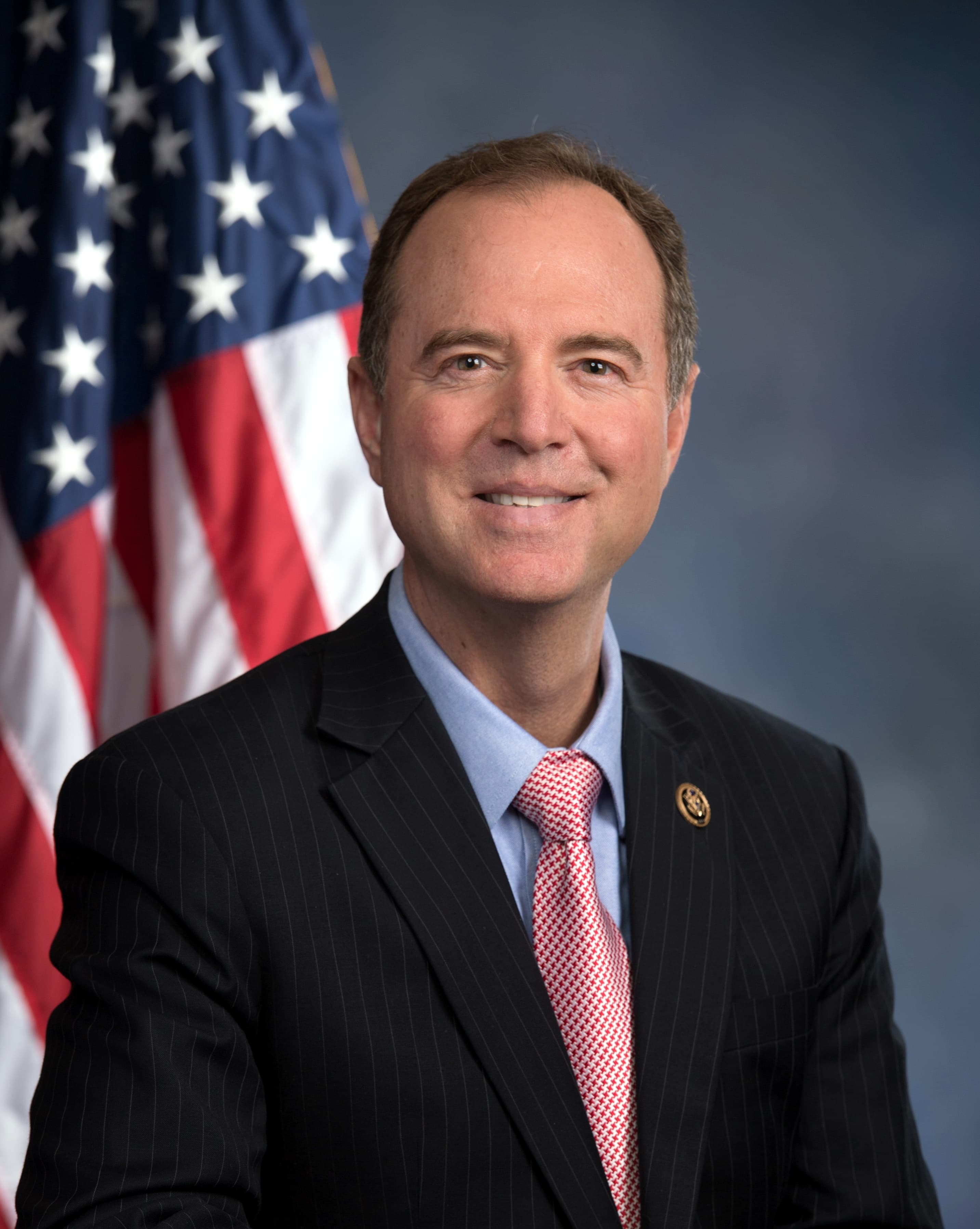

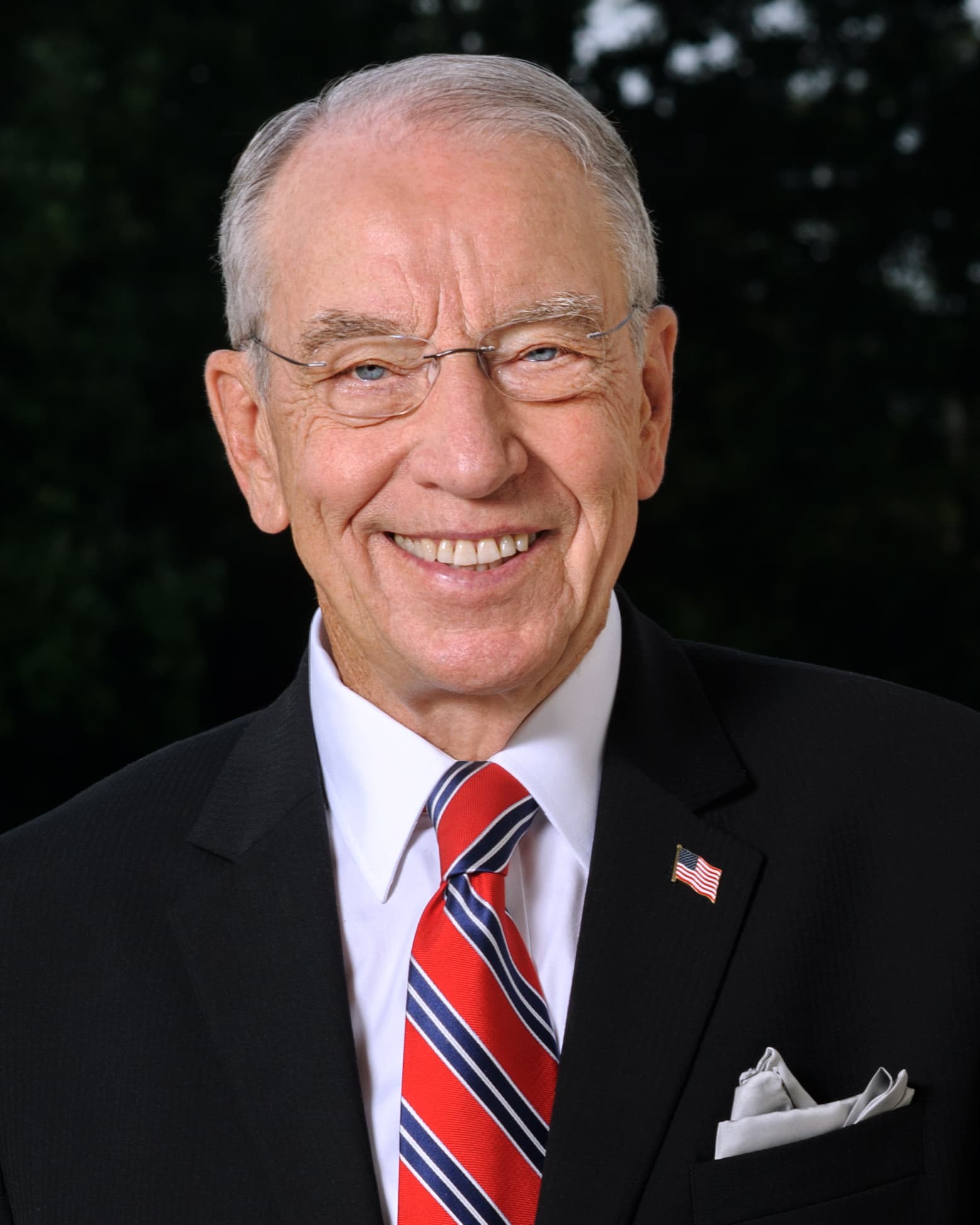

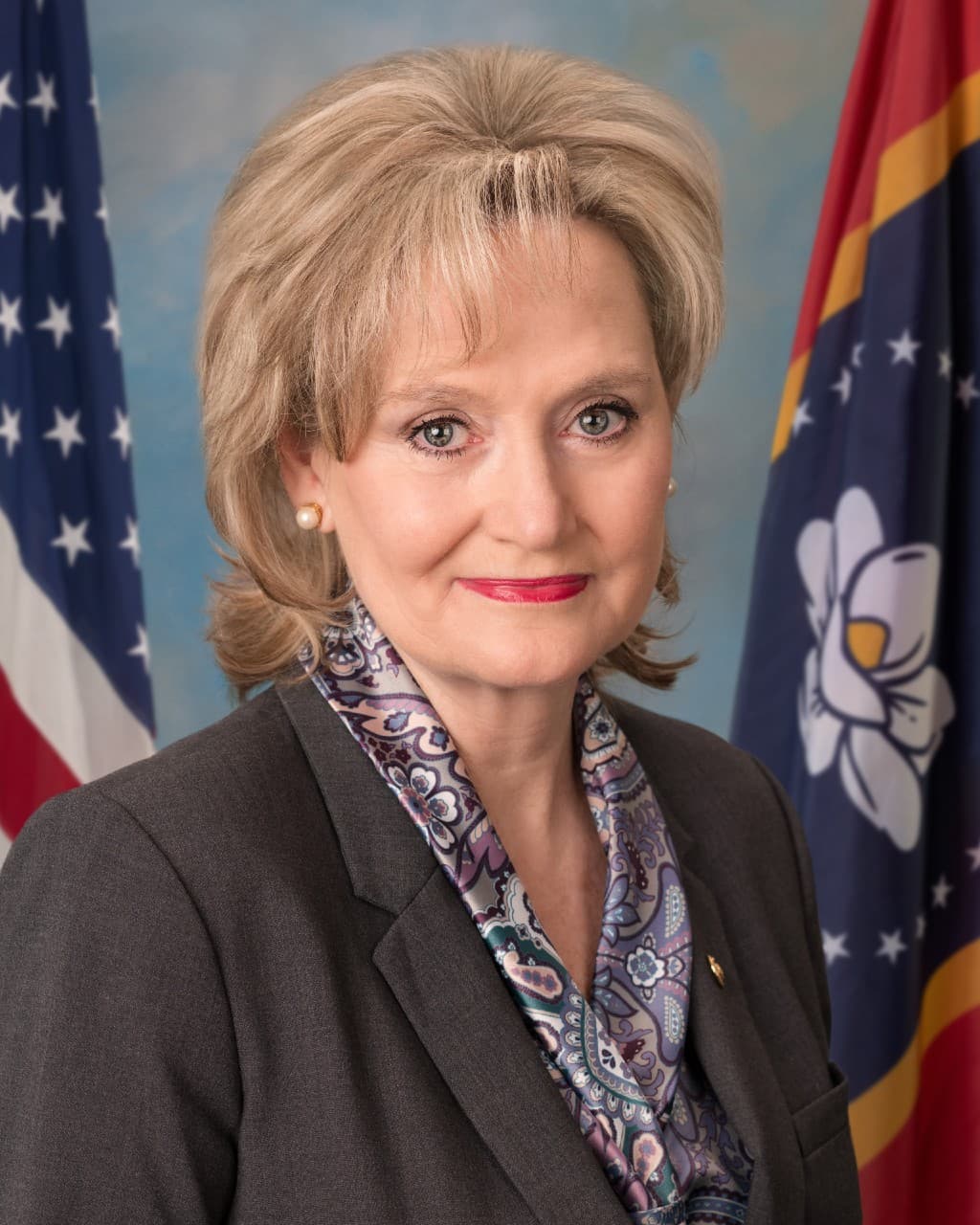

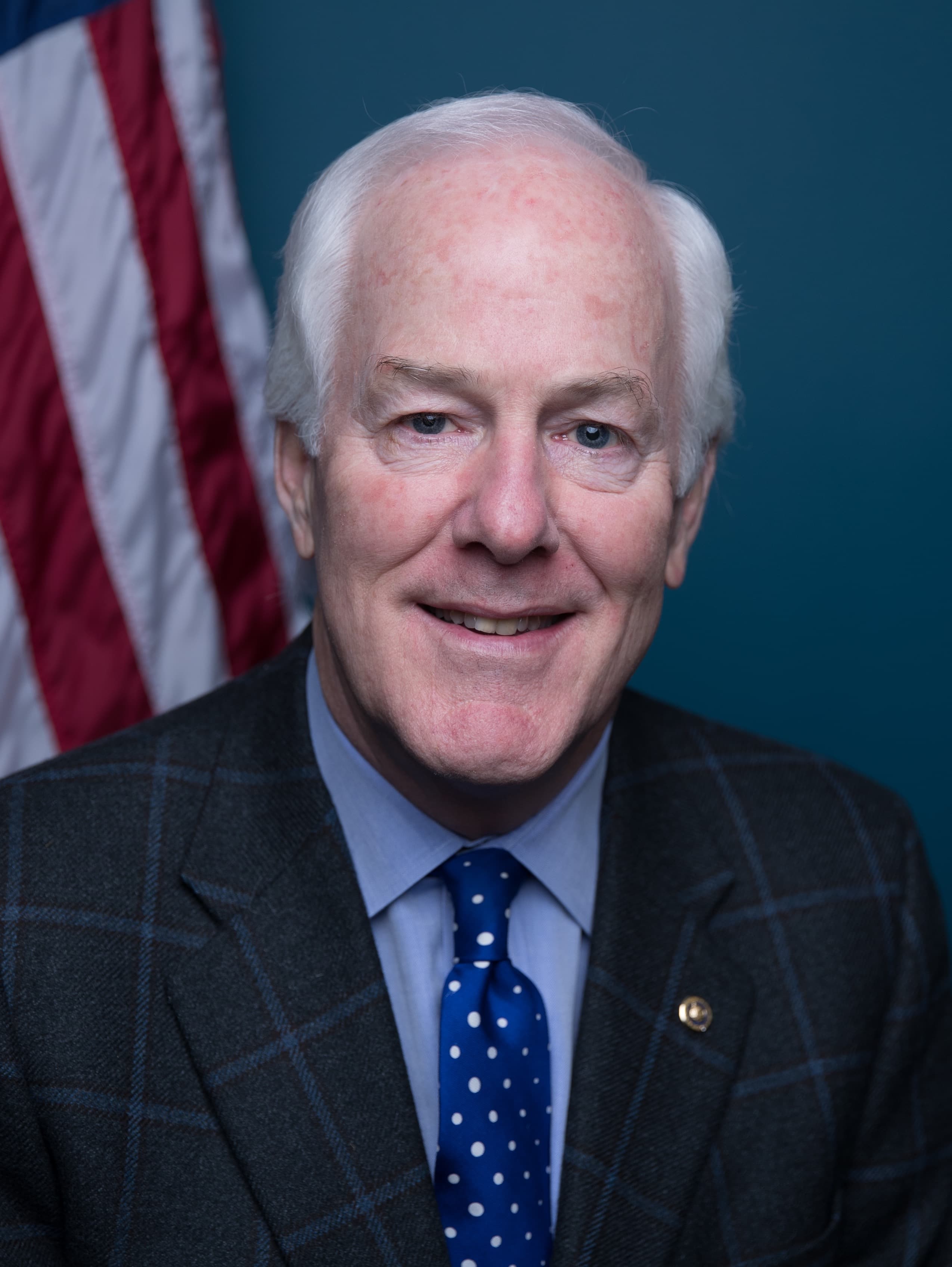

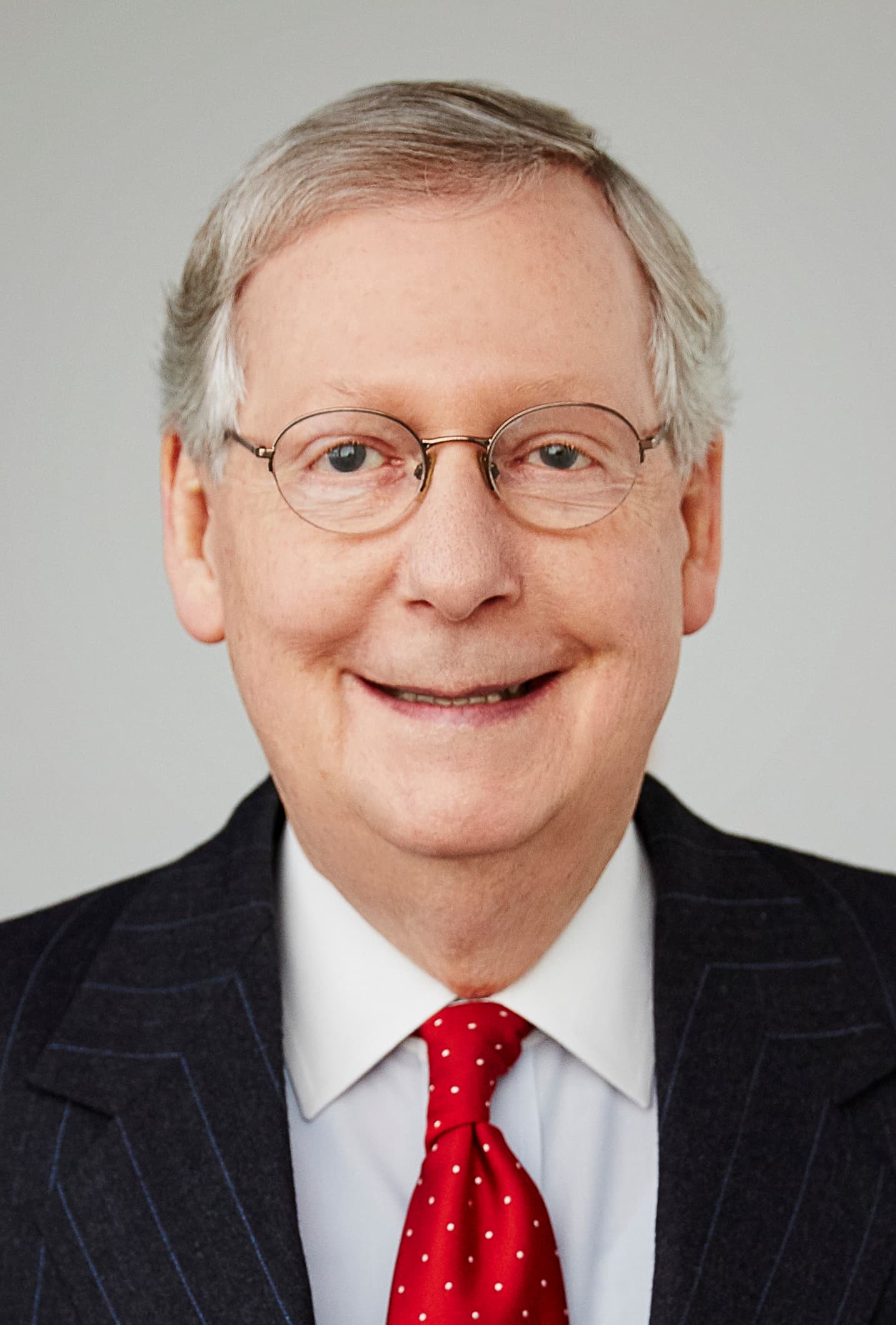

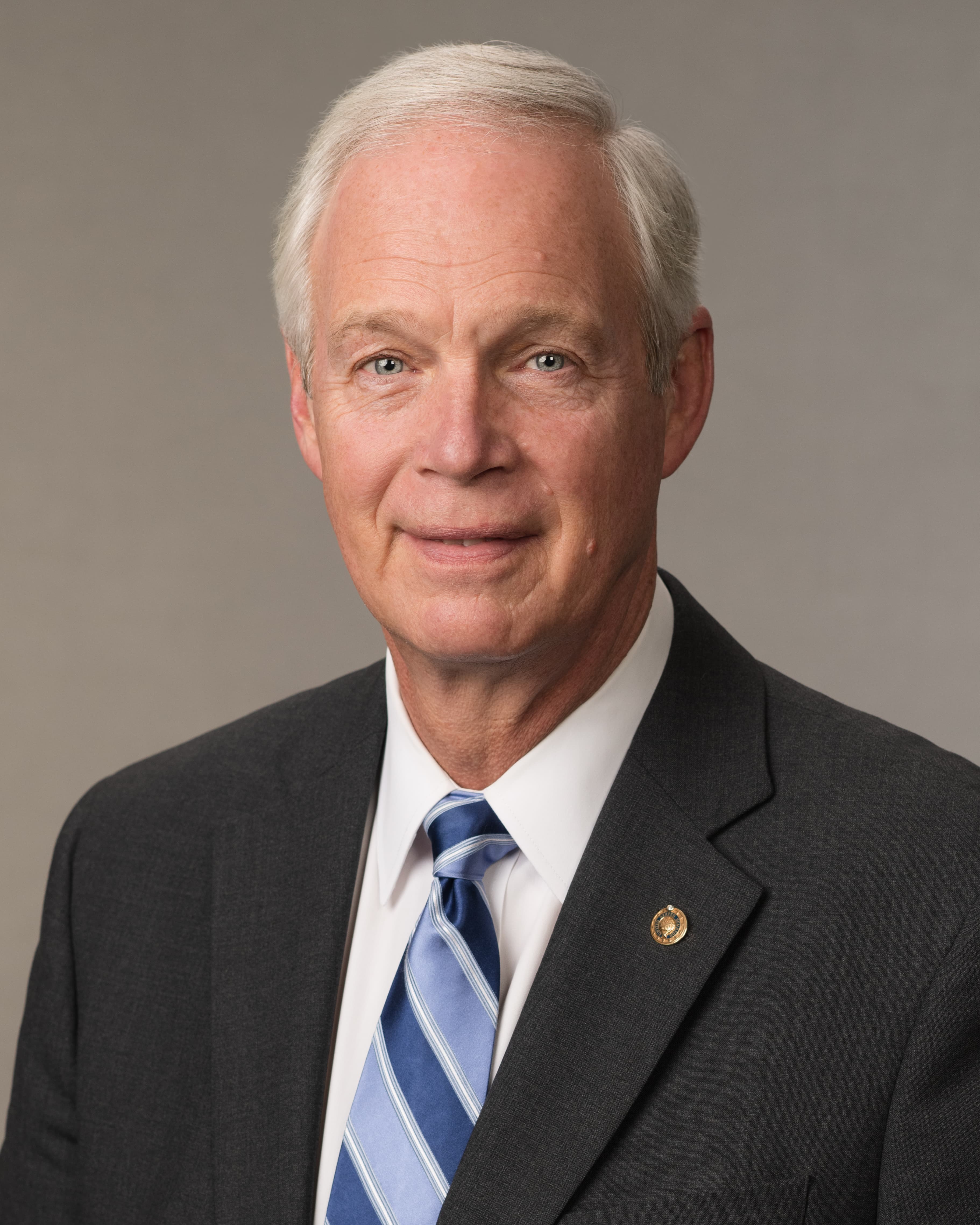

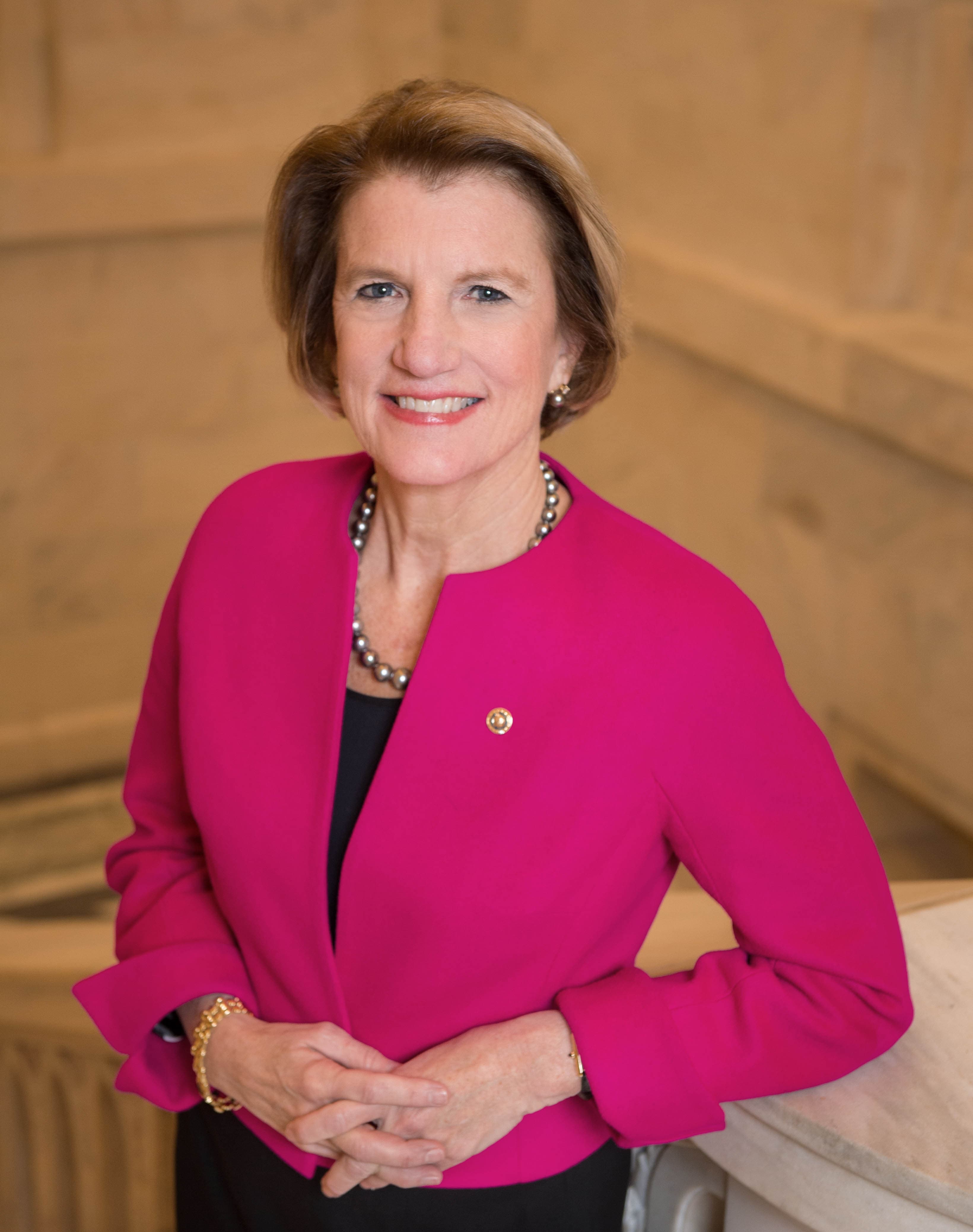

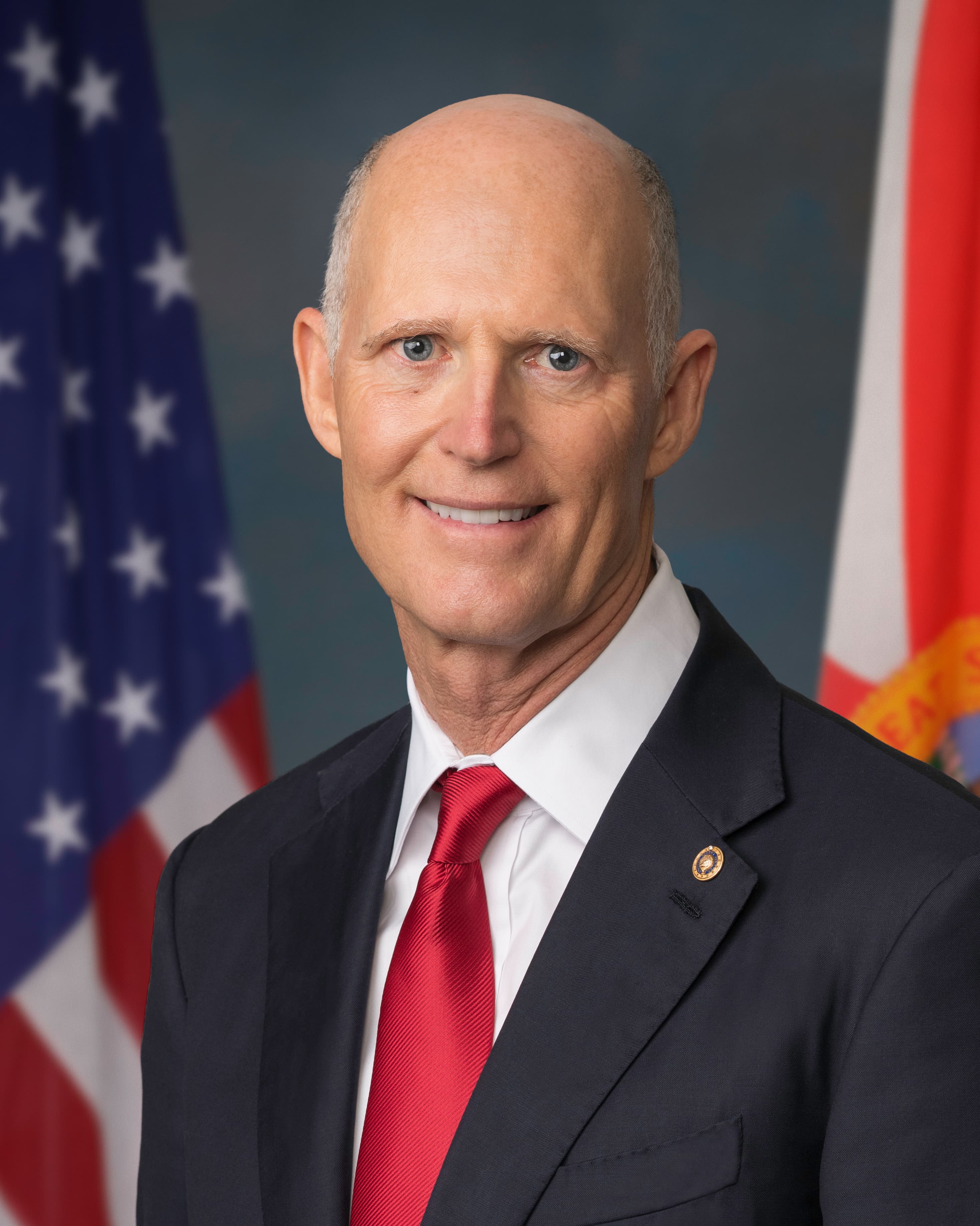

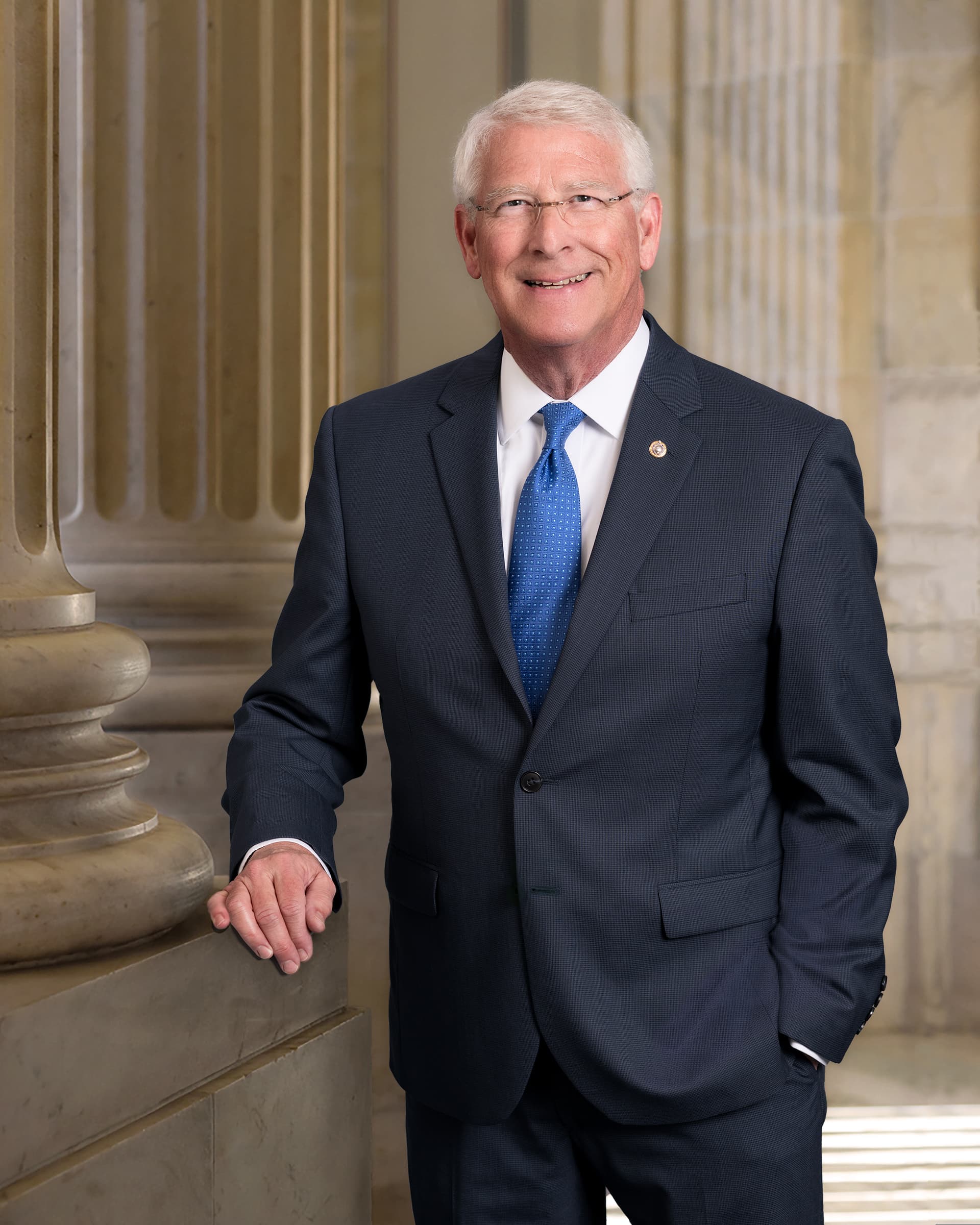

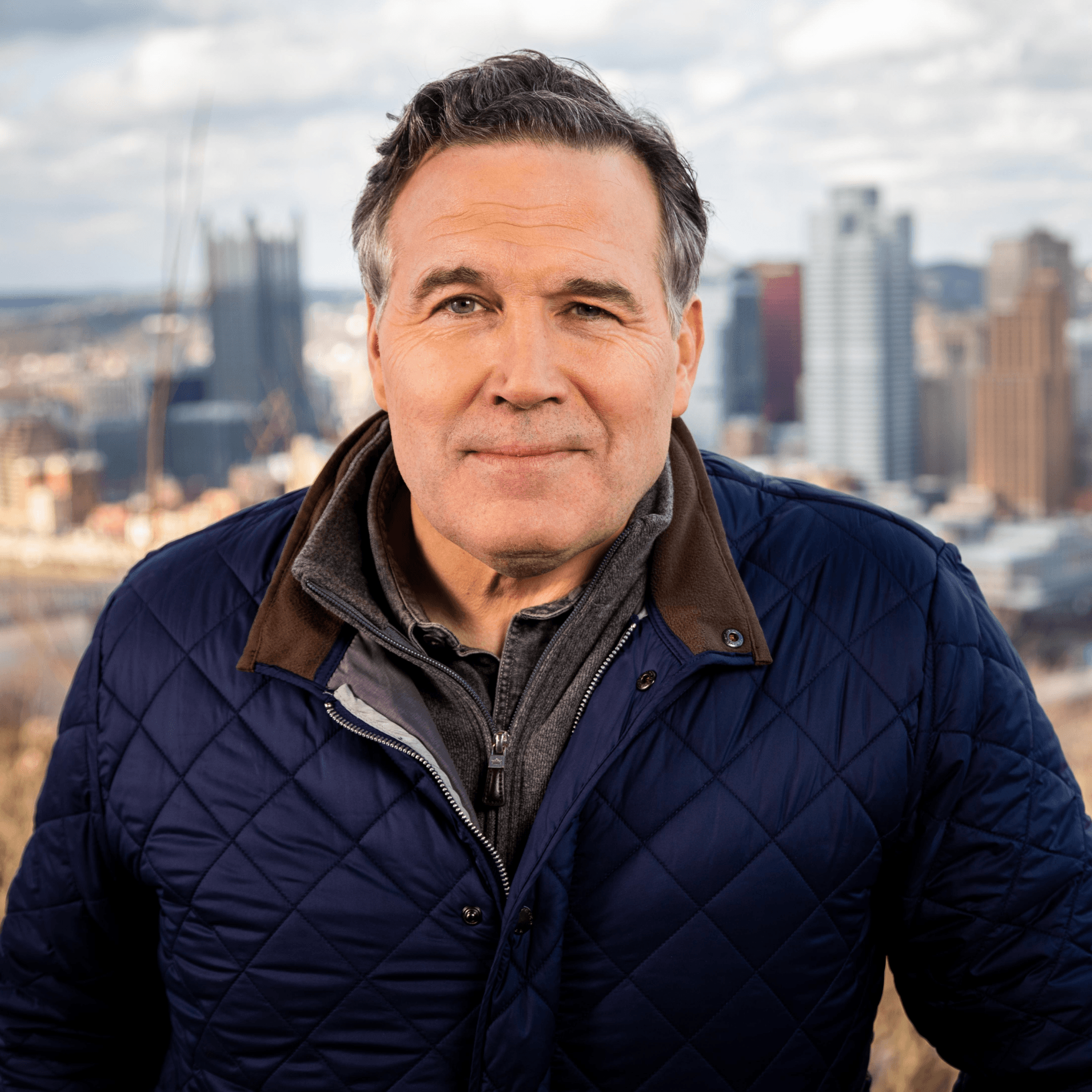

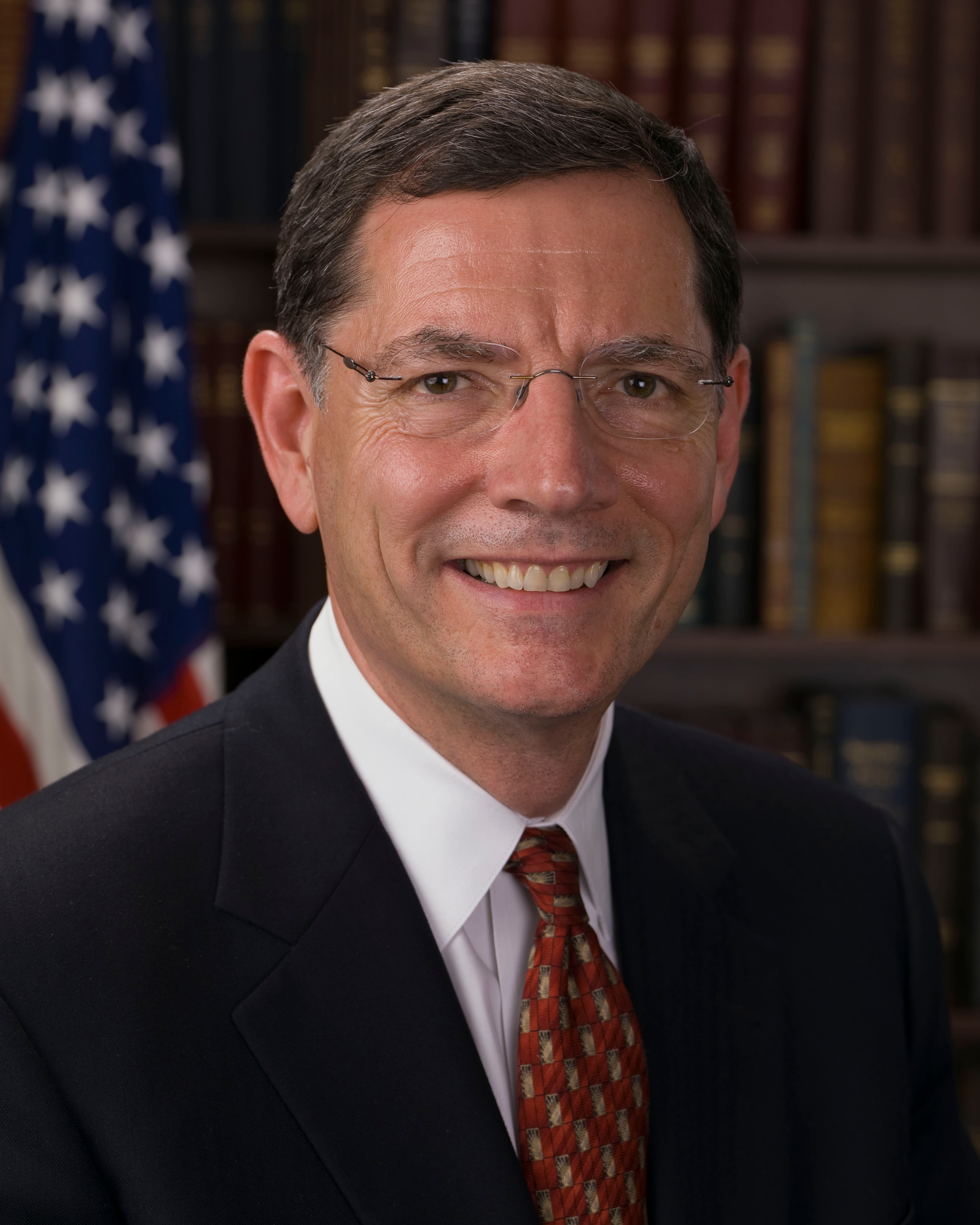

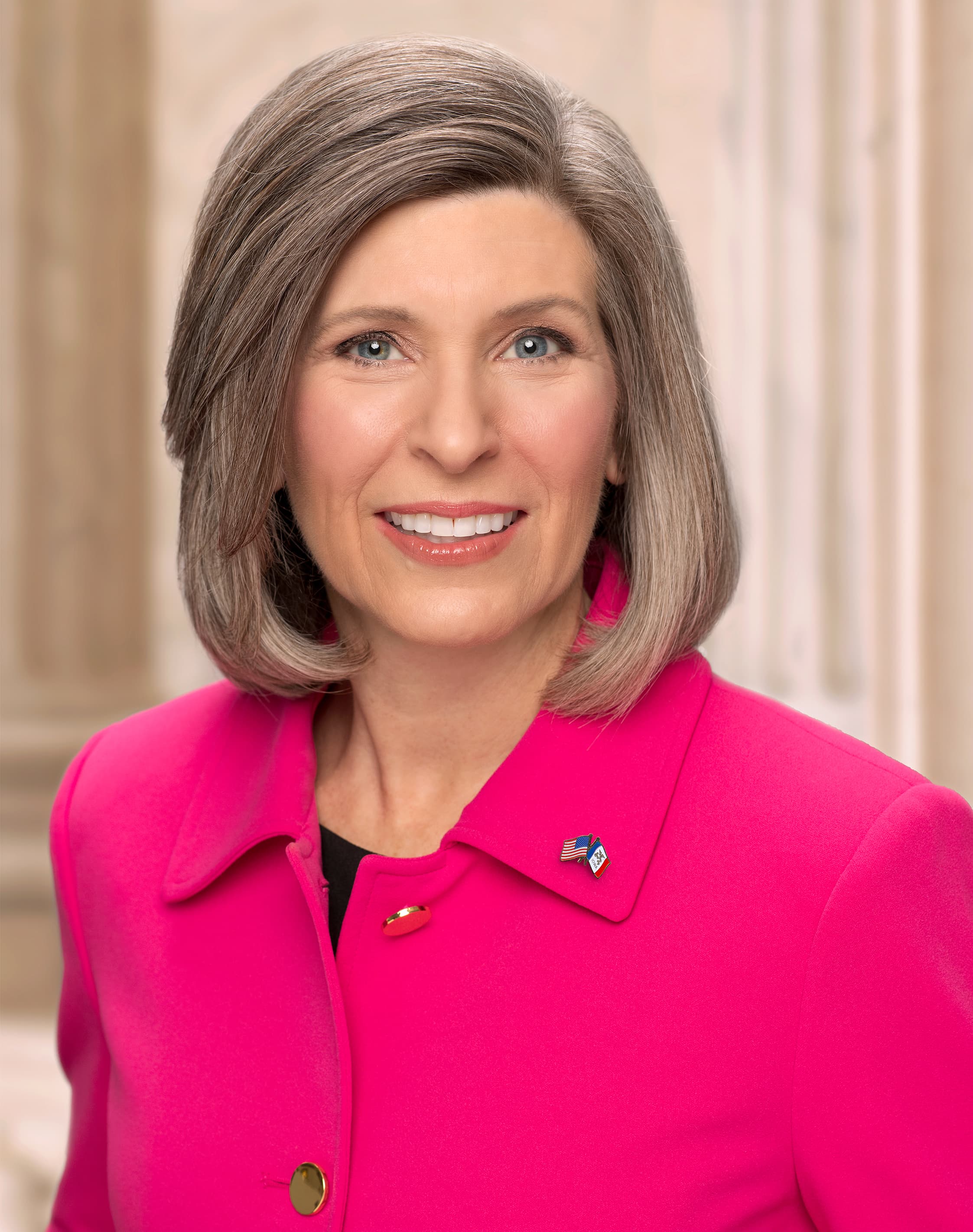

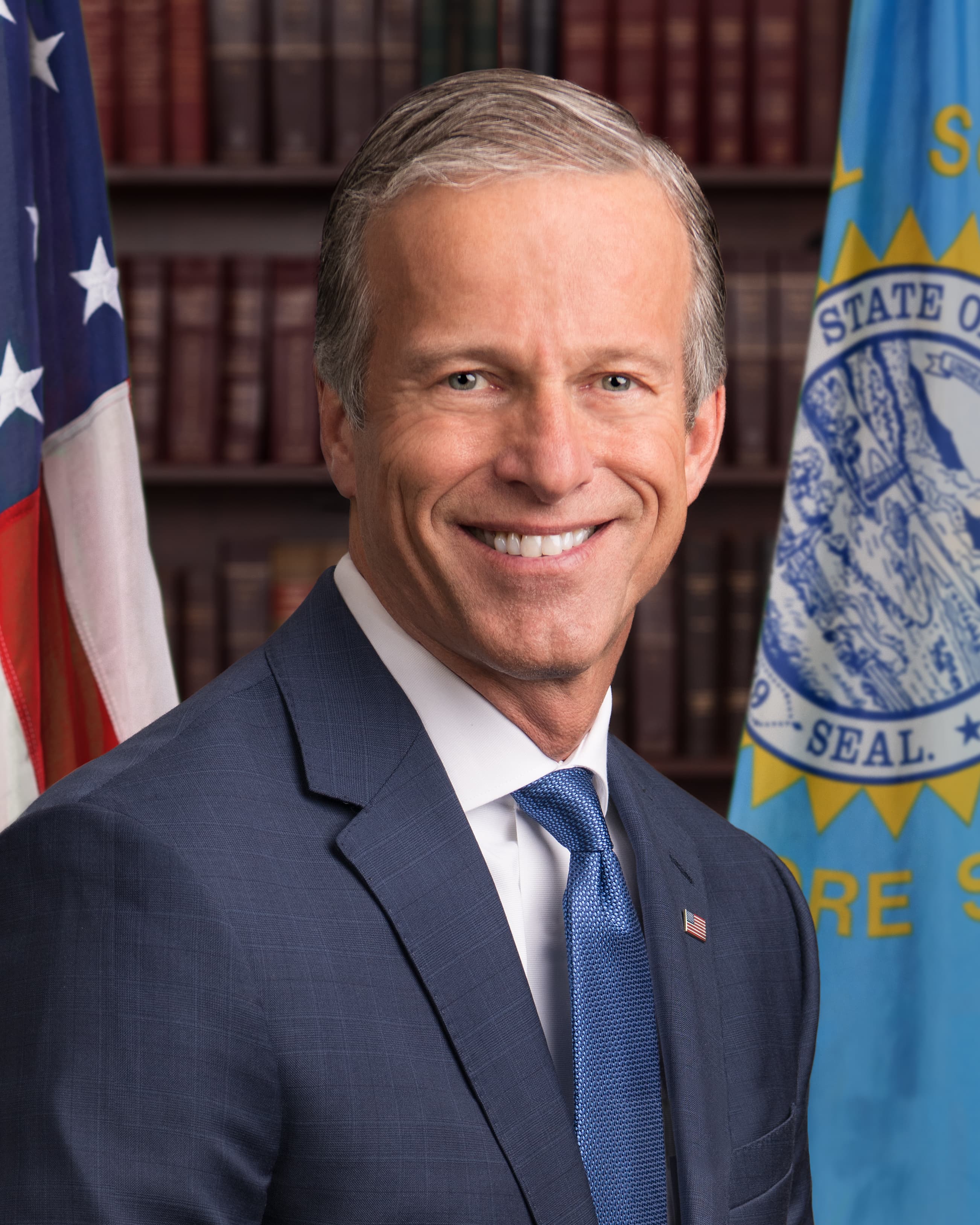

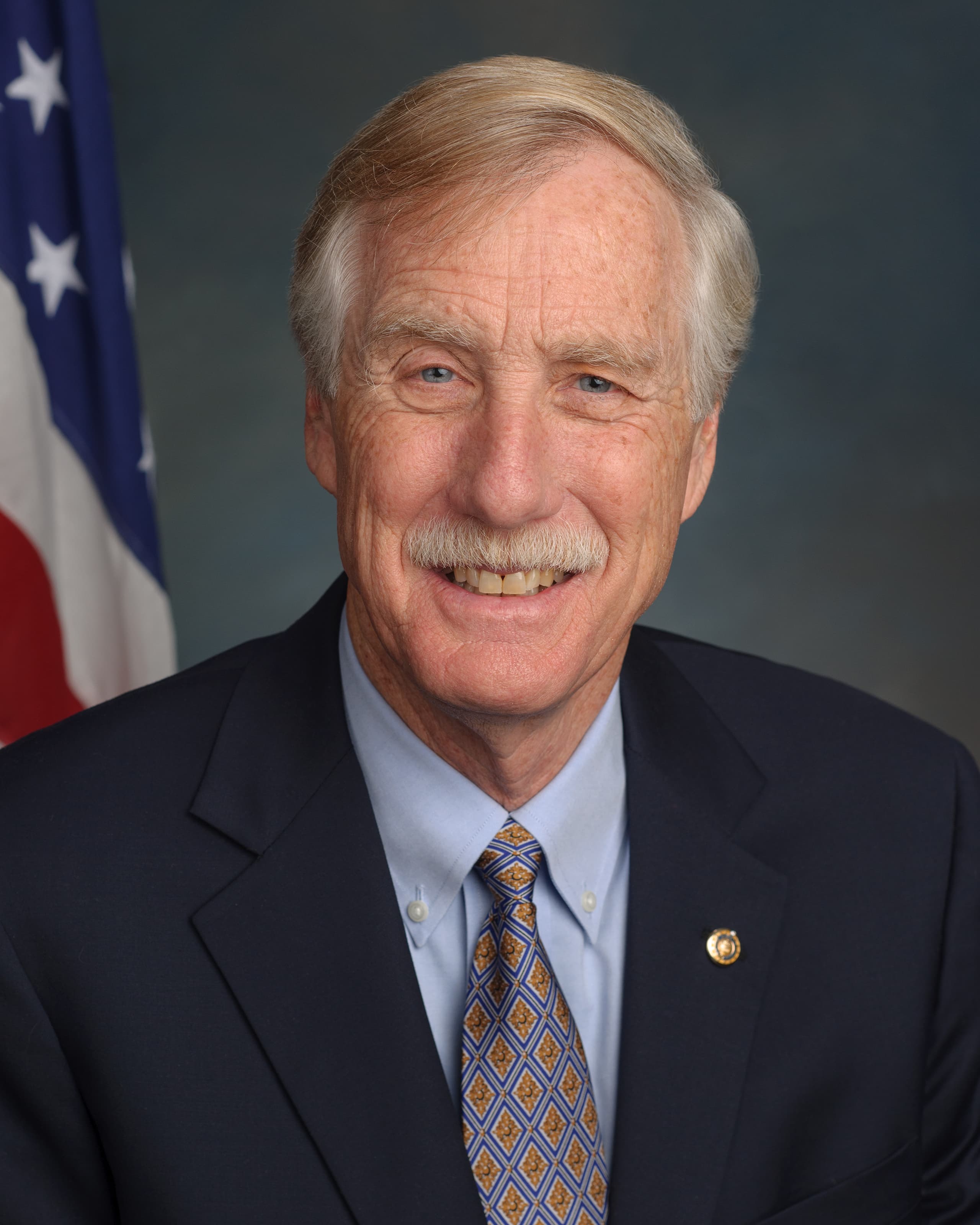

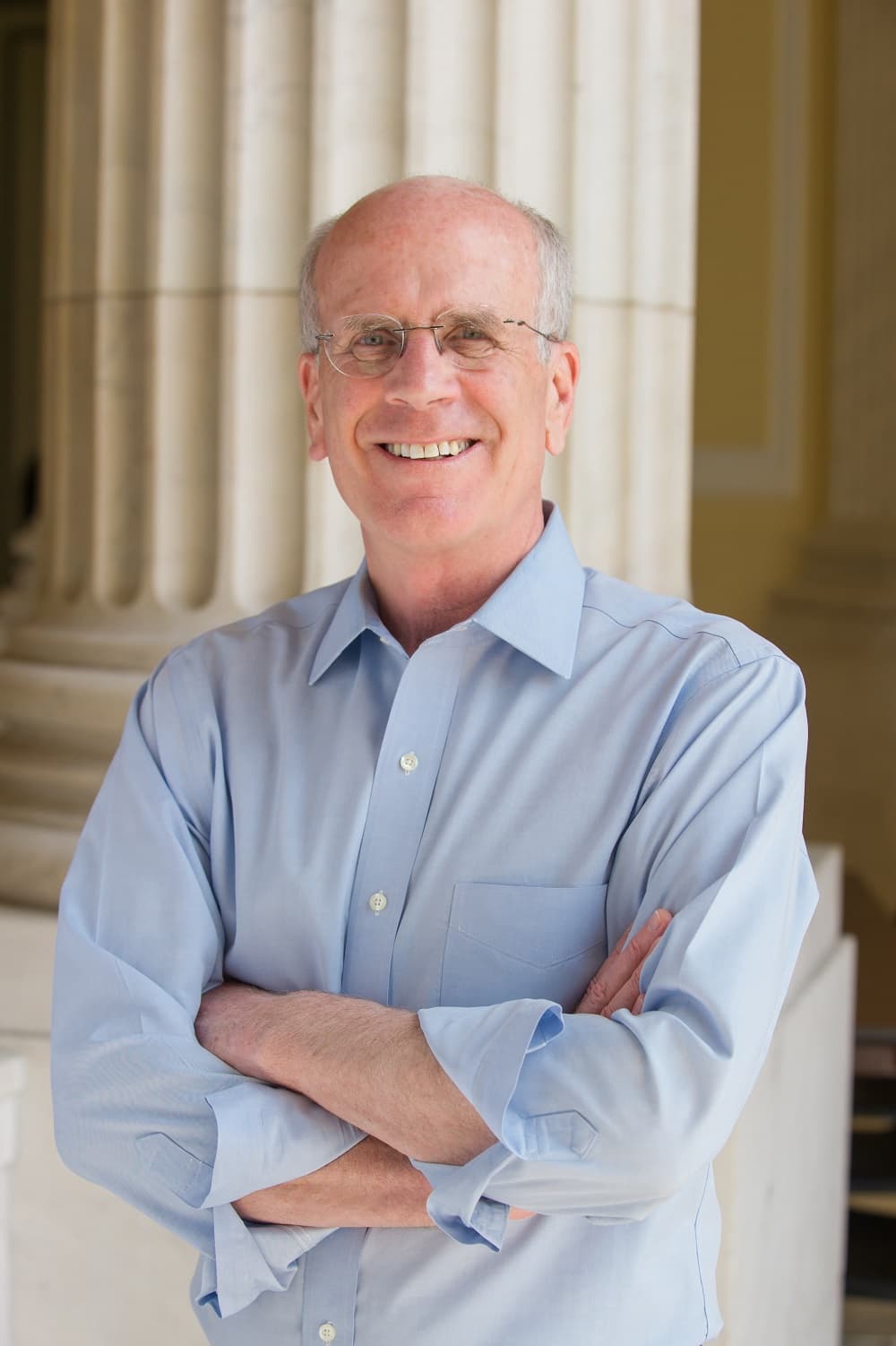

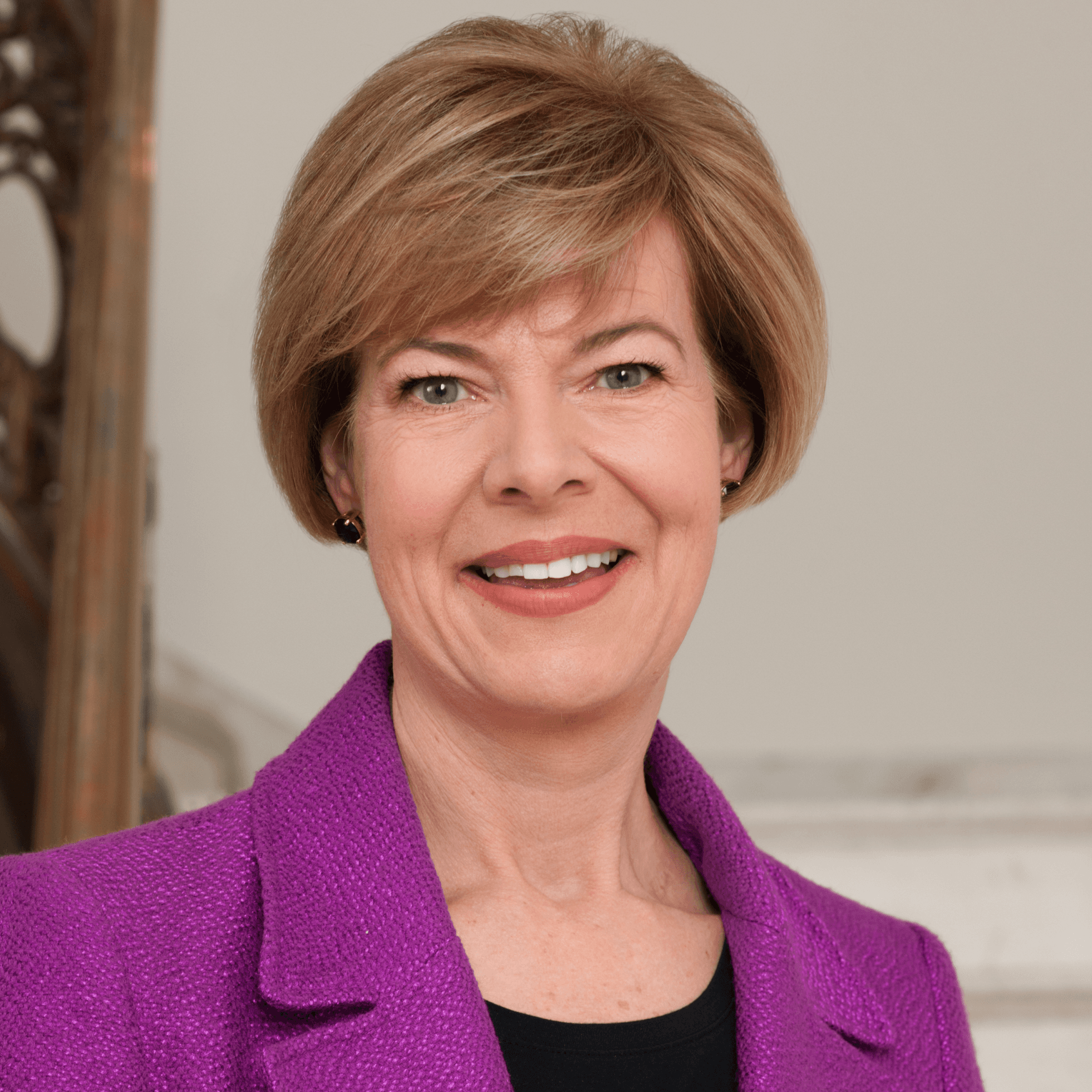

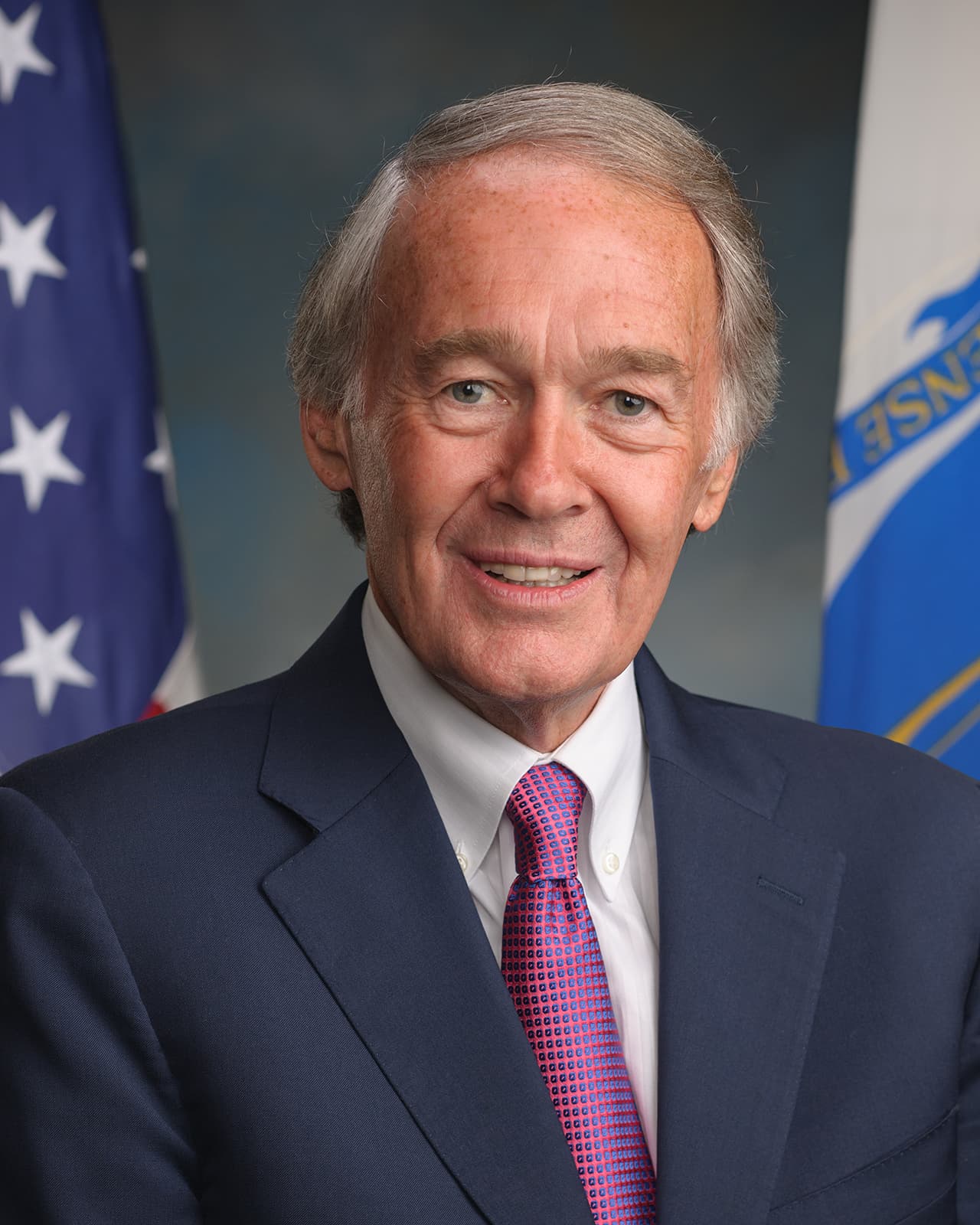

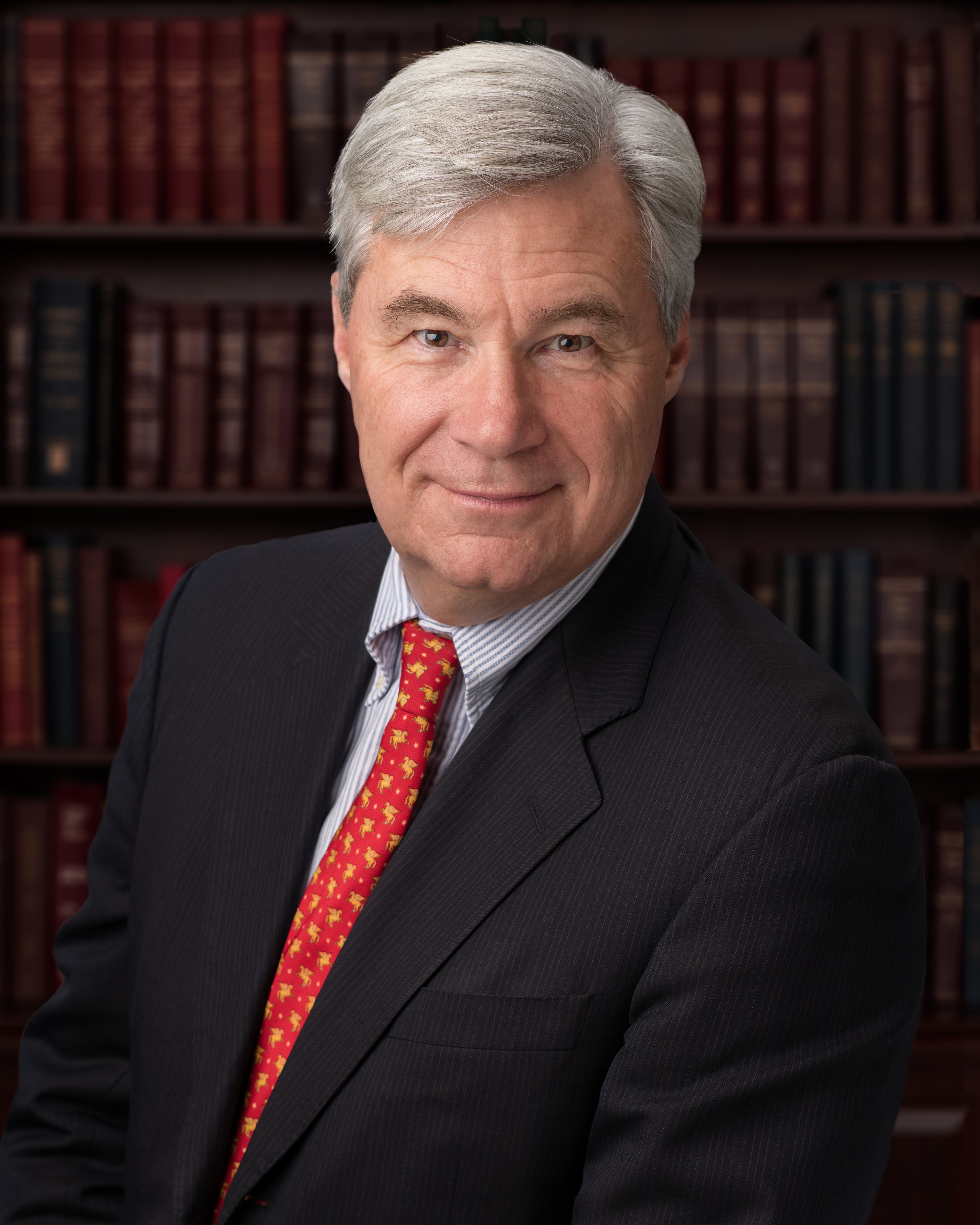

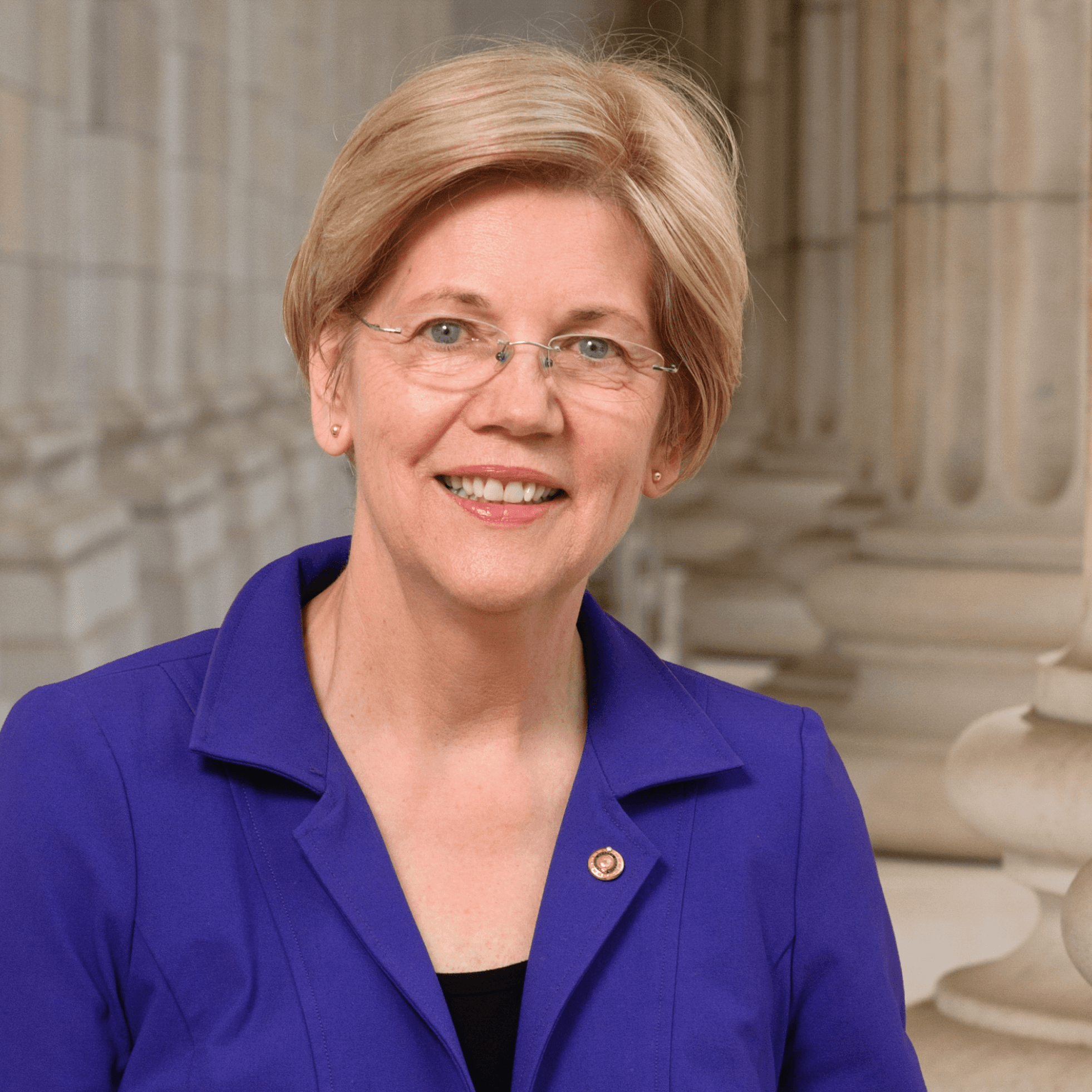

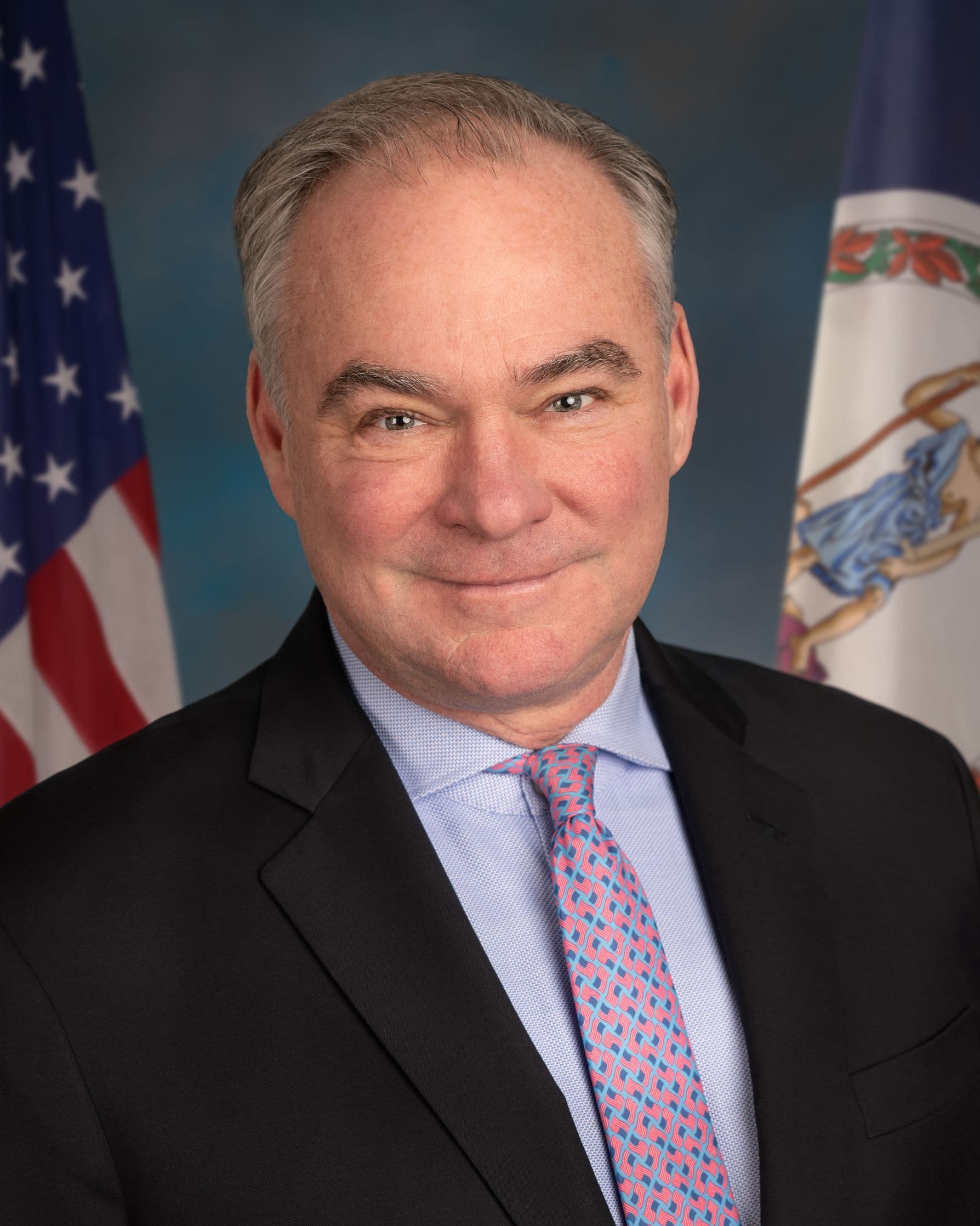

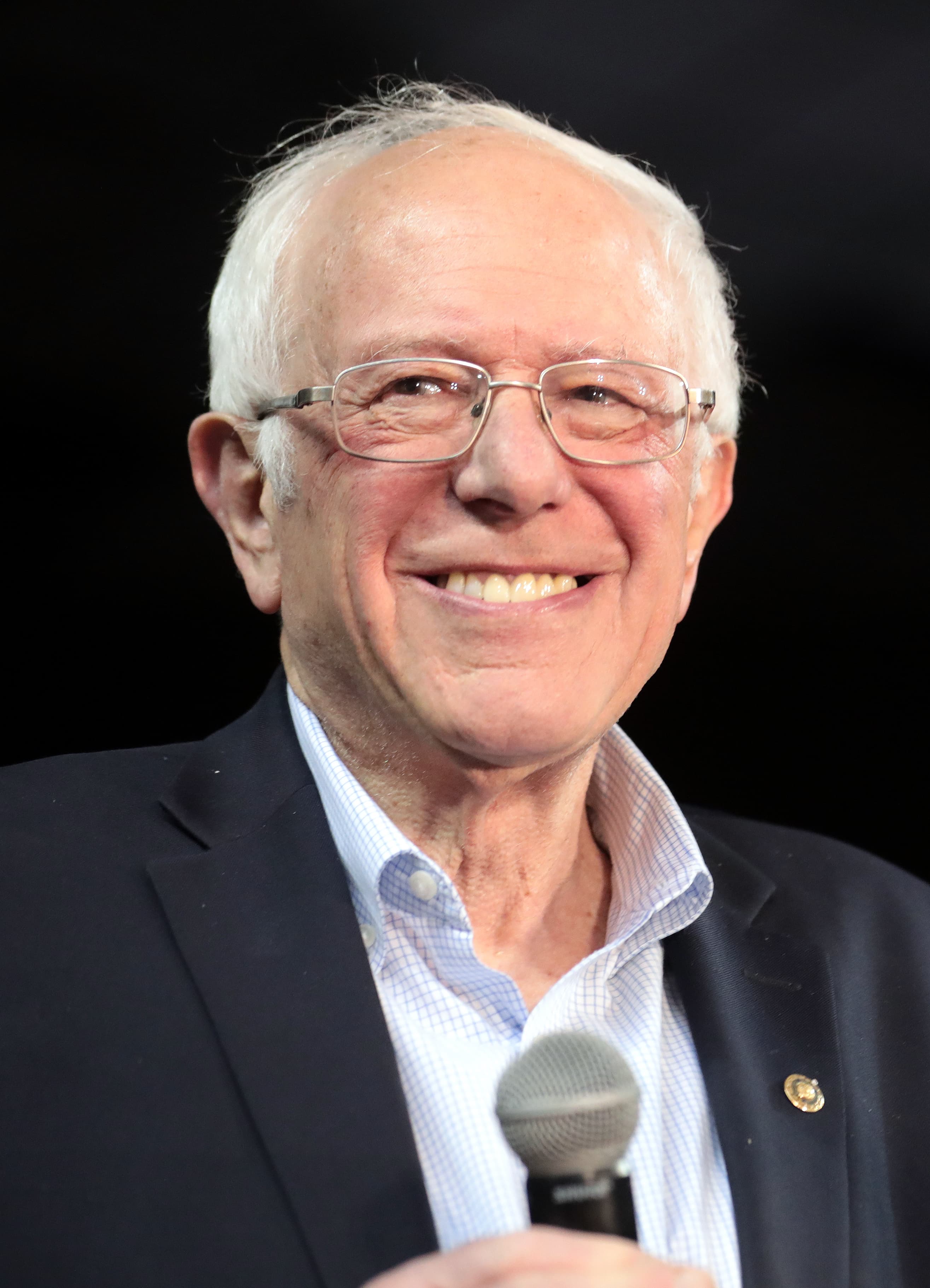

Congress members who support this bill

Cosponsors

Voted For

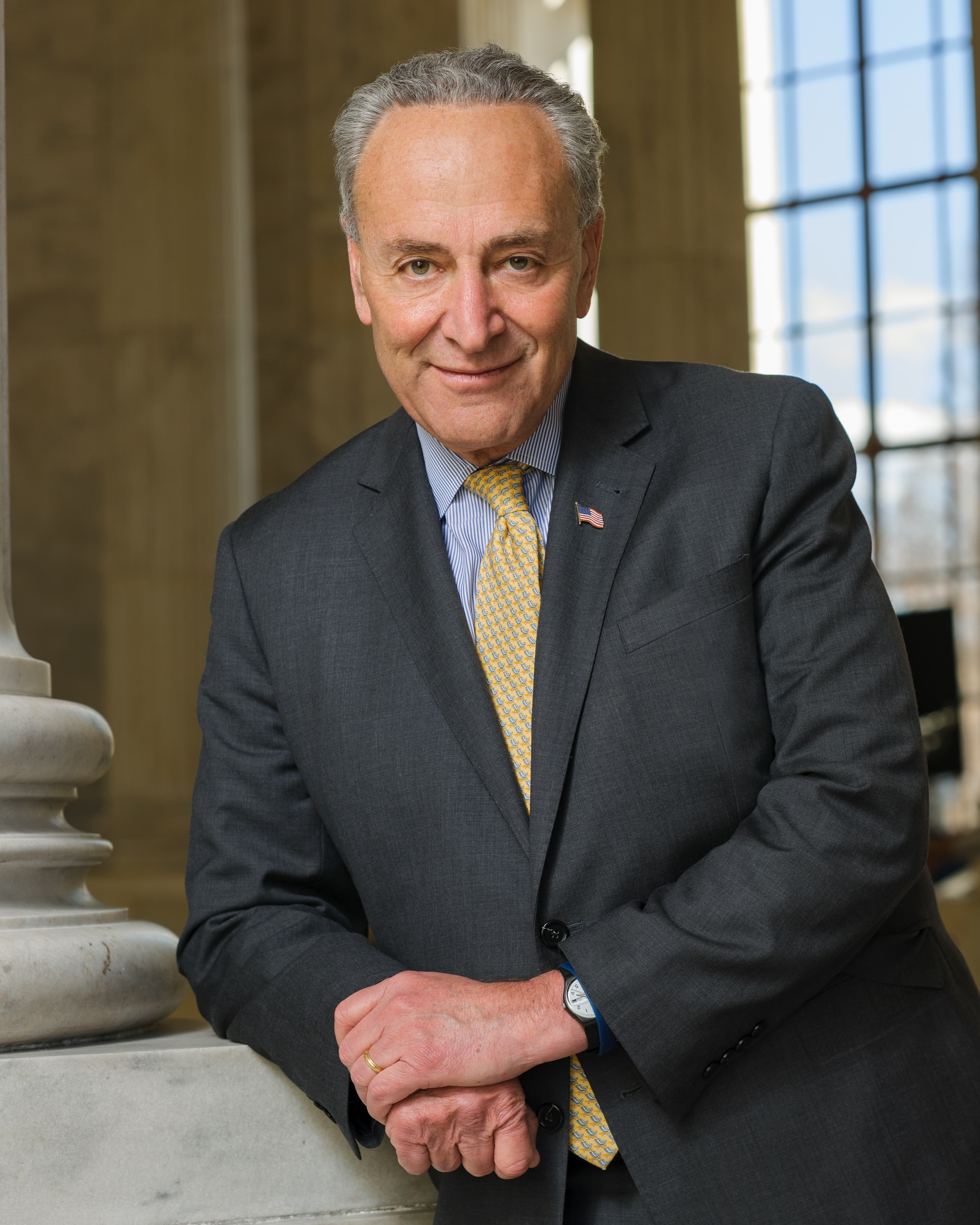

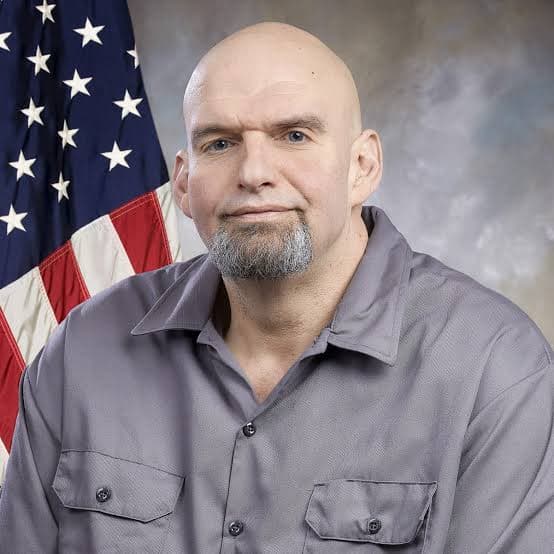

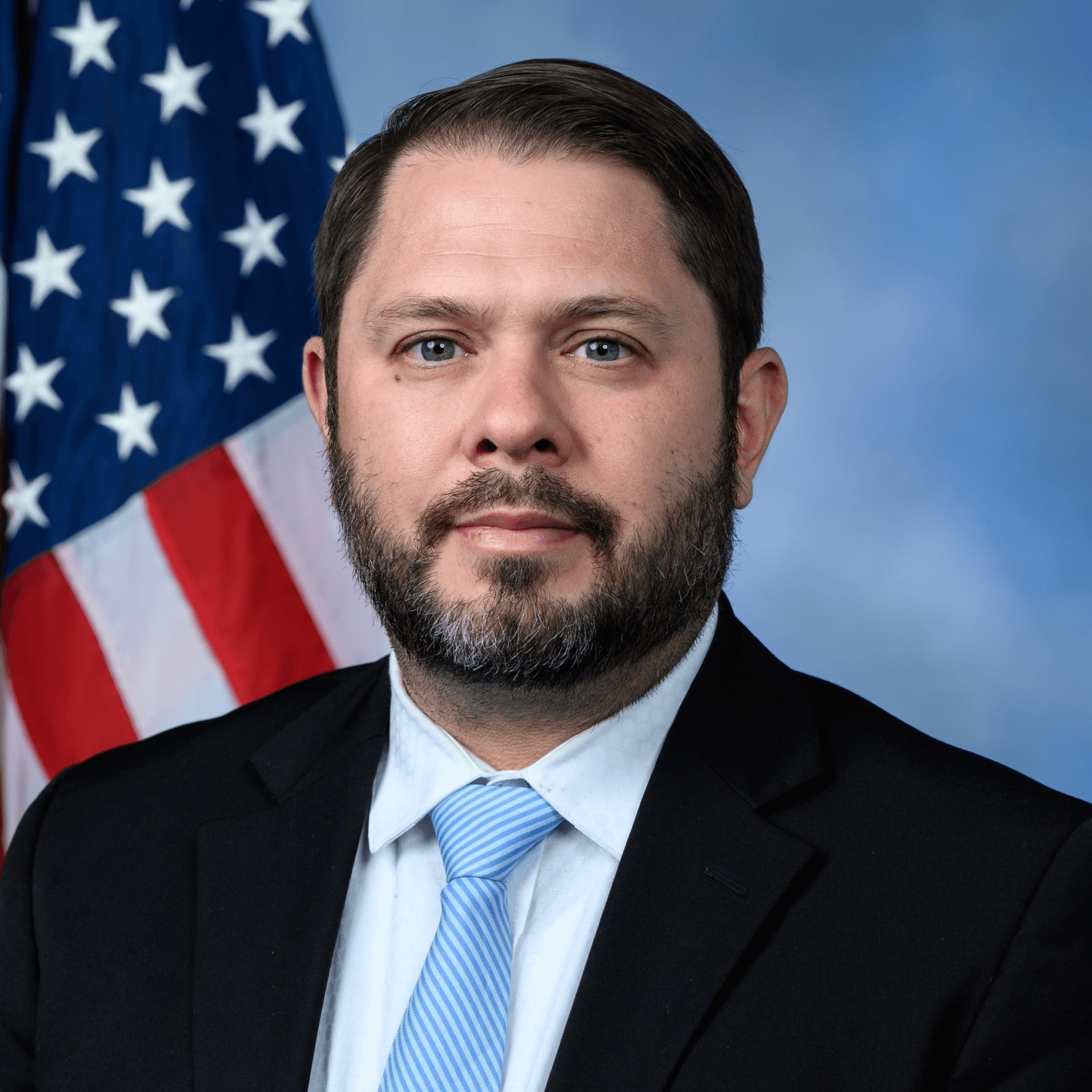

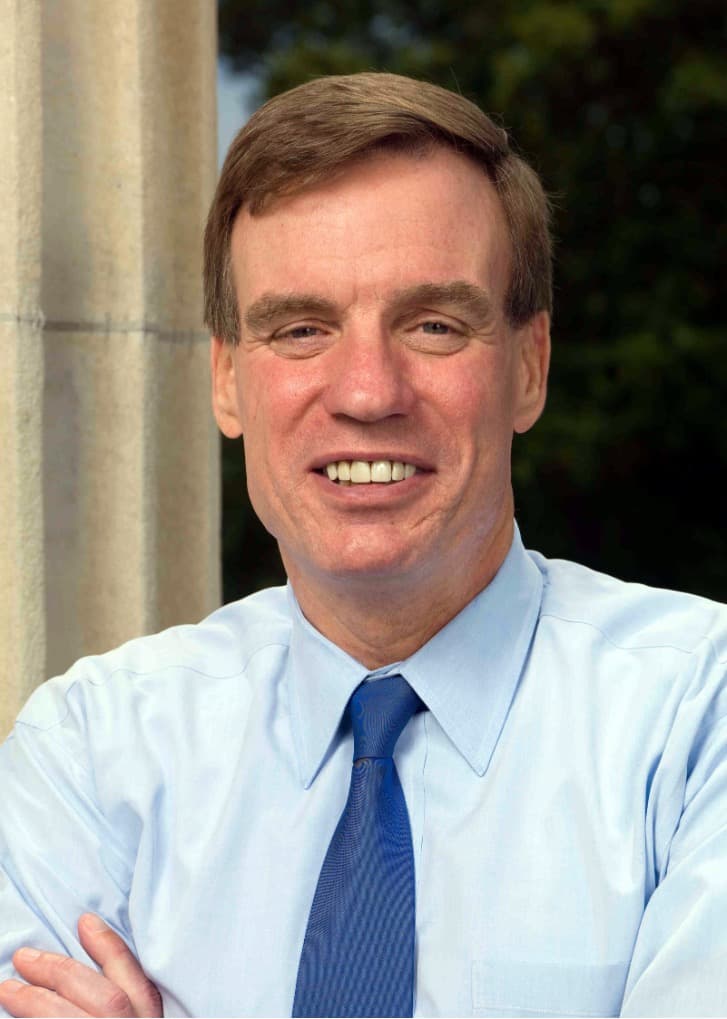

Democrats

Republicans

Independents

Voted Against

Democrats

Independents

Additional Analysis

No additional analysis for this bill yet