See Who Supports Crypto

We automatically track prominent politicians and the stances they make about crypto.

Track the Latest Stances

Real-time updates on the statements, interviews, social posts, and voting records of prominent politicians so you can quickly see their latest positions on crypto.

Community-Sourced Analysis

Crypto industry experts and community members weigh in on each politician and their stances to determine where they stand on crypto.

Recent Stances On Crypto

THREAD:

THREAD:

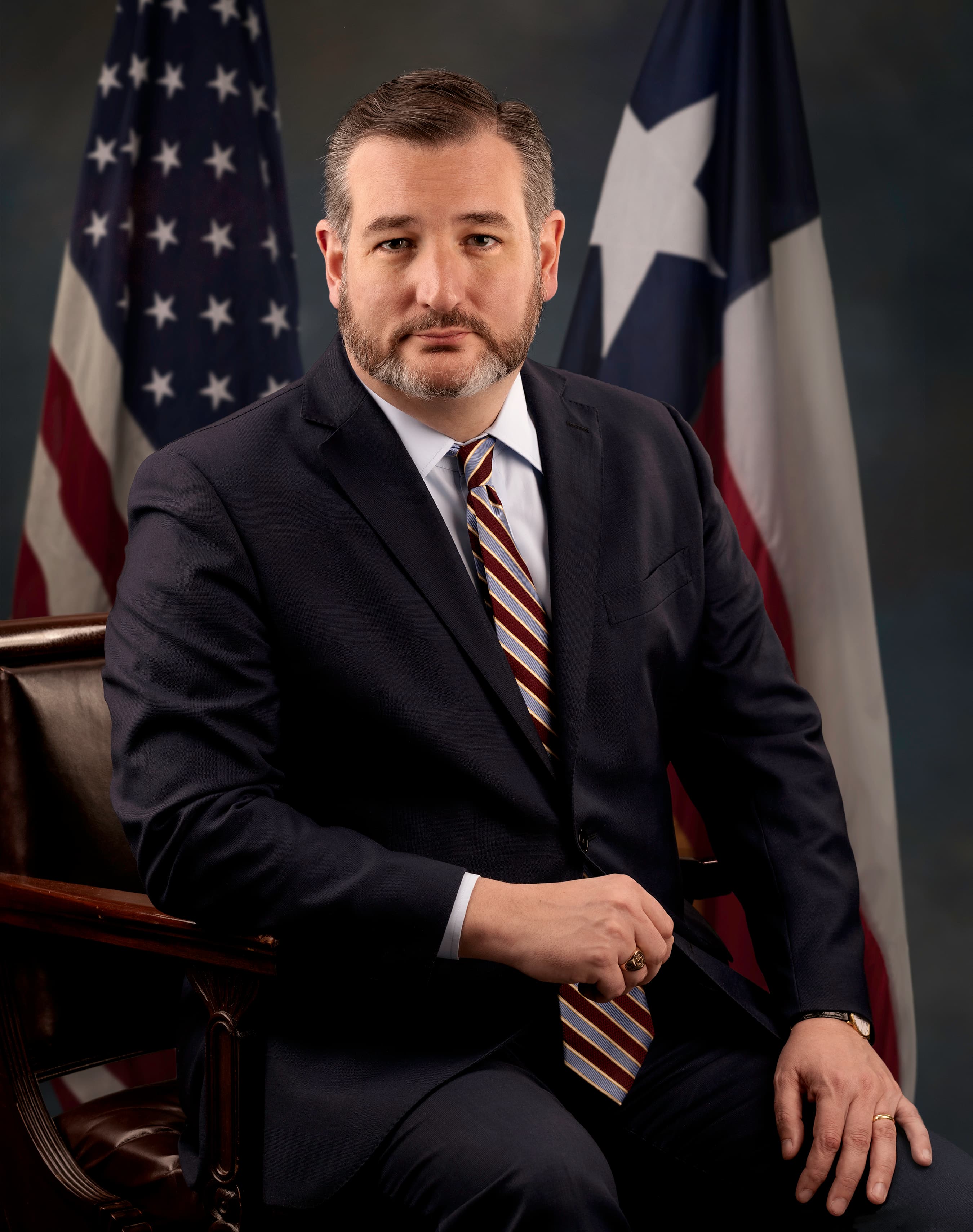

NEW: @SenTedCruz (R-TX) filed an amendment to strike the sunset provision on the CBDC ban in the Senate’s 21st Century ROAD to Housing Act, which will likely have a series of votes next week.

Sources close to Cruz tell me he plans to push for a vote on the amendment.

Note: Cruz introduced the Senate version of the Anti-CBDC Surveillance State Act last year — the Senate companion to @GOPMajorityWhip’s House bill.

NEW: @SenTedCruz (R-TX) filed an amendment to strike the sunset provision on the CBDC ban in the Senate’s 21st Century ROAD to Housing Act, which will likely have a series of votes next week.

Sources close to Cruz tell me he plans to push for a vote on the amendment.

Note: Cruz introduced the Senate version of the Anti-CBDC Surveillance State Act last year — the Senate companion to @GOPMajorityWhip’s House bill.

On @MorningsMaria, @RepBryanSteil weighs in on where crypto market structure legislation stands—and why stablecoins could be a big deal for the global dollar.

“The use case for stablecoins is yet to be fully seen, but it's very clear that there is a major opportunity here to dollarize the Global South. That is absolutely essential for U.S. dollar dominance and to maintain world reserve currency status.”

On @MorningsMaria, @RepBryanSteil weighs in on where crypto market structure legislation stands—and why stablecoins could be a big deal for the global dollar.

“The use case for stablecoins is yet to be fully seen, but it's very clear that there is a major opportunity here to dollarize the Global South. That is absolutely essential for U.S. dollar dominance and to maintain world reserve currency status.”

Quoted from congress.gov on 2026-03-05

"Trump meme coin down 96 percent as bitcoin and meme coins slide.' This is the $TRUMP memecoin." [H2455]

"Melania Trump's meme coin architects accused of pump-and-dump fraud in lawsuit.'" [H2456]

"This coin traded at a peak of $45.47 and now goes for $5.79." [H2456]

Quoted from standwithcrypto.org on 2026-03-05

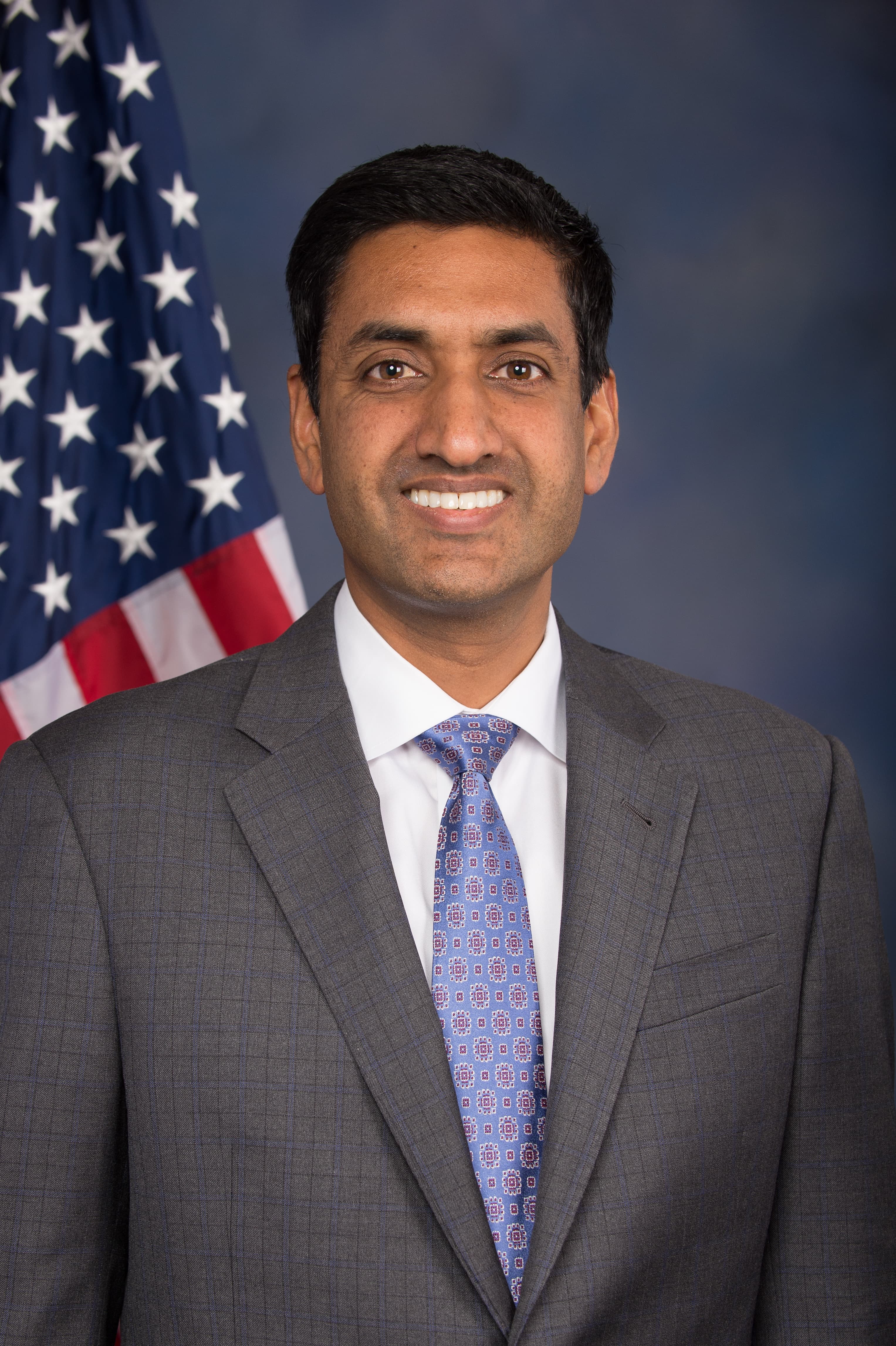

Raja Krishnamoorthi completed the Stand With Crypto Questionnaire and expressed strong support for establishing a clear, pro-innovation regulatory framework for digital assets, viewing it as crucial for America to remain a global blockchain leader. He voted in favor of the CLARITY Act, GENIUS Act, and FIT21, and advocates for policies that include protecting the right to self-custody, providing clear pathways for digital asset businesses, and defining when digital assets are securities or commodities.

Quoted from congress.gov on 2026-03-05

"Then at the bottom down here, they are arranging for a Bitcoin to be sent to a wallet address." [H2429]

"I am actually going to read that address out loud: 3Cr9TpVeBegey 4zGRPEdzMC94HzUUScBHN." [H2429]

Quoted from standwithcrypto.org on 2026-03-05

Sam Liccardo completed the Stand With Crypto Questionnaire, affirming his belief that Congress must pass legislation to provide clear pathways for digital asset businesses and for Americans to self-custody their assets, while also opposing de-banking of lawful crypto firms. He supports a clear legislative framework to define digital assets, has co-sponsored the Stable Act, and plans to introduce a bill to offer fintech and crypto exchanges access to federal payment rails.

Quoted from standwithcrypto.org on 2026-03-05

Eric Sorensen completed the Stand With Crypto Questionnaire and supports establishing clear legislative pathways for digital asset businesses, self-custody rights, and ending de-banking for lawful crypto entities. He advocates for a legislative framework to define digital assets as securities or commodities and supports exploring blockchain technology for government efficiency, while also believing non-custodial software developers should not be regulated as financial intermediaries. Sorensen has supported bills like the Clarity Act and FIT21, emphasizing the need for clear, consistent regulations, strong market structure, and consumer protections, though he does not support widely accessible 1:1 backed stablecoins.

Recent Bills On Crypto

Blockchain Regulatory Certainty Act of 2026

Date Introduced: 2026-01-12

Status: Introduced and Sponsored

CLARITY Act

Date Introduced: 2025-05-29

Status: Introduced and Sponsored

Blockchain Regulatory Certainty Act

Date Introduced: 2025-05-21

Status: Introduced and Sponsored

GENIUS Act

Date Introduced: 2025-05-01

Status: Introduced and Sponsored

Promoting Resilient Supply Chains Act of 2025

Date Introduced: 2025-01-27

Status: Introduced and Sponsored

H.J. Res 25

Date Introduced: 2025-01-21

Status: Introduced and Sponsored

S.J. Res 3

Date Introduced: 2025-01-21

Status: Introduced and Sponsored

SAB 121 House Joint Resolution

Date Introduced: 2024-02-01

Status: Introduced and Sponsored

Uniform Treatment of Custodial Assets Act

Date Introduced: 2023-09-27

Status: Introduced and Sponsored

CBDC Anti-Surveillance State Act

Date Introduced: 2023-09-12

Status: Introduced and Sponsored

Executive Branch

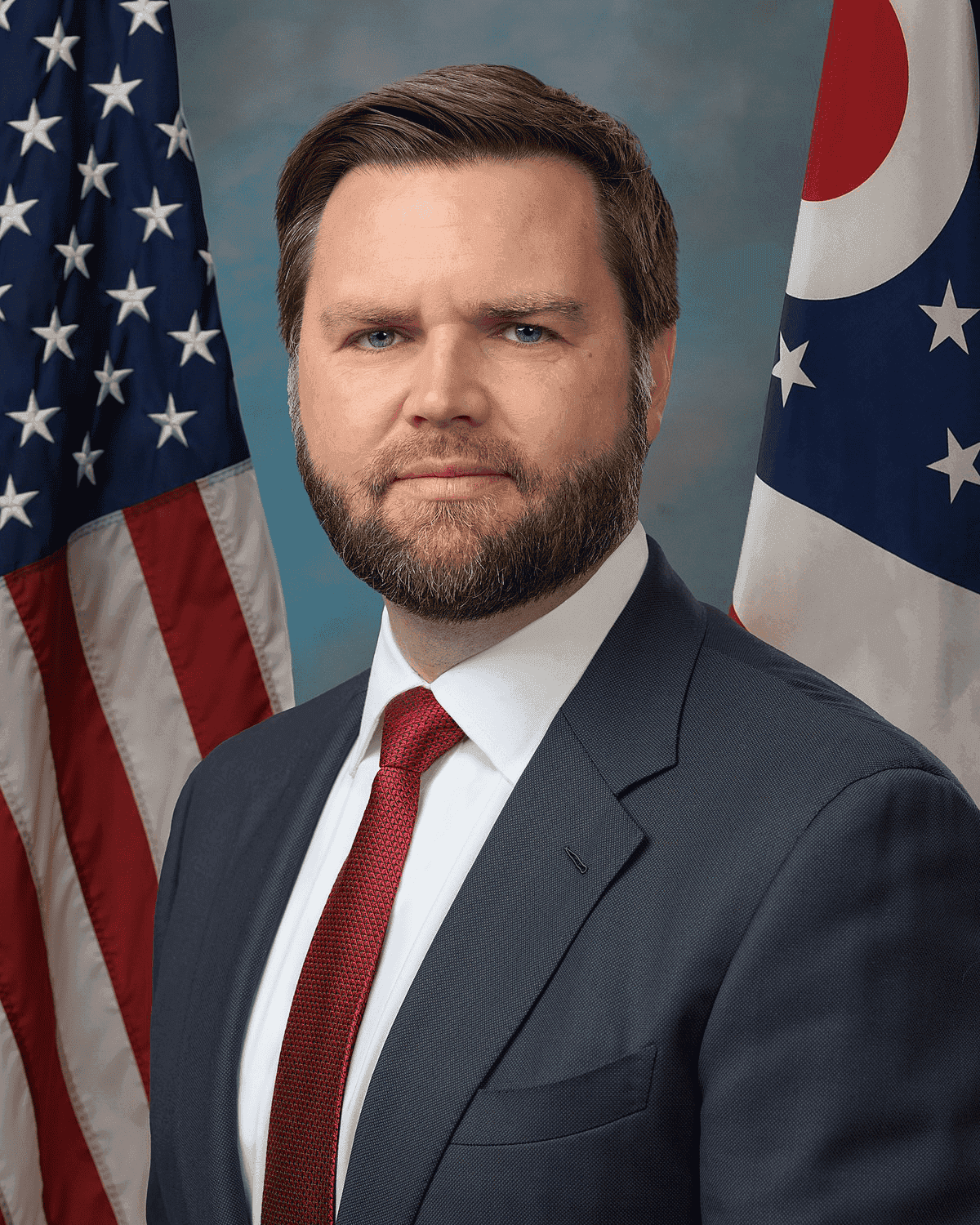

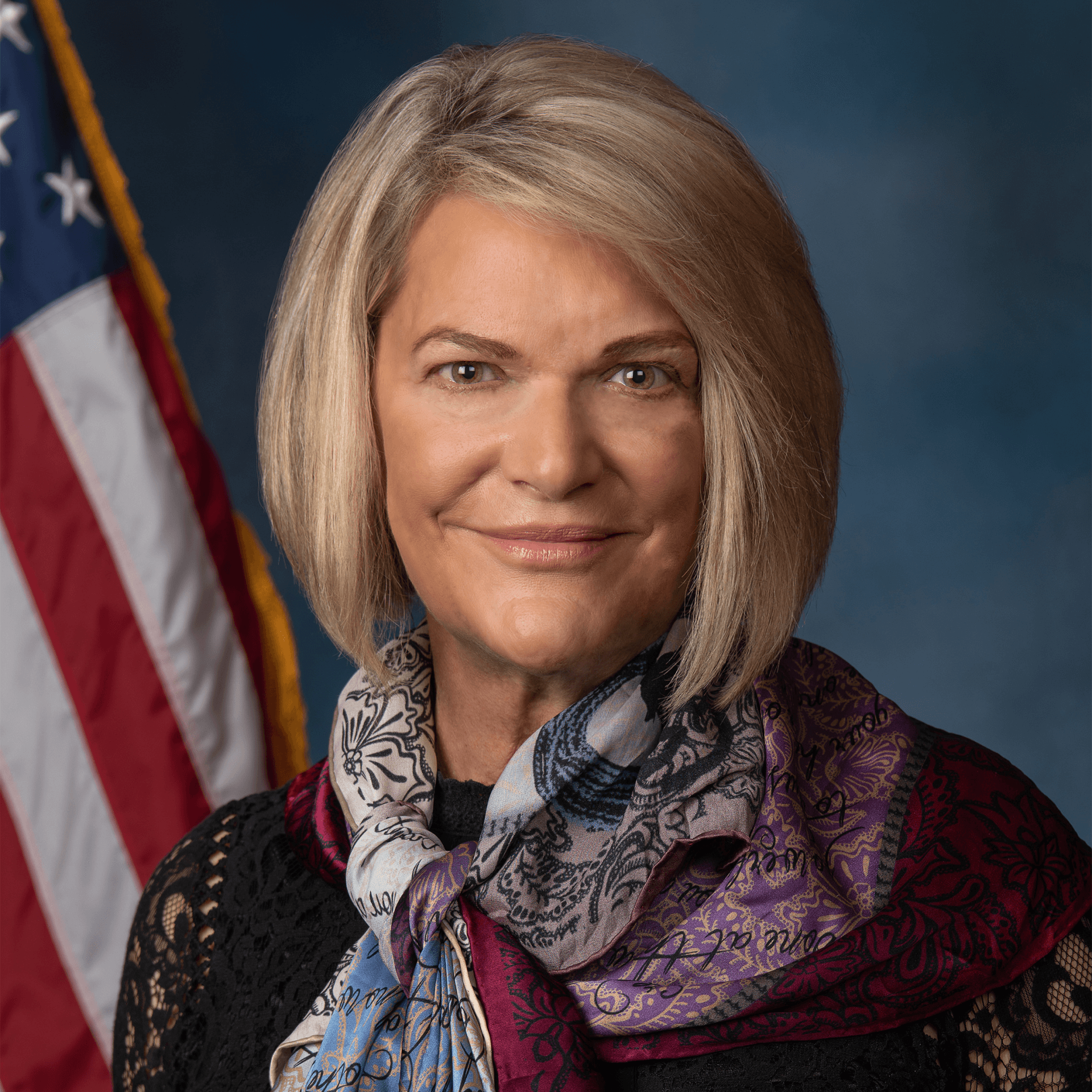

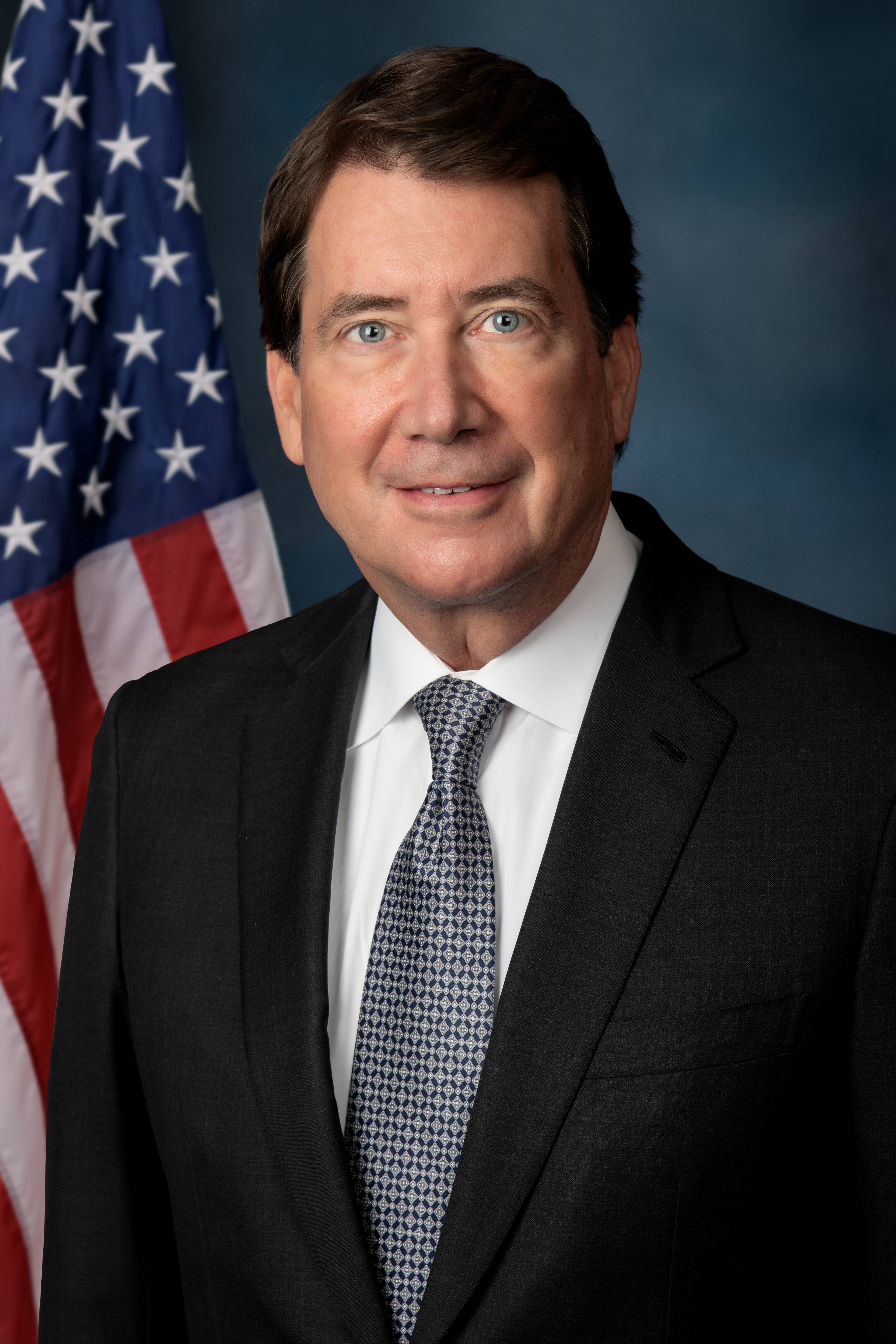

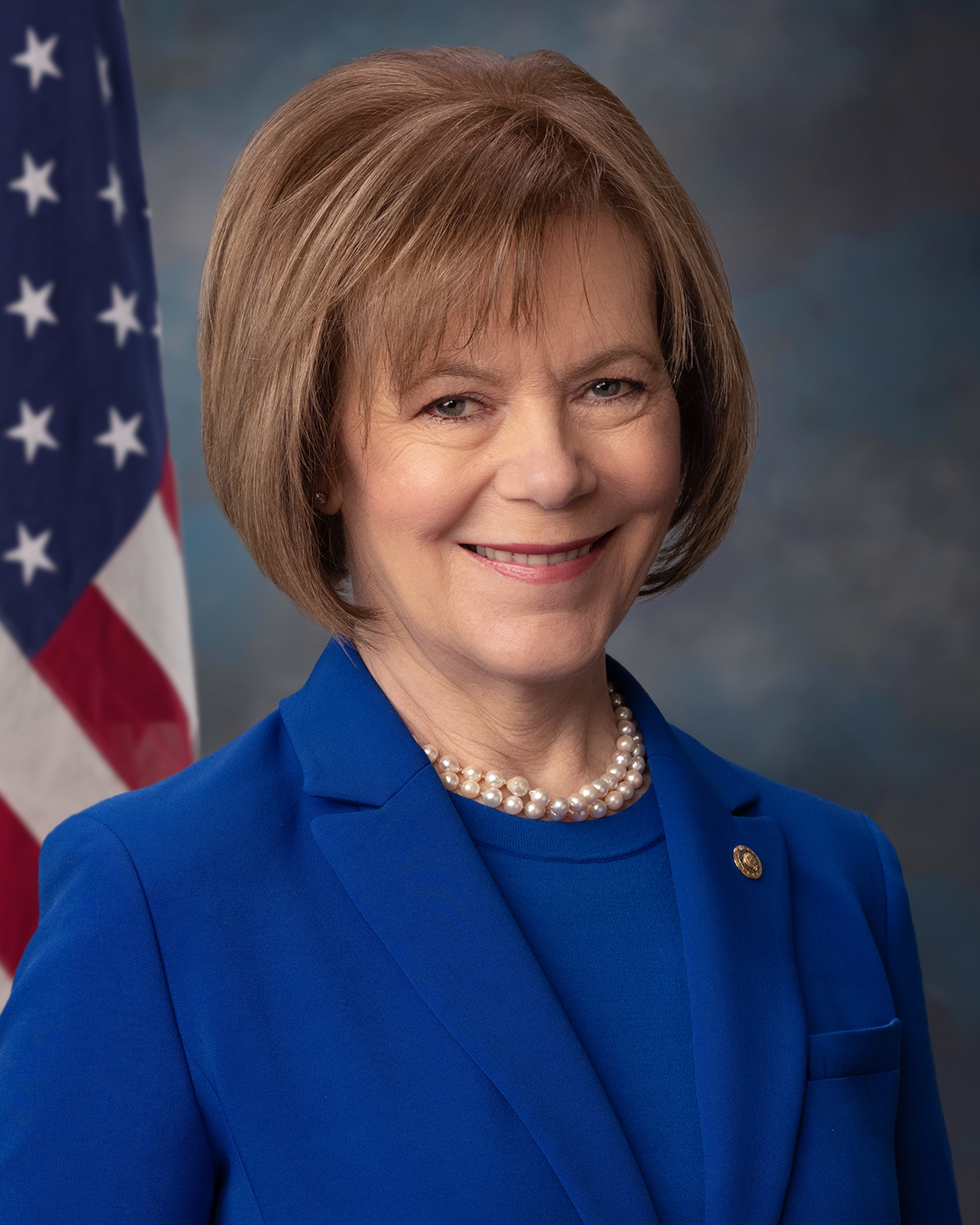

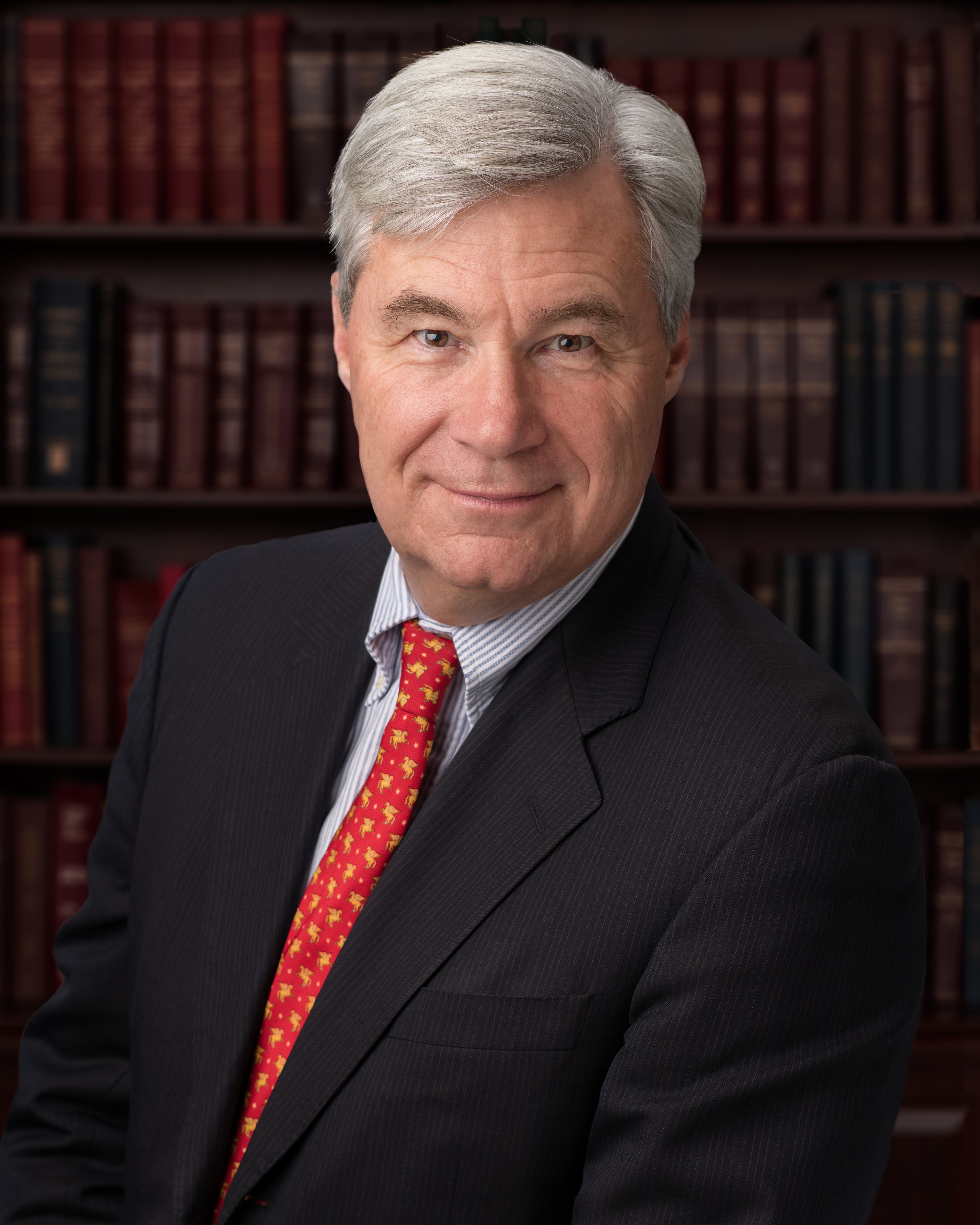

Pro-Crypto Republican Senators

Pro-Crypto Democrat Senators

Anti-Crypto Republican Senators

Anti-Crypto Democrat Senators

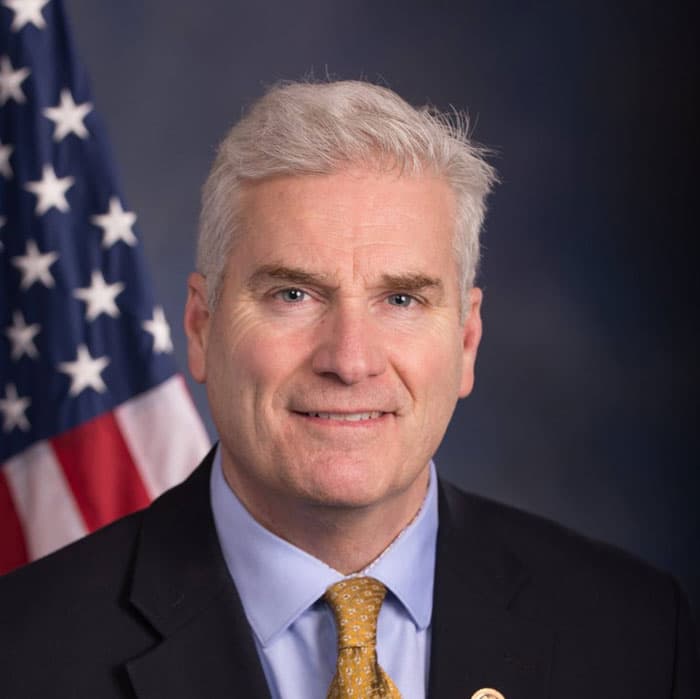

Pro-Crypto Republican Congress Reps

Pro-Crypto Democrat Congress Reps

Anti-Crypto Republican Congress Reps

Anti-Crypto Democrat Congress Reps

.jpeg&w=3840&q=75)