See Who Supports Crypto

Track influential people's stances on bitcoin, ethereum, and other cryptocurrencies.

Track the Latest Stances

Crypto industry experts closely monitor tweets, news quotes, and bill votes to keep you informed about the latest stances from influential figures.

Make Your Voice Heard

Sign up for a free account and submit your own analysis on the stances you see to determine whether someone is supportive or against crypto. Help us build a community-driven database of crypto support.

Recent Stances On Crypto

Securing US elections

Securing US elections

Banning members of Congress from buying stocks

Banning members of Congress from buying stocks

Ensuring US leadership in digital assets

Ensuring US leadership in digital assets

Quoted from www.congress.gov on 2026-02-24

"S. 3907. A bill to amend the GENIUS Act to require foreign payment stablecoin issuers to undergo an annual audit similar to United States payment stablecoin issuers, and for other purposes; to the Committee on Banking, Housing, and Urban Affairs." [S651]

Quoted from www.standwithcrypto.org on 2026-02-24

Mike Lawler completed the Stand With Crypto Questionnaire and expressed strong support for digital assets, advocating for clear legislative frameworks, the right to self-custody, and accessible stablecoins. He also supports ending de-banking, updating market structure laws, and reforming the tax code for digital assets, while cosponsoring bills like the STABLE Act, Digital Asset Market Clarity Act, and Anti-CBDC Surveillance State Act.

Quoted from www.standwithcrypto.org on 2026-02-23

Brian Fitzpatrick completed the Stand With Crypto Questionnaire and indicated support for clear legislative frameworks, aiming to provide accessible pathways for digital asset businesses and define when an asset is a security or a commodity. He advocates for consumer rights, including the ability to self-custody digital assets and widely access 1:1 backed stablecoins, while also supporting policies that promote blockchain innovation and prevent the de-banking of lawful crypto users.

Quoted from www.standwithcrypto.org on 2026-02-20

Nick Begich III completed the Stand With Crypto Questionnaire and demonstrated strong support for clear regulatory pathways for digital assets, advocating for the right to self-custody, accessible stablecoins, and updated market structure laws for trading venues, while also opposing the de-banking of crypto businesses. He is the House sponsor of the BITCOIN Act, aiming to establish a Strategic Bitcoin Reserve, and plans to re-introduce an amended version to expand cryptocurrency participation and access, though he believes non-custodial software developers should not be exempt from financial intermediary regulation.

Recent Bills On Crypto

Blockchain Regulatory Certainty Act of 2026

Date Introduced: 2026-01-12

Status: Introduced and Sponsored

CLARITY Act

Date Introduced: 2025-05-29

Status: Introduced and Sponsored

Blockchain Regulatory Certainty Act

Date Introduced: 2025-05-21

Status: Introduced and Sponsored

GENIUS Act

Date Introduced: 2025-05-01

Status: Introduced and Sponsored

Promoting Resilient Supply Chains Act of 2025

Date Introduced: 2025-01-27

Status: Introduced and Sponsored

H.J. Res 25

Date Introduced: 2025-01-21

Status: Introduced and Sponsored

S.J. Res 3

Date Introduced: 2025-01-21

Status: Introduced and Sponsored

SAB 121 House Joint Resolution

Date Introduced: 2024-02-01

Status: Introduced and Sponsored

Uniform Treatment of Custodial Assets Act

Date Introduced: 2023-09-27

Status: Introduced and Sponsored

CBDC Anti-Surveillance State Act

Date Introduced: 2023-09-12

Status: Introduced and Sponsored

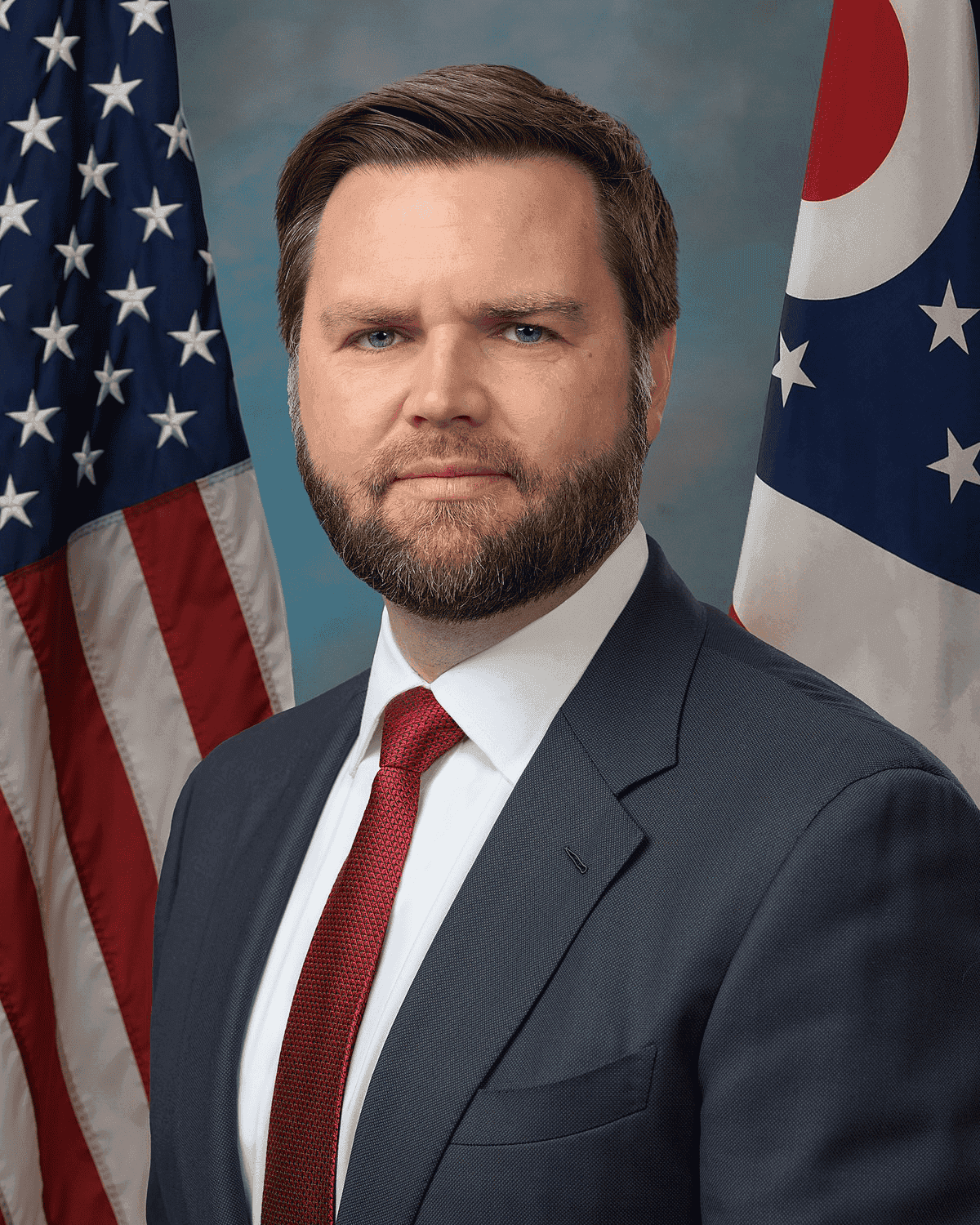

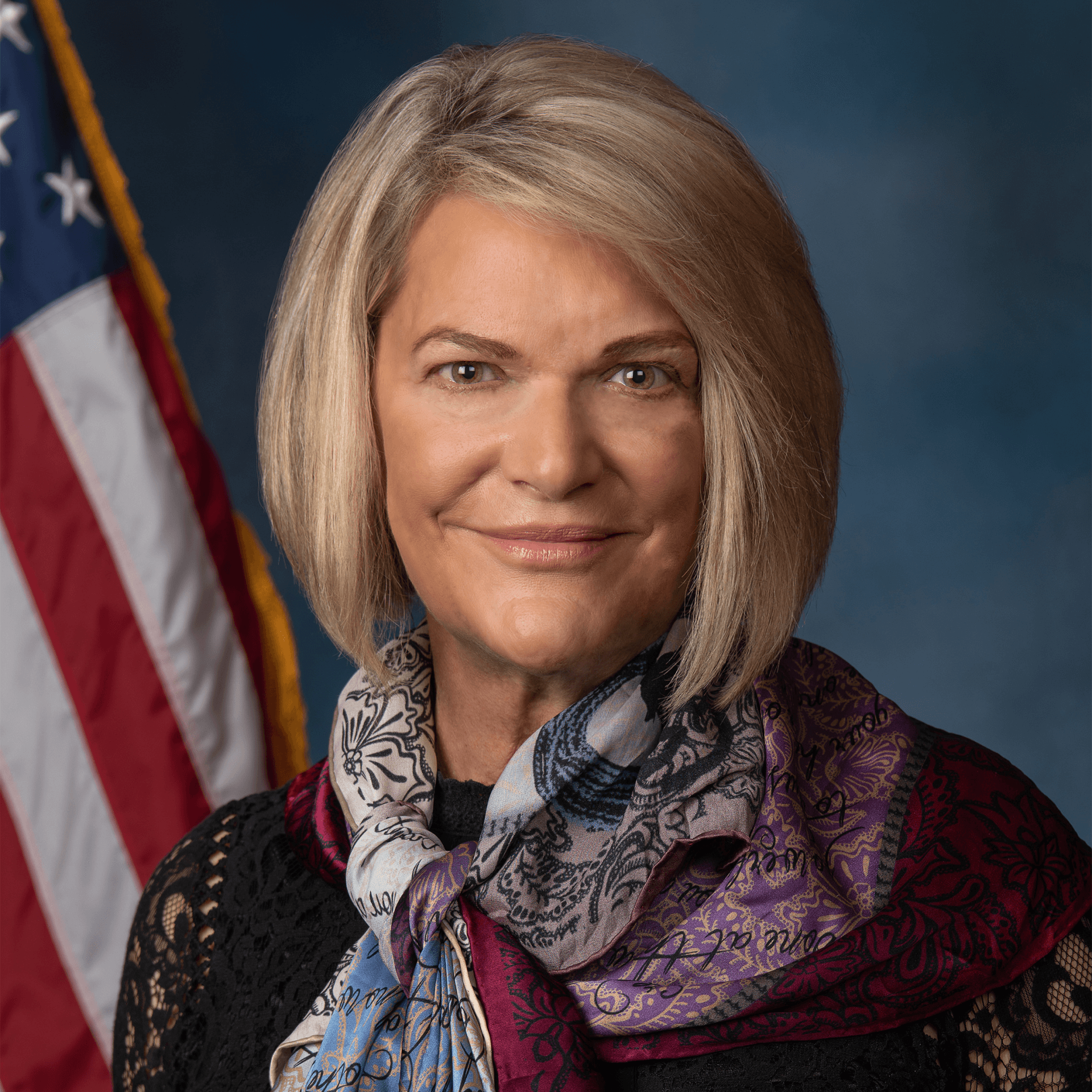

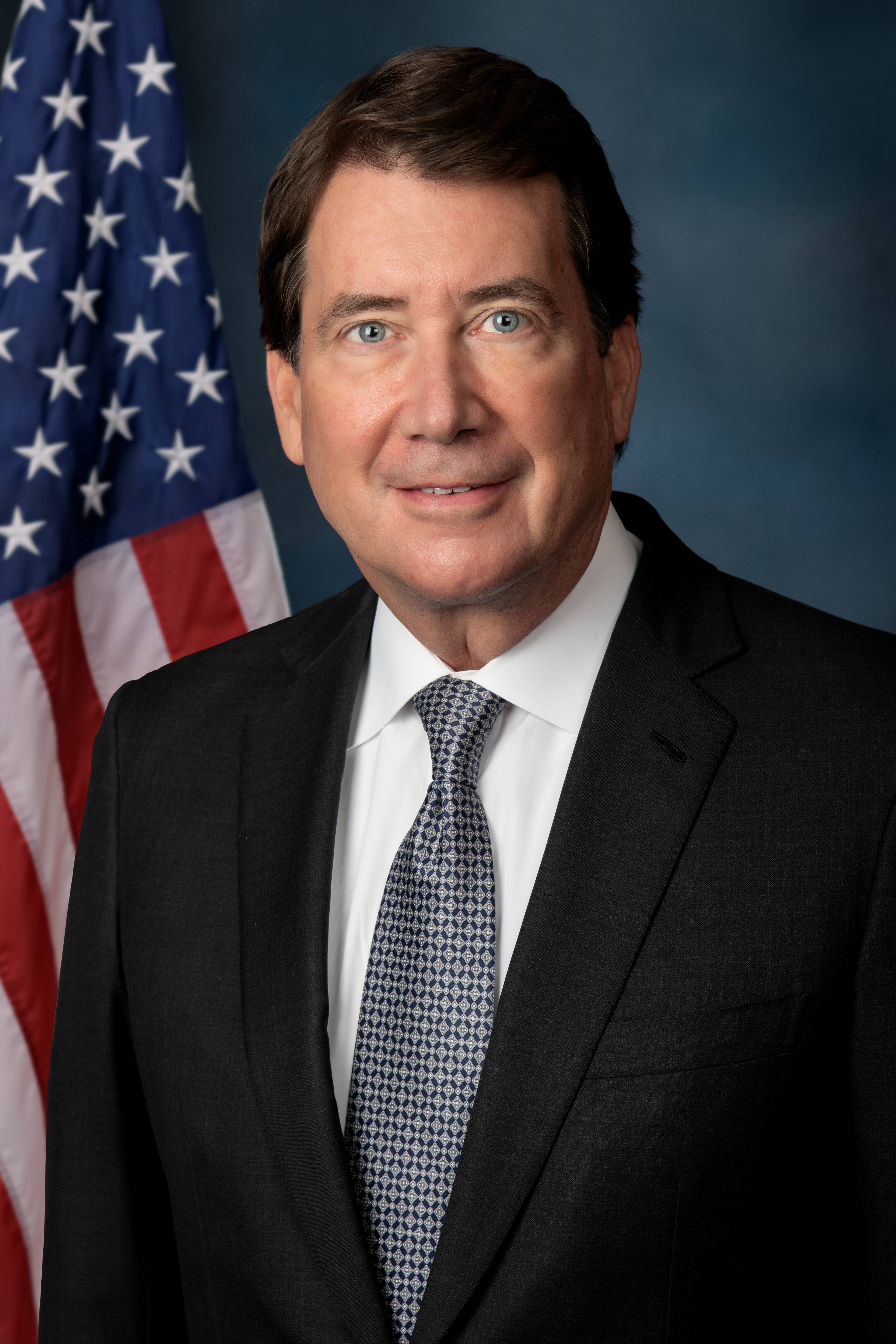

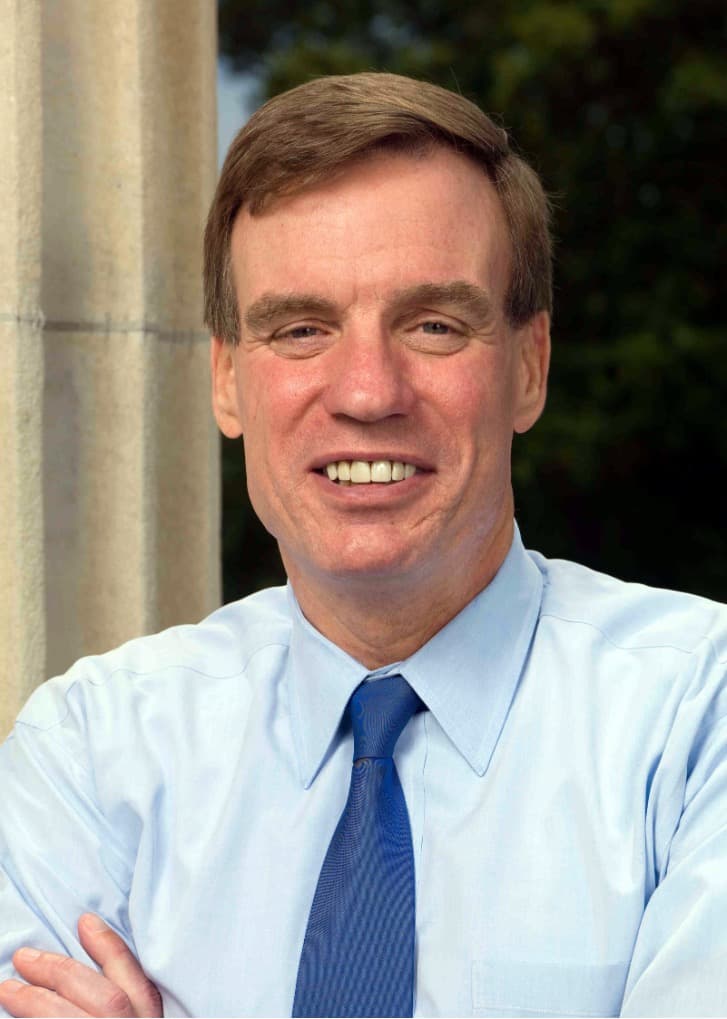

Executive Branch

Pro-Crypto Republican Senators

Pro-Crypto Democrat Senators

Anti-Crypto Republican Senators

Anti-Crypto Democrat Senators

Pro-Crypto Republican Congress Reps

Pro-Crypto Democrat Congress Reps

Anti-Crypto Republican Congress Reps

Anti-Crypto Democrat Congress Reps

.jpeg&w=3840&q=75)