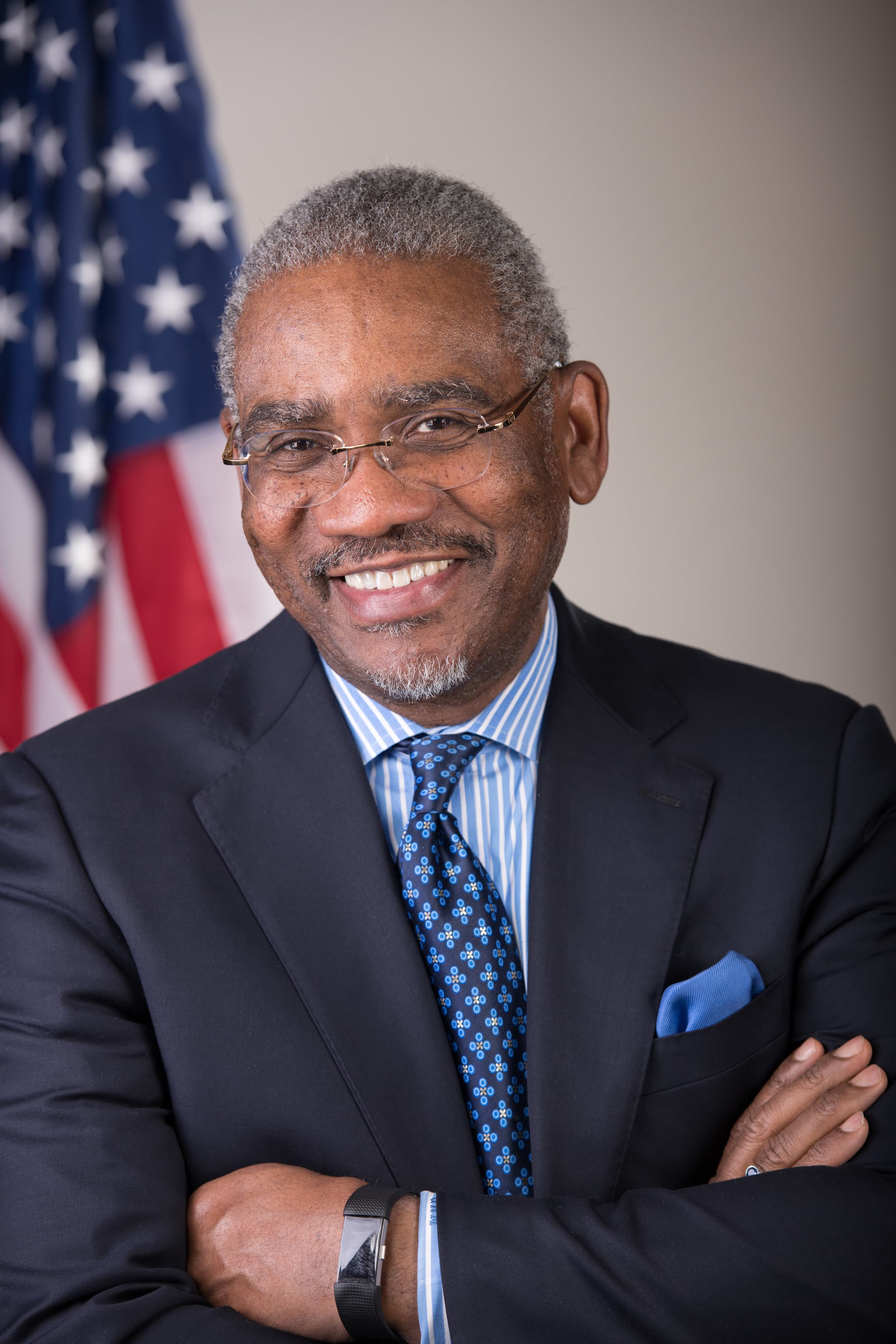

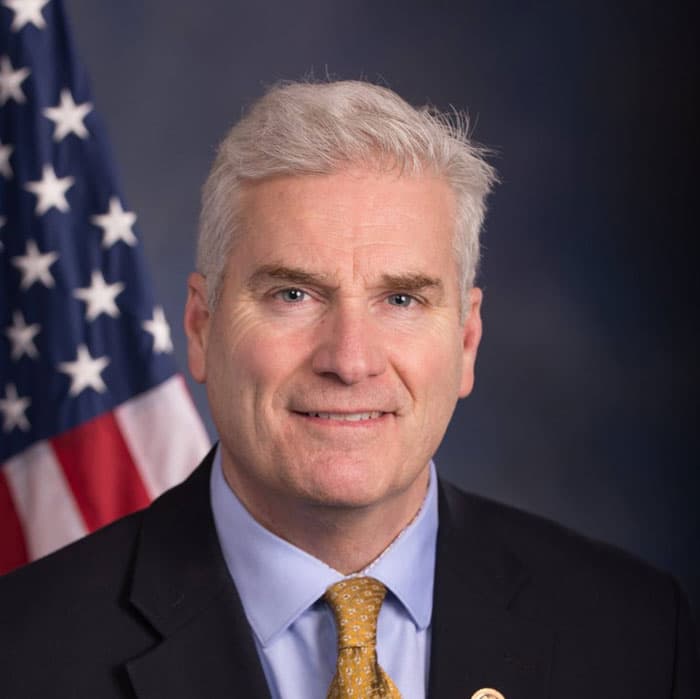

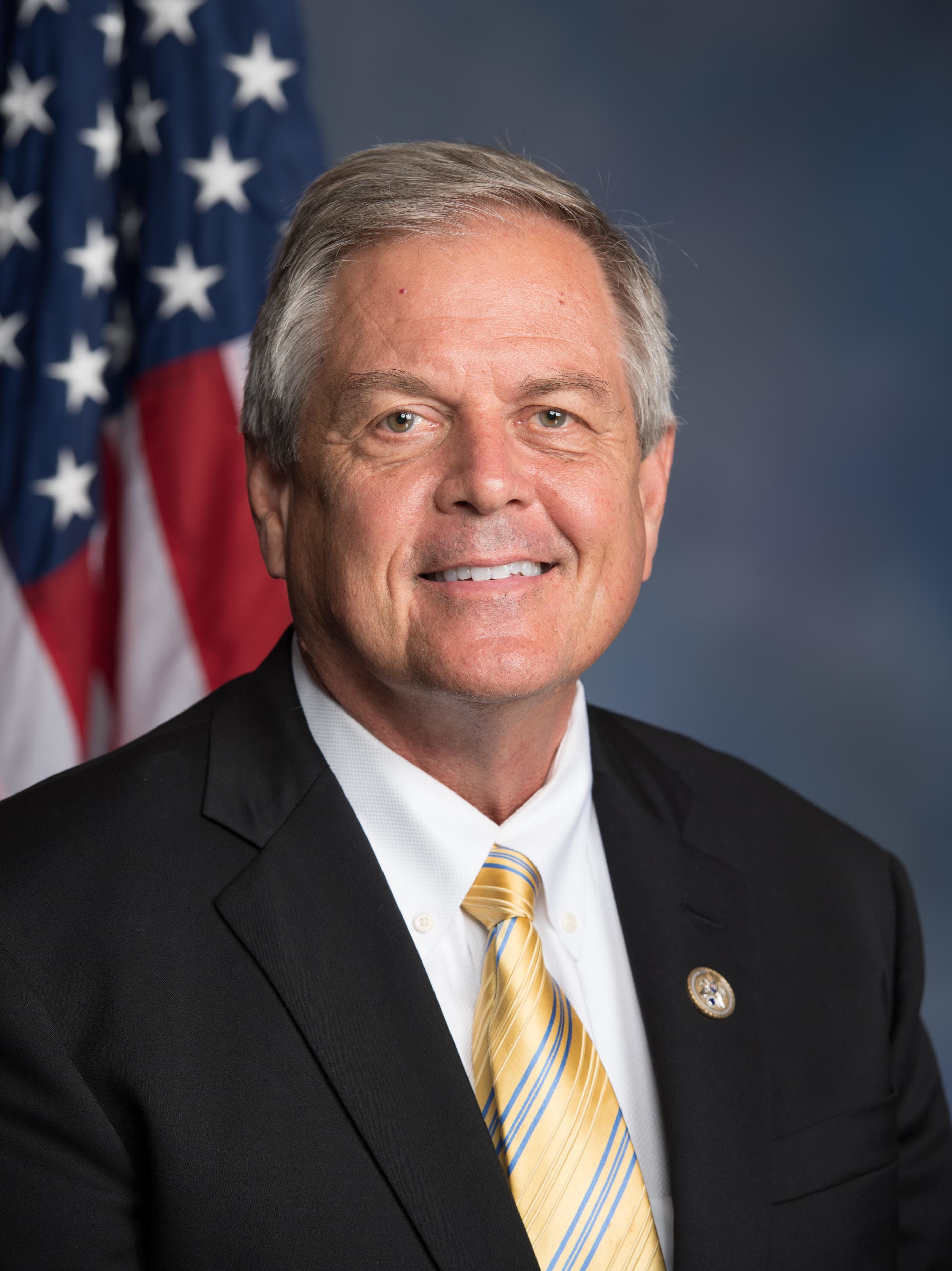

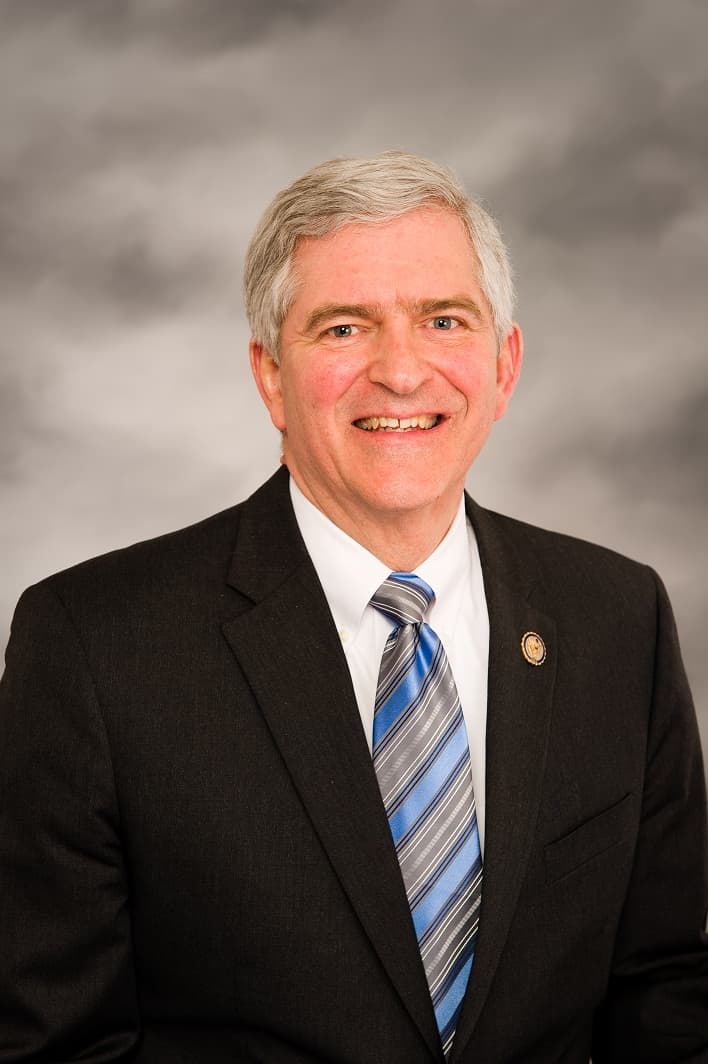

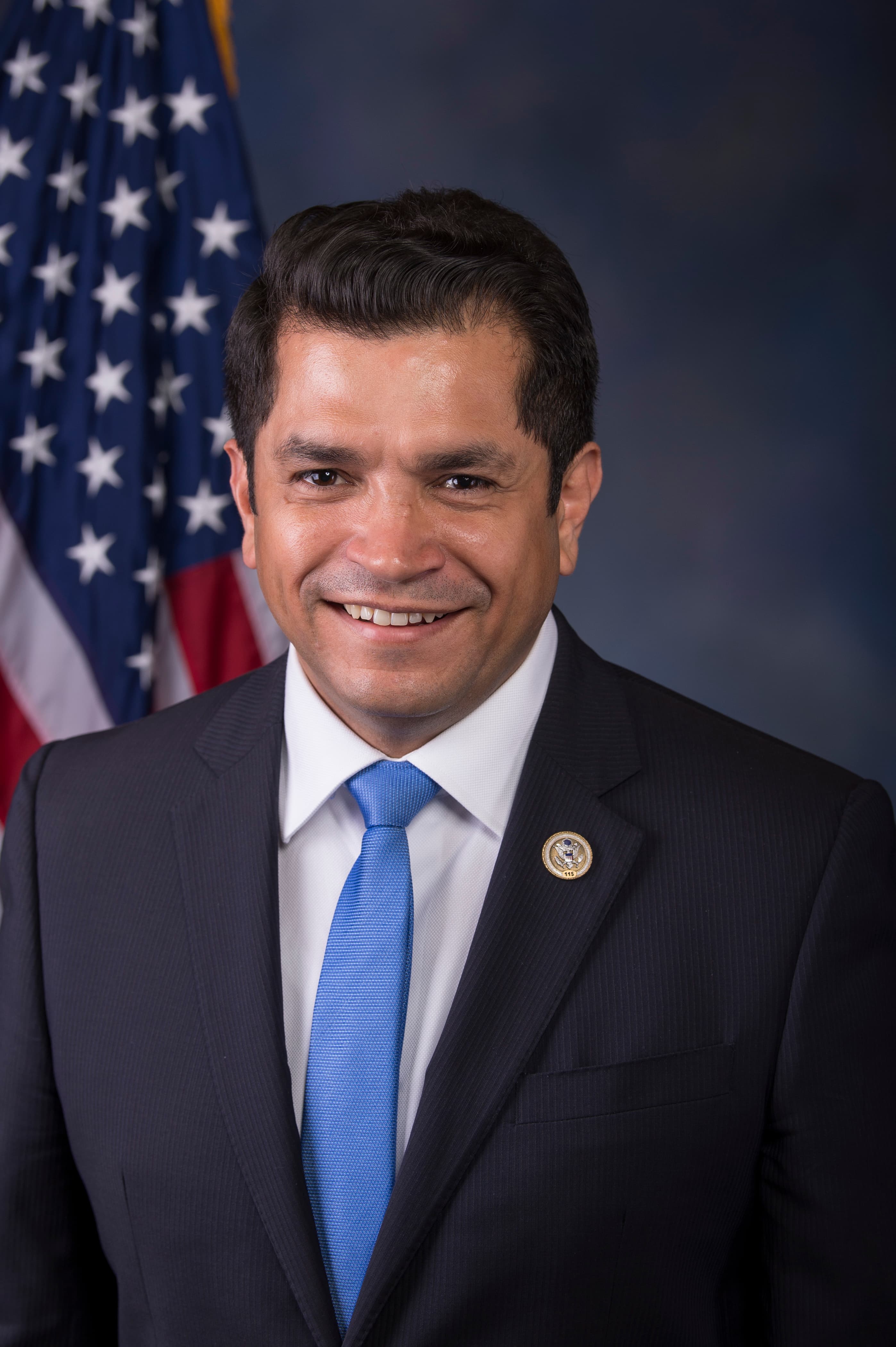

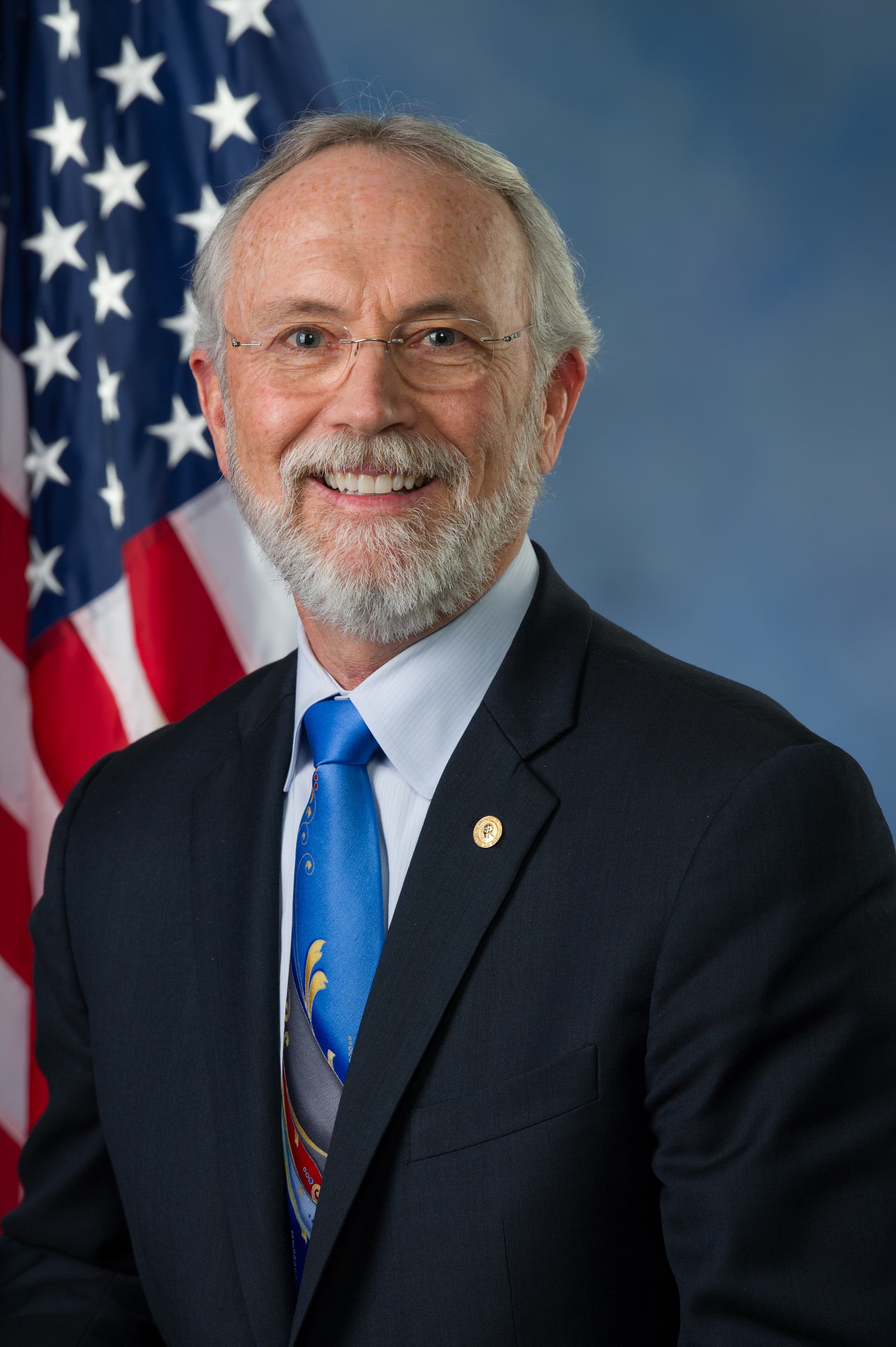

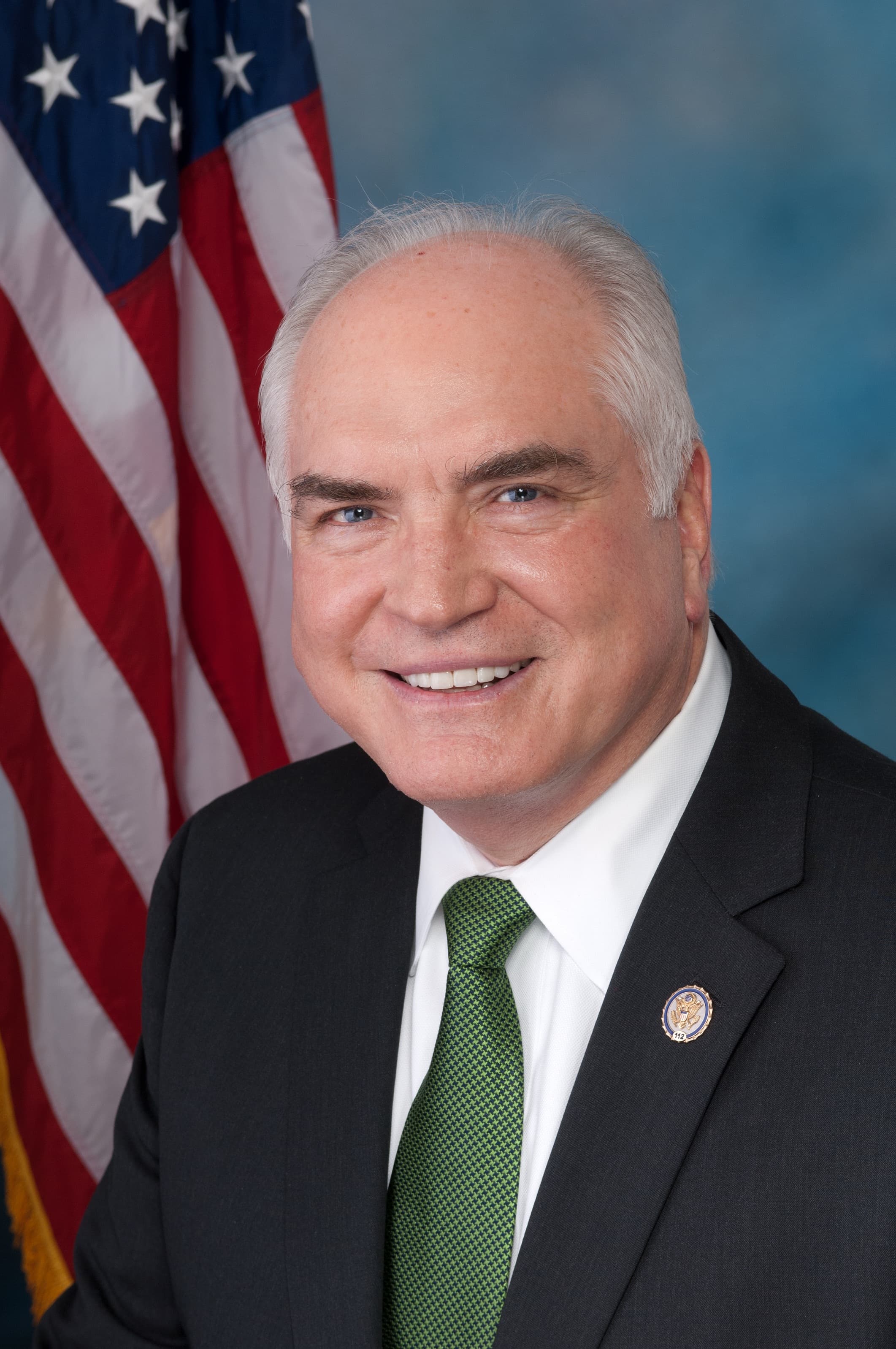

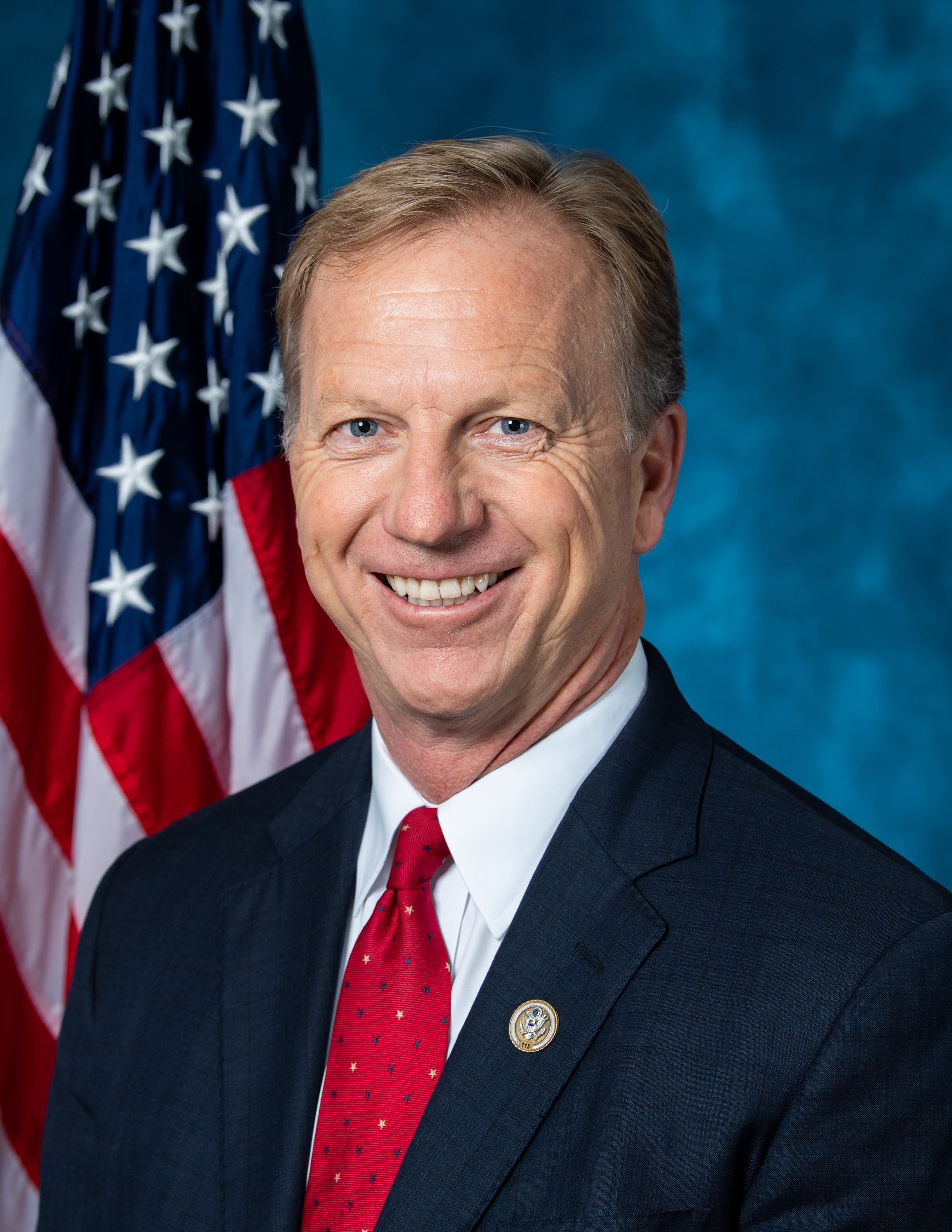

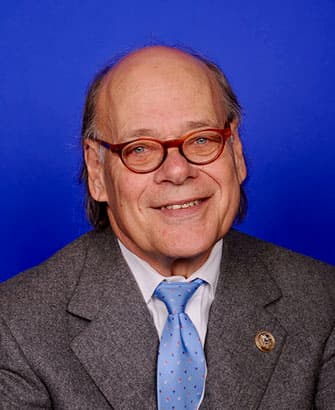

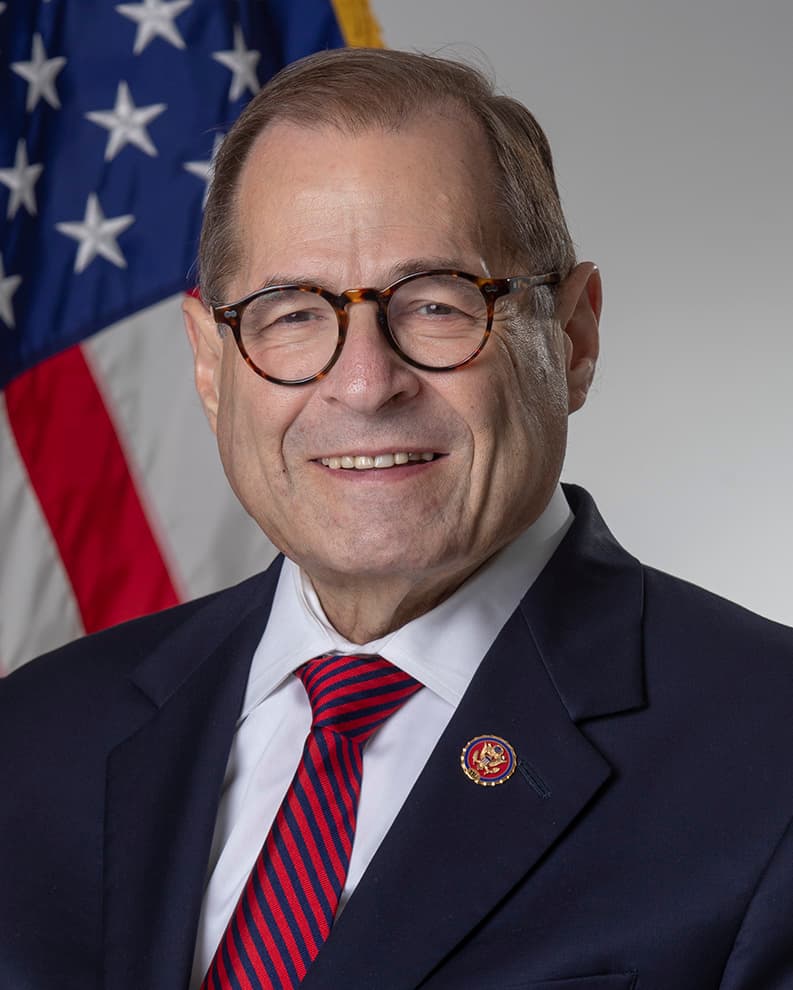

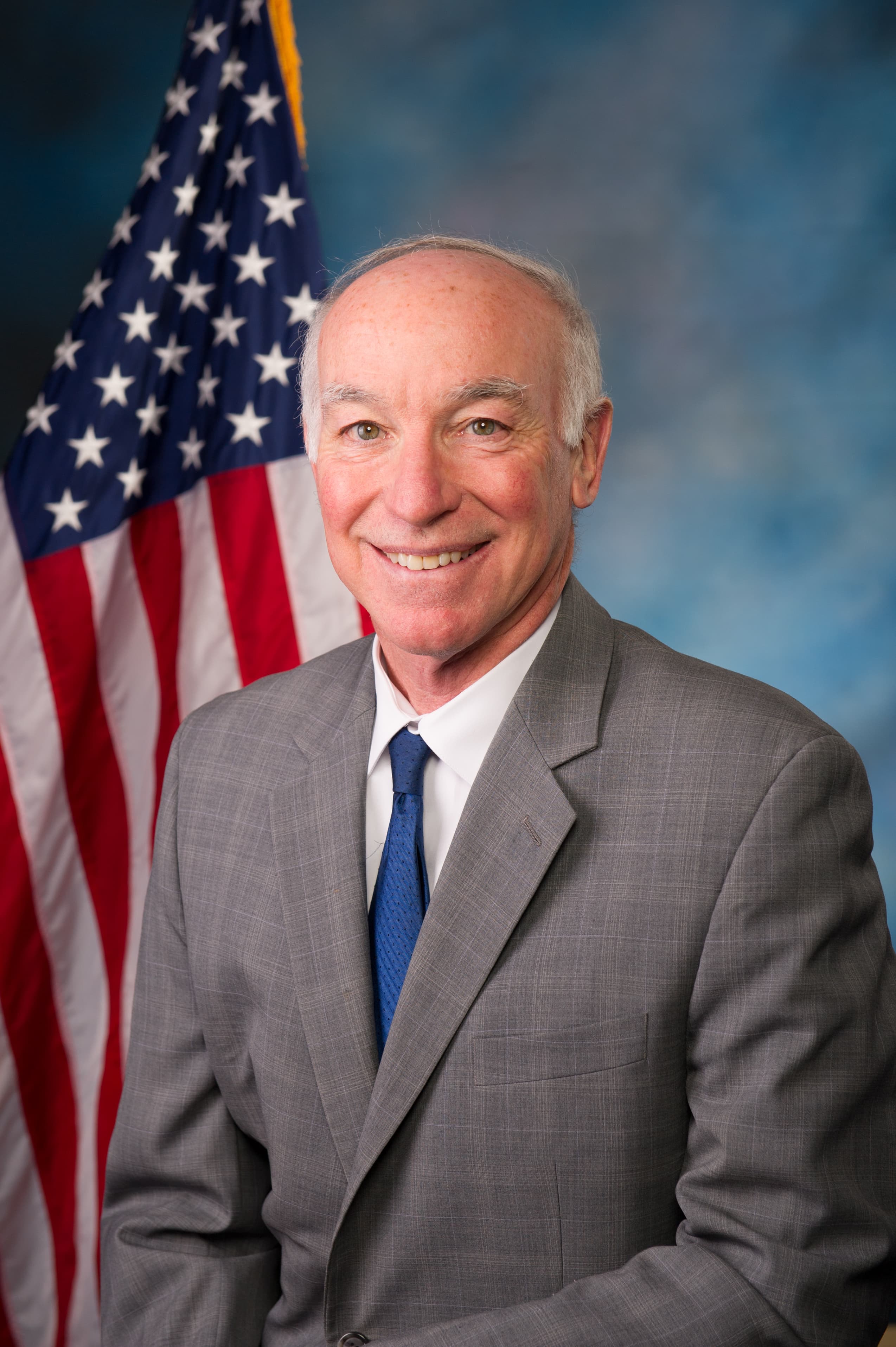

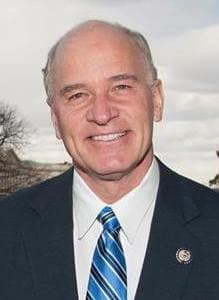

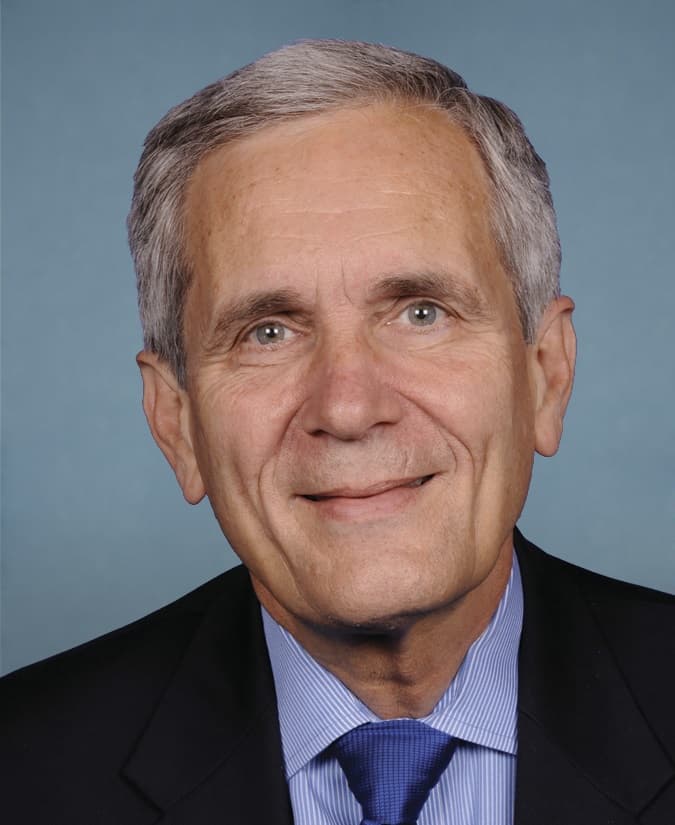

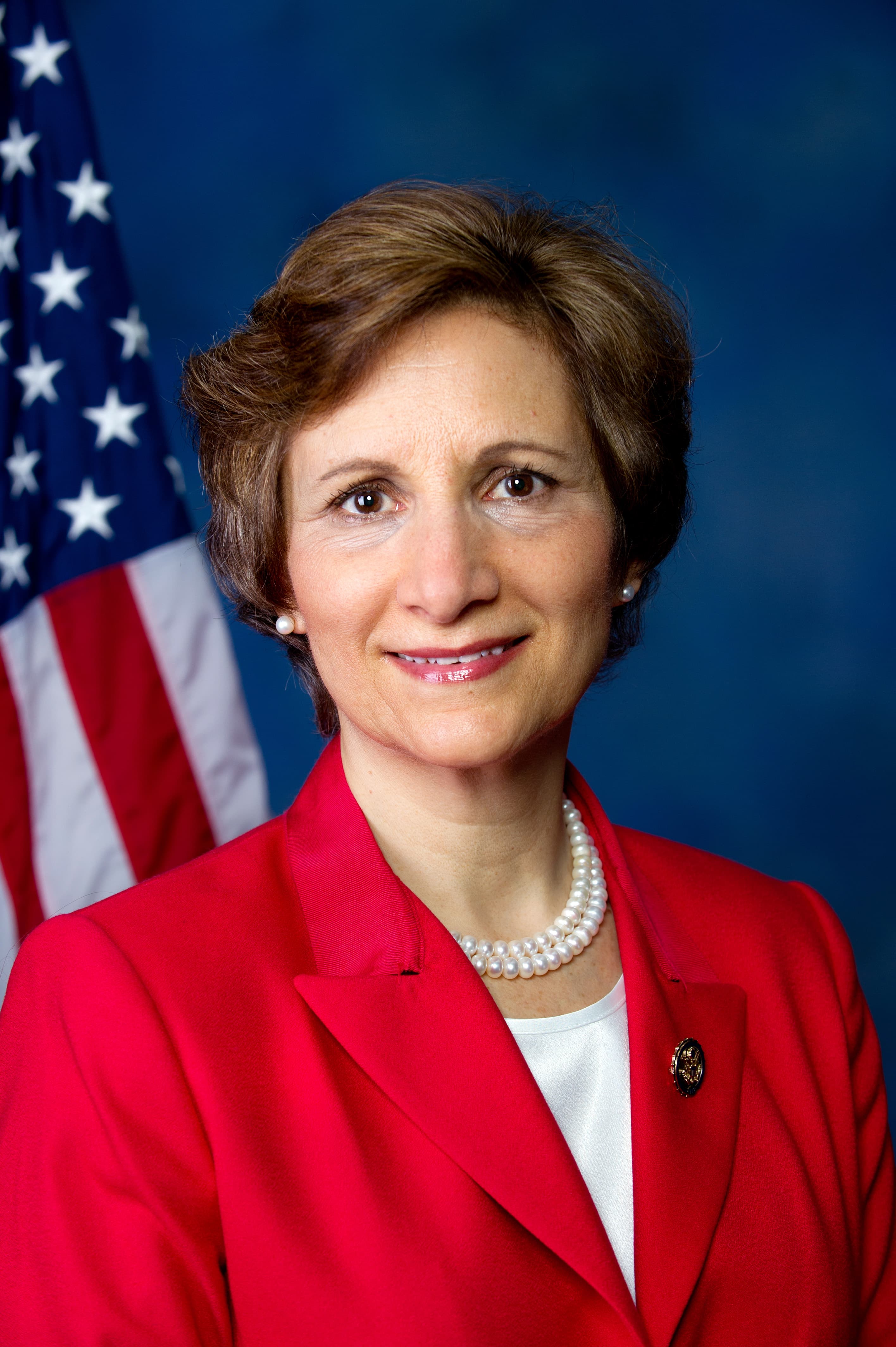

Congressman Brad Sherman

@BradSherman

He’s also offering exemptions to certain products, to the benefit of those in Trump’s orbit. The richest and most powerful in America are now trying to figure out how to give money to Trump’s favorite political operatives and family members – possibly by transferring Bitcoin through secret crypto wallets or making large purchases of Trump’s own crypto coins. (2/3)

2025-04-14T21:47:14.000Z

1.) The

1.) The

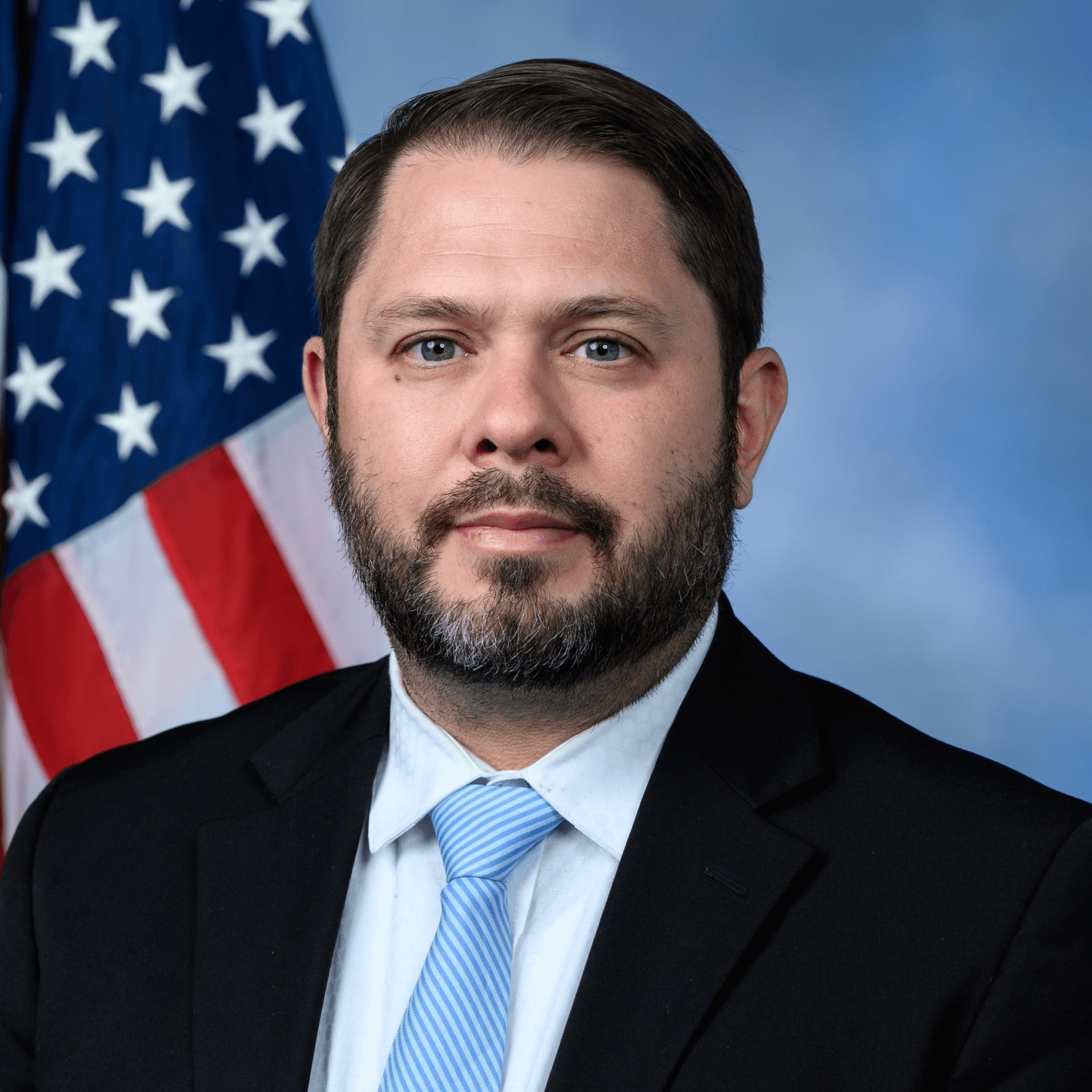

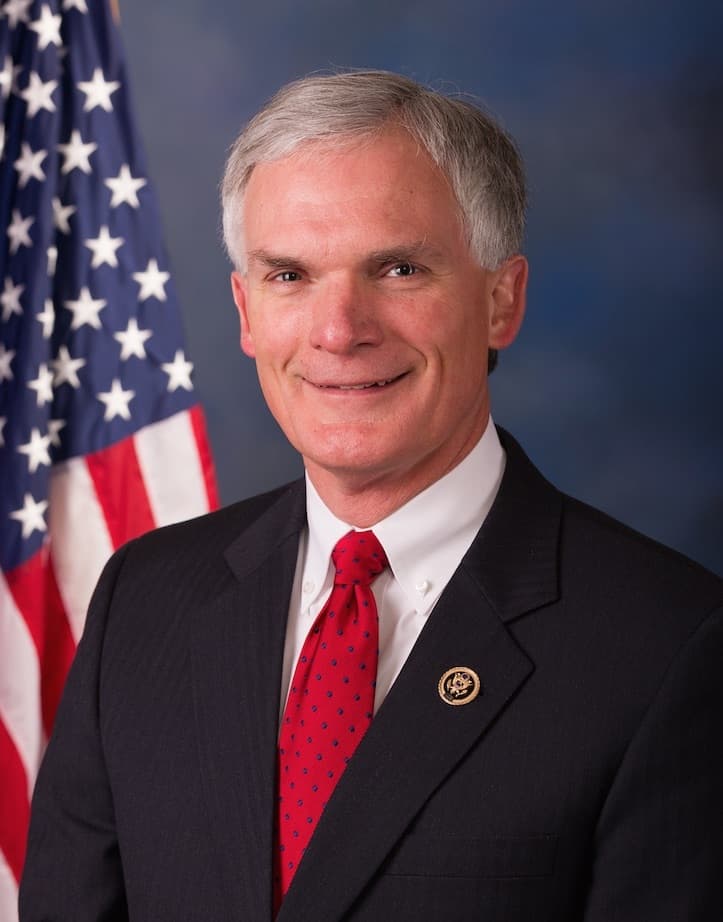

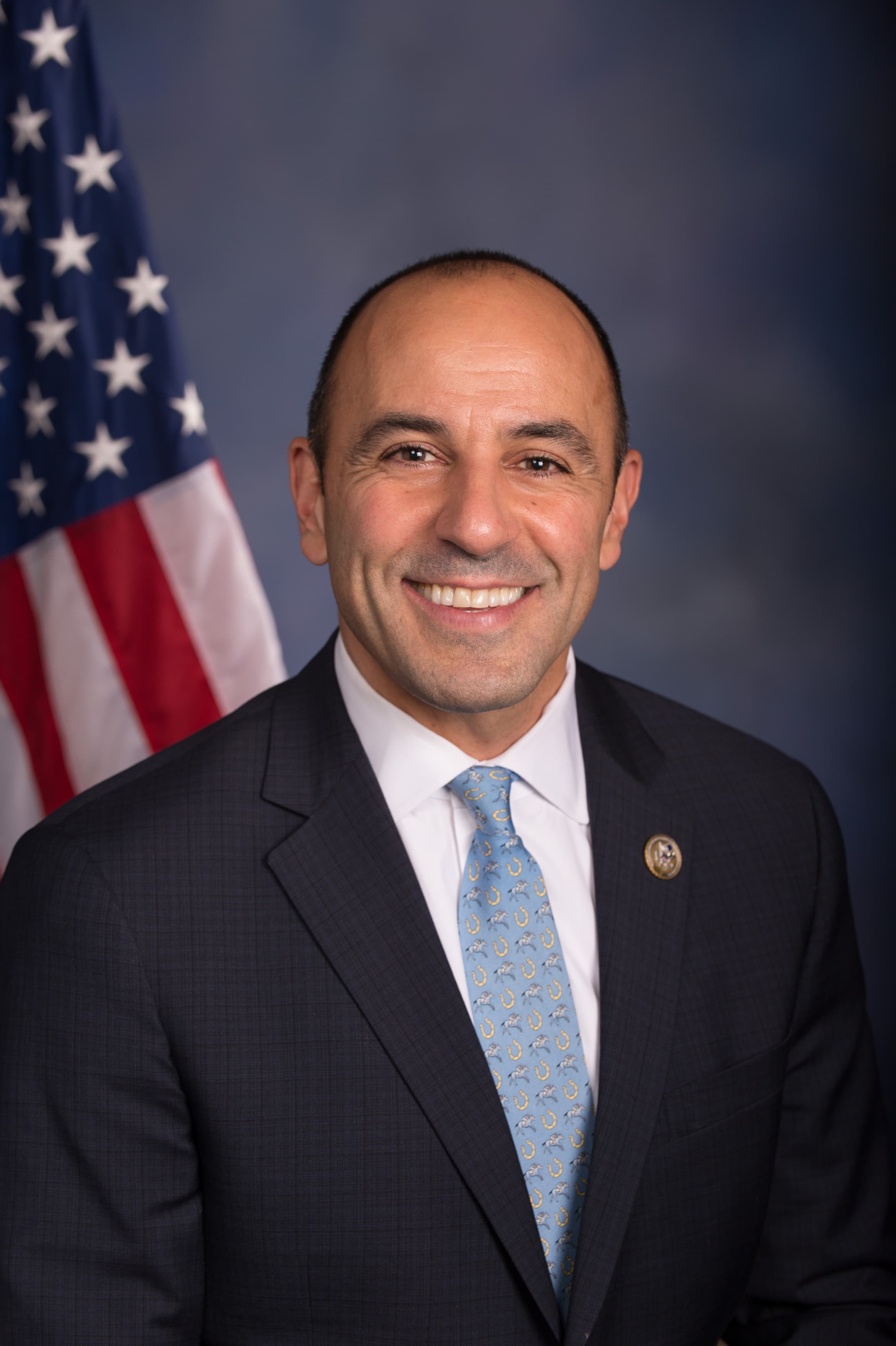

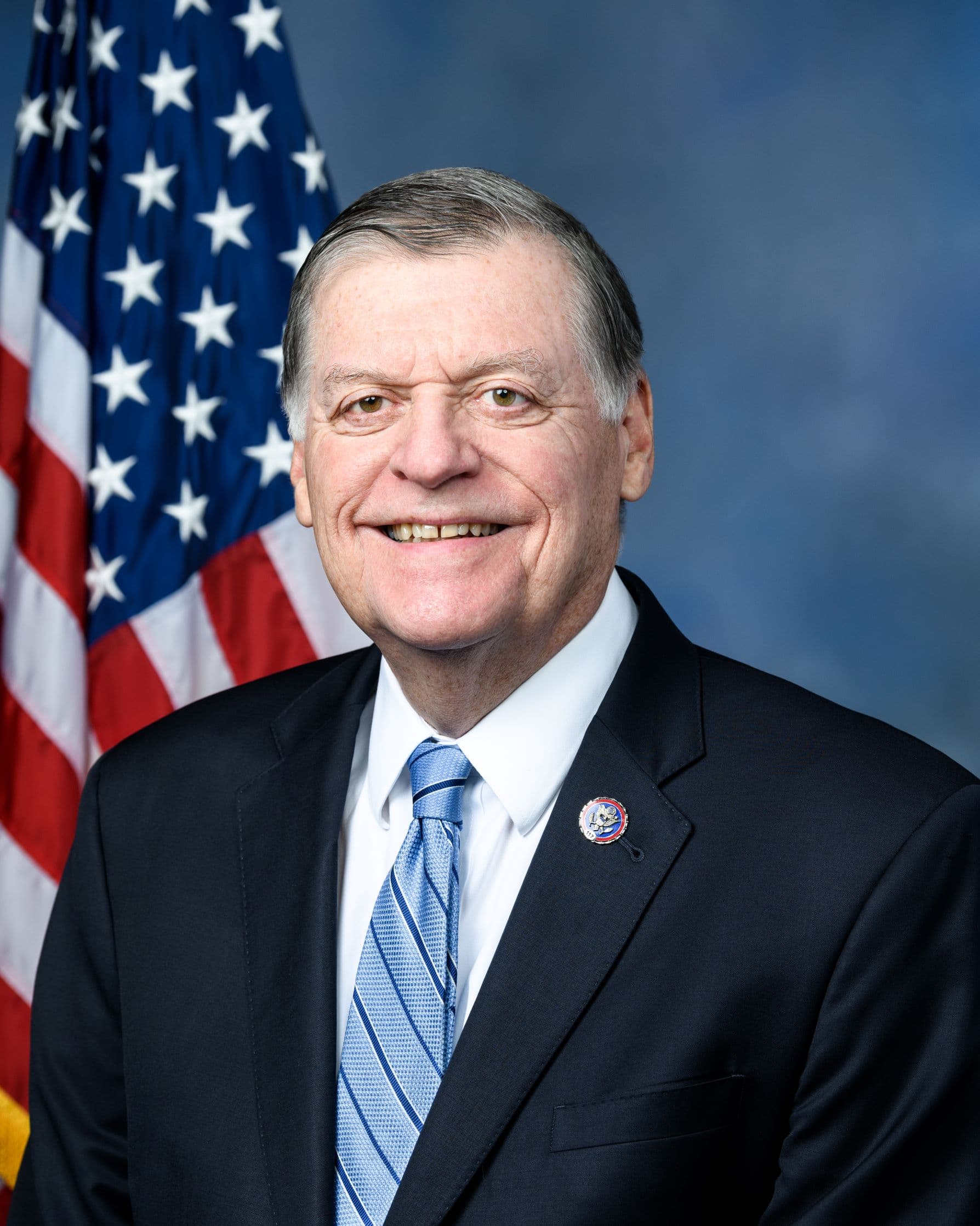

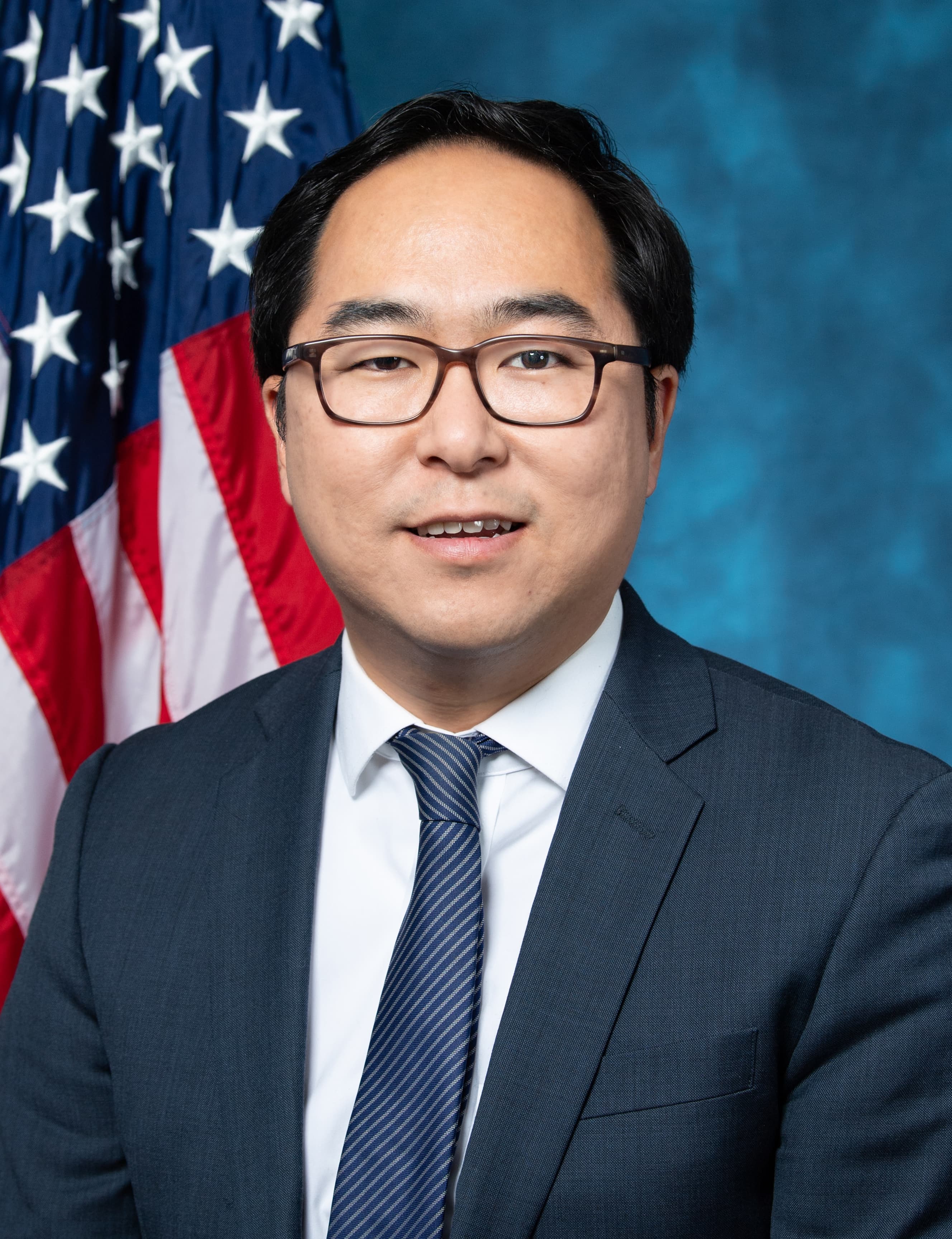

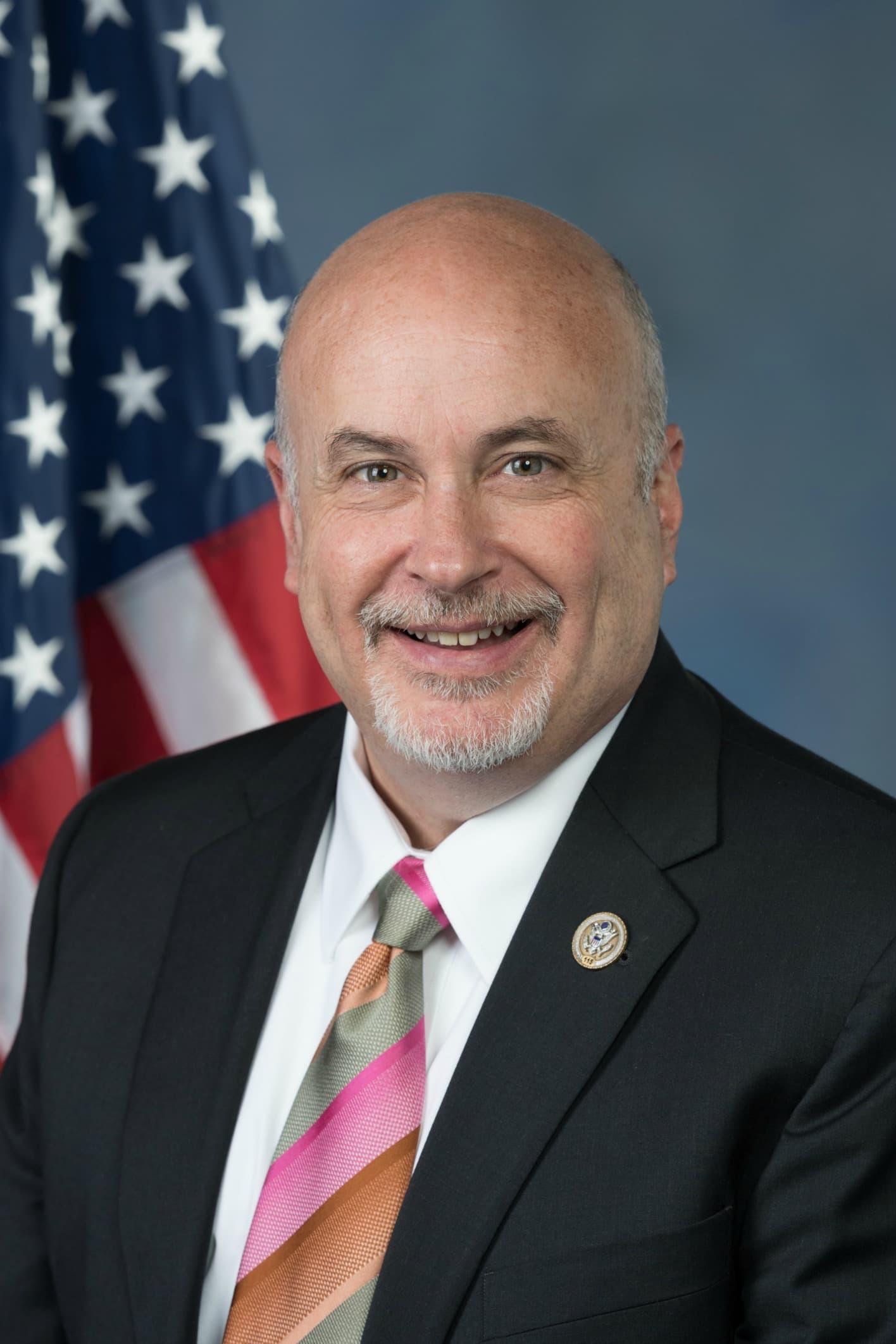

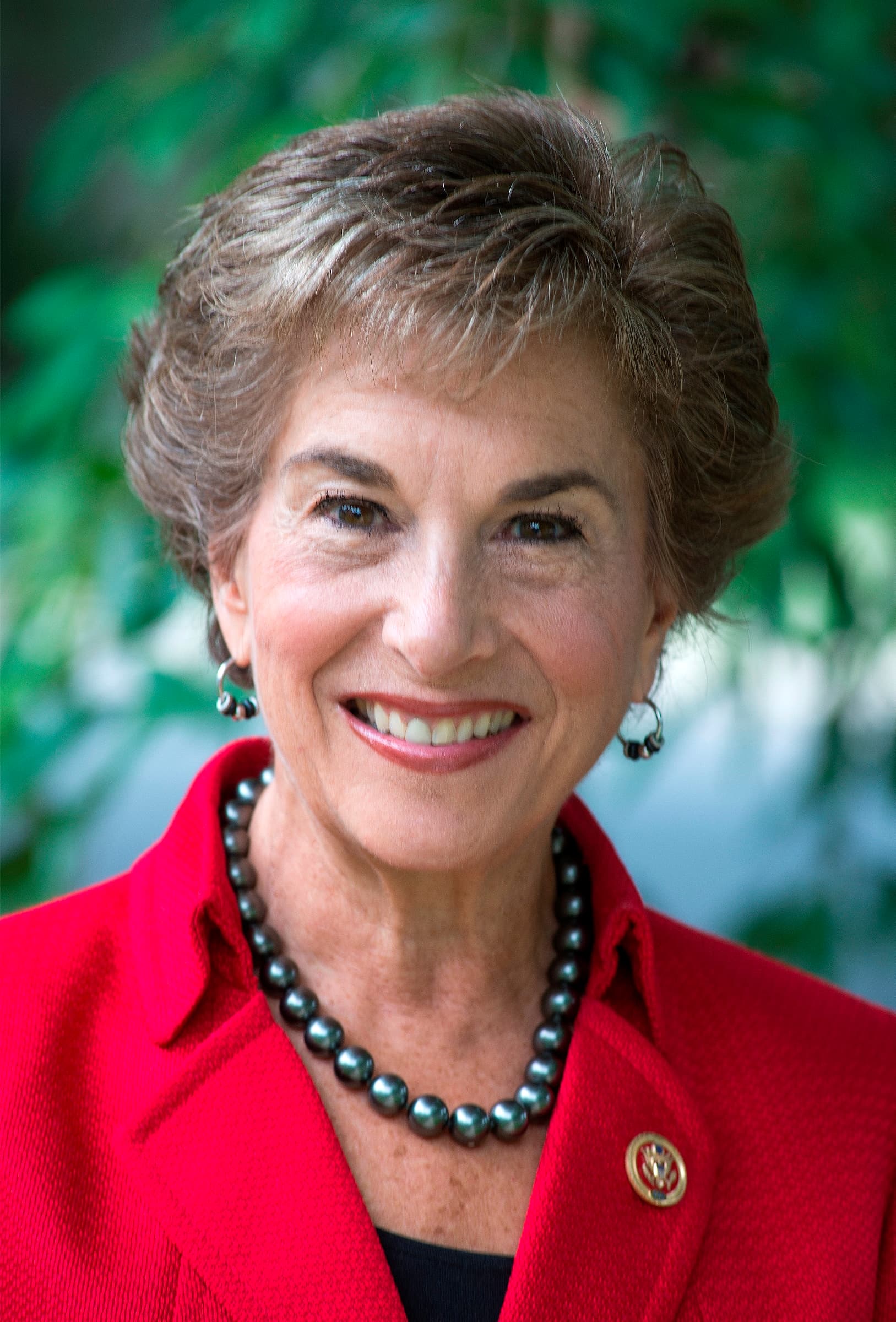

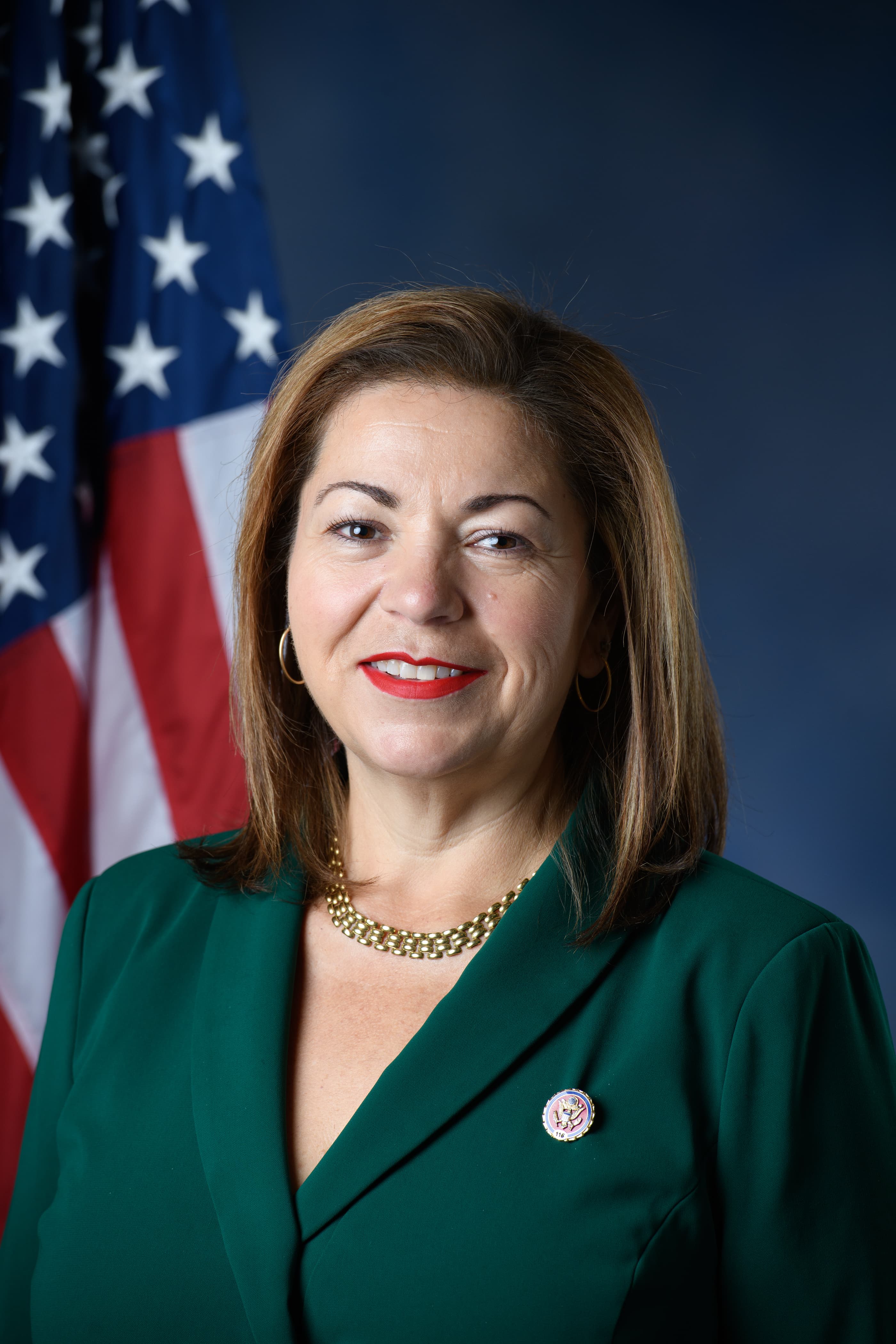

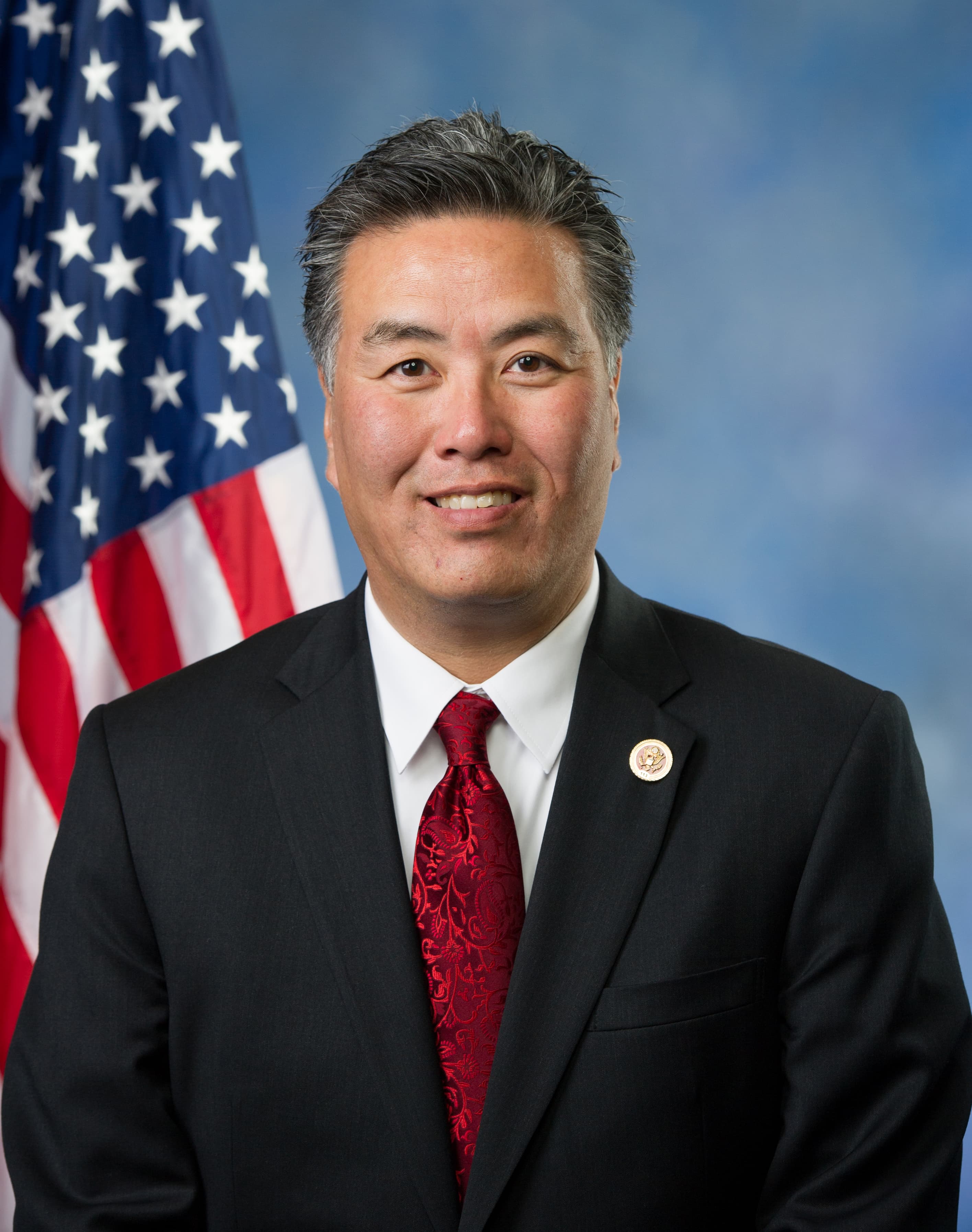

Digital Asset market structure hearing starts at 10am!

Digital Asset market structure hearing starts at 10am!

.jpeg&w=3840&q=75)